🦔Welcome back! This week marked a decisive shift in the economic narrative, with Friday's dismal jobs report finally forcing markets to confront the labor market deterioration I've been tracking for months. The reaction tells you everything about current positioning: stocks hit new highs despite awful employment data because traders are celebrating the Fed's upcoming rescue mission.

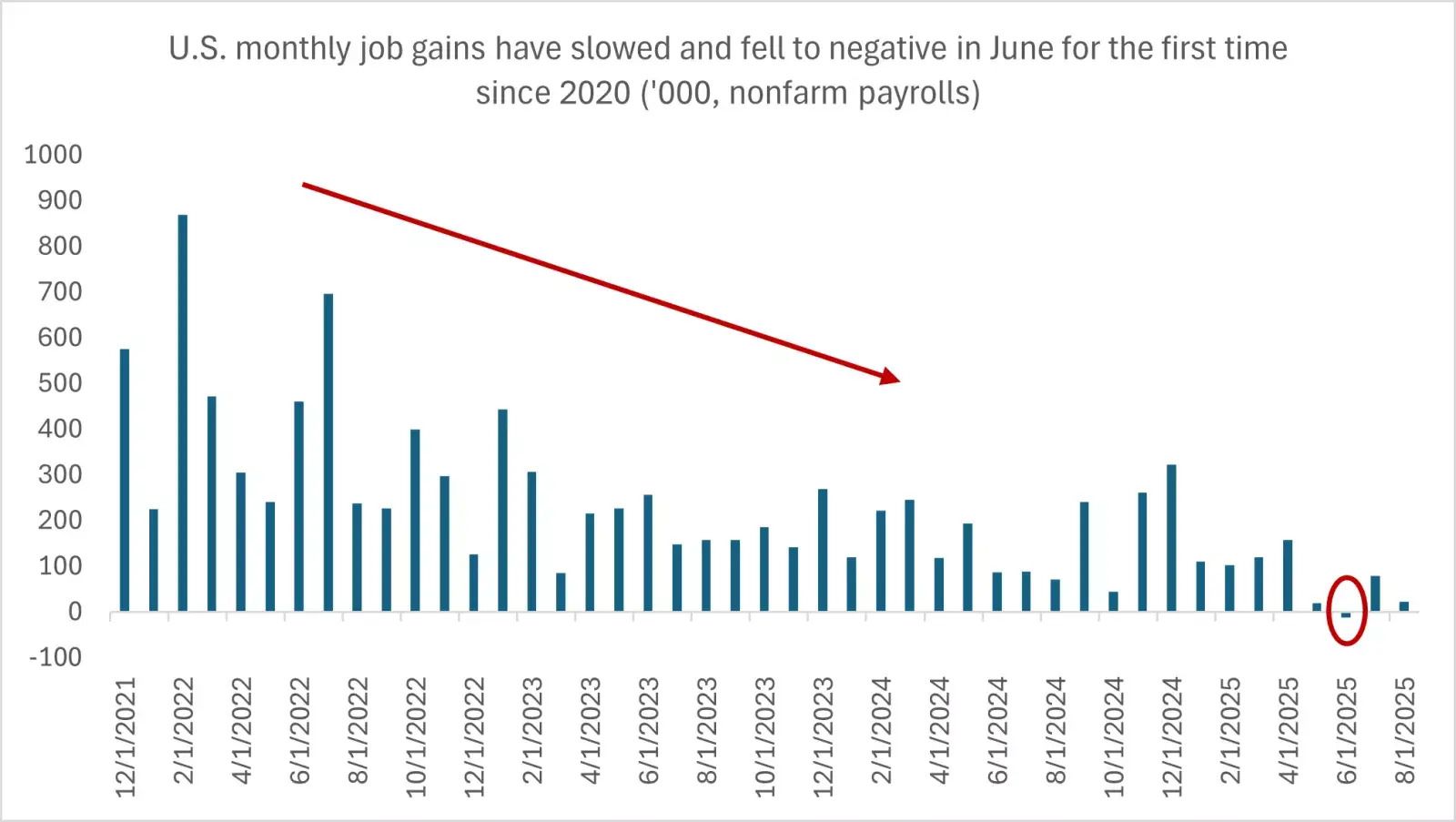

August delivered just 22,000 jobs, well below the 75,000 expected, while unemployment rose to 4.3% - the highest since 2021. What made it worse was the June revision showing the first monthly job losses since 2020. For the first time since 2021, there are now more unemployed people than job openings.

This isn't cyclical weakness anymore. It's structural change that rate cuts alone won't fix.

THE LABOR MARKET: FROM FROZEN TO CRACKING

The employment picture is deteriorating faster than most anticipated. When you exclude healthcare jobs, total employment has actually declined in three of the last four months. Multiple sectors posted outright job losses including information, financial activities, manufacturing, and business services.

One economist described it as "a white-collar and a blue-collar jobs recession." Companies aren't just being cautious about hiring; they're actively pulling job postings and cutting positions. The combination of tariff uncertainty, AI displacement, and policy volatility has created what I've been calling a hiring freeze that traditional monetary policy can't easily address.

Job growth has materially cooled Monthly job gains averaging just 29,000 over the last three months

The data keeps getting revised downward, which prompted Trump to fire the Bureau of Labor Statistics commissioner earlier this year. The reliability of employment statistics has become politicized, adding another layer of uncertainty to an already complex situation.

Youth unemployment hitting 10.5% for ages 16-24 signals deeper structural problems. Young workers are typically the first hired during expansions and first cut during downturns, making them a leading indicator of labor market health.

MARKETS: BAD NEWS IS GOOD NEWS (FOR NOW)

The market reaction perfectly captures current positioning. Stocks reversed early losses to close higher Friday because the weak jobs data guarantees Fed rate cuts. Bond yields plummeted, with the 10-year Treasury falling to 4.09% and mortgage rates dropping from 6.45% to 6.29% in a single day.

Markets are now pricing in a 100% probability of a September rate cut, with a 12% chance of a 50 basis point move. Over the next 12 months, traders expect 142 basis points of total easing. This represents a complete reversal from just months ago when markets worried about persistent inflation.

Fed rate cut expectations have surged September cut now fully priced with potential for larger move

But I think this "bad news is good news" mentality misses the bigger picture. We're celebrating rate cuts that are necessary because the economy is deteriorating, not because everything is healthy. The underlying fundamentals suggest this relief could prove temporary.

THE STAGFLATION SETUP INTENSIFIES

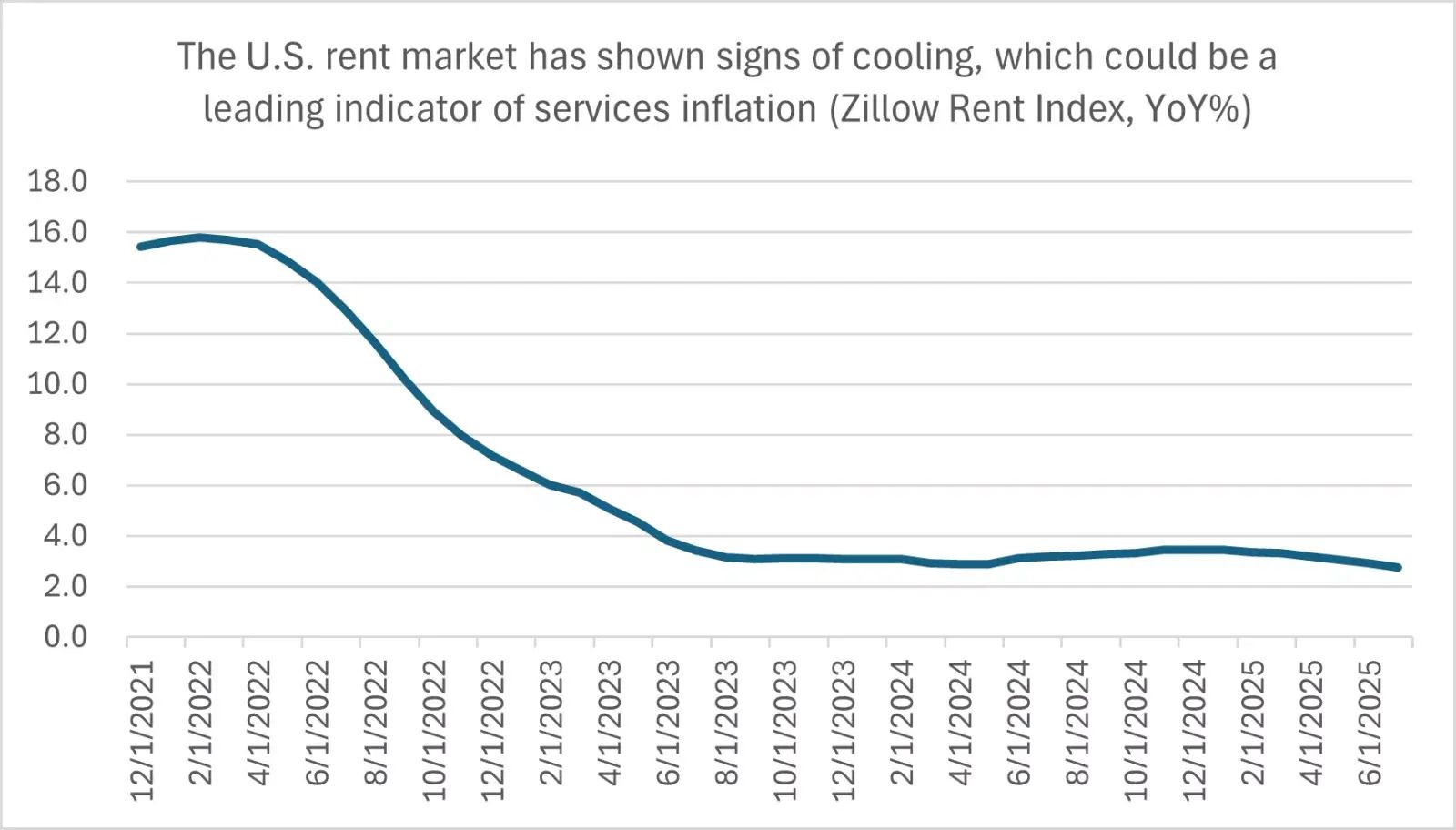

This week confirmed the stagflation scenario I've been tracking. We're getting labor market weakness that demands rate cuts while inflation remains stubbornly above the Fed's 2% target. Core CPI is expected to stay at 3.1% when reported Thursday, well above target and potentially rising due to tariff effects.

This creates an impossible situation for the Fed. Cut rates to help the job market and you risk fueling more inflation. Keep rates high to fight inflation and you worsen the economic slowdown. Traditional monetary policy tools become much less effective when you're dealing with supply-side inflation pressures.

The bond market is already signaling concern. While equity volatility remains subdued, bond market volatility has spiked, with the MOVE Index gaining 10 points over two days in its biggest advance since April's tariff turmoil. This disconnect between bond and stock volatility typically doesn't last long.

THURSDAY'S CPI: THE NEXT TEST

Thursday's CPI report could be the wake-up call markets need. Options traders are expecting just a 0.7% move in the S&P 500, showing dangerous complacency. If inflation comes in hot, it could force a rapid repricing of Fed expectations and create the kind of volatility that low VIX readings suggest markets aren't prepared for.

The threat of persistent inflation is real given ongoing trade wars, deportations, and government workforce cuts. We're essentially watching the Fed try to solve a 2025 structural problem with 1985 monetary tools.

US rent market showing signs of cooling Potential leading indicator for broader services inflation moderation

GLOBAL CONTEXT: RELATIVE OUTPERFORMANCE MASKS PROBLEMS

Despite our challenges, US assets continue outperforming globally. Treasury yields have fallen while UK, Japanese, and European bonds have been hammered. The UK faces potential IMF bailout discussions, while other developed economies grapple with worse structural problems.

This reflects what one strategist called being "the best house in a crumbling neighborhood" rather than genuine confidence in US policies. However, this outperformance creates complacency that could make an eventual reckoning more severe.

The dollar-to-gold ratio continues its historic breakdown, signaling deeper concerns about fiscal sustainability and monetary policy credibility. Gold hitting records above $3,500 while Treasury yields approach 5% tells a story about confidence in US financial management.

POSITIONING FOR STAGFLATION RISKS

Given the economic uncertainty and competing pressures, I maintain focus on defensive positioning that can weather both inflation and growth challenges:

Inflation Protection

TIPS and I Bonds for direct inflation hedging

Gold allocation (5-10%) as monetary policy insurance

Energy and materials exposure for commodity inflation

Quality Equities

Companies with pricing power like utilities (NextEra Energy, Consolidated Edison)

Consumer staples with defensive characteristics (Procter & Gamble, Coca-Cola)

Healthcare for demographic tailwinds and defensive qualities

Fixed Income Strategy

Keep duration short with funds like iShares 1-3 Year Treasury (SHY)

Consider floating rate exposure through senior loan ETFs

Avoid long-term bonds given rising term premiums

What to Avoid

Commercial real estate REITs, especially office properties

High-multiple growth stocks dependent on easy money

Long-duration bond funds vulnerable to inflation surprises

Highly leveraged companies facing refinancing pressure

This week marked a turning point where markets finally acknowledged what the data has been showing for months. The labor market is weakening while inflation remains problematic - exactly the stagflation setup that makes traditional economic management so difficult.

The Fed will likely cut rates in September, but don't confuse monetary easing with economic strength. We're getting rate cuts because the economy is deteriorating, not because everything is fine. This environment rewards patience and defensive positioning over aggressive growth strategies.

Municipal bond ETFs pulling in $19.6 billion versus just $8 billion for mutual funds reflects smart money positioning for potential tax increases and local government stability. CLO managers raising record amounts suggests institutional preparation for distressed opportunities ahead.

Government intervention required to maintain bond market liquidity

The Treasury buying back $138 billion of its own bonds this year, nearly double all of 2024, reveals how much intervention is needed to keep the world's most important bond market functioning. When the largest bond market needs constant government support, it signals systemic stress beneath the surface.

MY TAKE: PATIENCE REQUIRED IN DIFFICULT TERRAIN

We're transitioning from a momentum-driven rally to a period where fundamentals matter more and expectations face reality testing. The jobs report delivered that reality check, even as markets chose to focus on the policy response rather than the underlying weakness.

The setup isn't immediately bearish given Fed support, but it requires much more selectivity. This economic environment is unlike anything we've seen in decades, with policy-induced supply constraints creating inflation while technological displacement and uncertainty slow growth.

Traditional playbooks may not apply when you're dealing with tariff-induced stagflation during a period of unprecedented fiscal stress. The key is maintaining defensive positioning while staying flexible enough to adapt as conditions evolve.

Thursday's CPI report will test market complacency. If inflation surprises to the upside, we could see a rapid shift from the current "bad news is good news" mentality to genuine concern about the Fed's ability to manage competing mandates.

Stay defensive, stay patient, and remember that this environment rewards quality over speculation, diversification over concentration, and preparation over hope.

🦔 Hedgie

Weekly Market Stats

Index | Close | Week | YTD |

|---|---|---|---|

S&P 500 | 6,482 | +0.3% | +10.2% |

NASDAQ | 21,700 | +1.1% | +12.4% |

Dow Jones | 45,401 | -0.3% | +6.7% |

Russell 2000 | 2,489 | +1.8% | +8.8% |

10-yr Treasury | 4.09% | -0.1% | +0.2% |

DISCLAIMER: For educational purposes only. I'm a hedgehog who gets concerned about stagflation risks, not a licensed financial advisor. Taking investment advice from woodland creatures, no matter how well they understand economic cycles, requires your own research and professional consultation for personalized guidance.