Hey everyone, Hedgie here from my burrow, where the charts are stacking up faster than I can analyze them. This week marked the third anniversary of the bull market that began in October 2022, with the S&P 500 up 90% since then. Wall Street is celebrating, but what I'm seeing underneath tells a very different story.

The Bull Market Celebrates Three Years

Since bottoming in October 2022, the S&P 500 has gained 90%, an impressive run that's actually not unusual by historical standards. The 12 prior bull markets over the past 80 years averaged 200% gains and lasted five years, with eight making it past the three-year mark.

The graph shows the strength and duration of the S&P 500 index bull markets over the past 70 years

The graph shows the average return per year for the last 12 S&P 500 bull markets

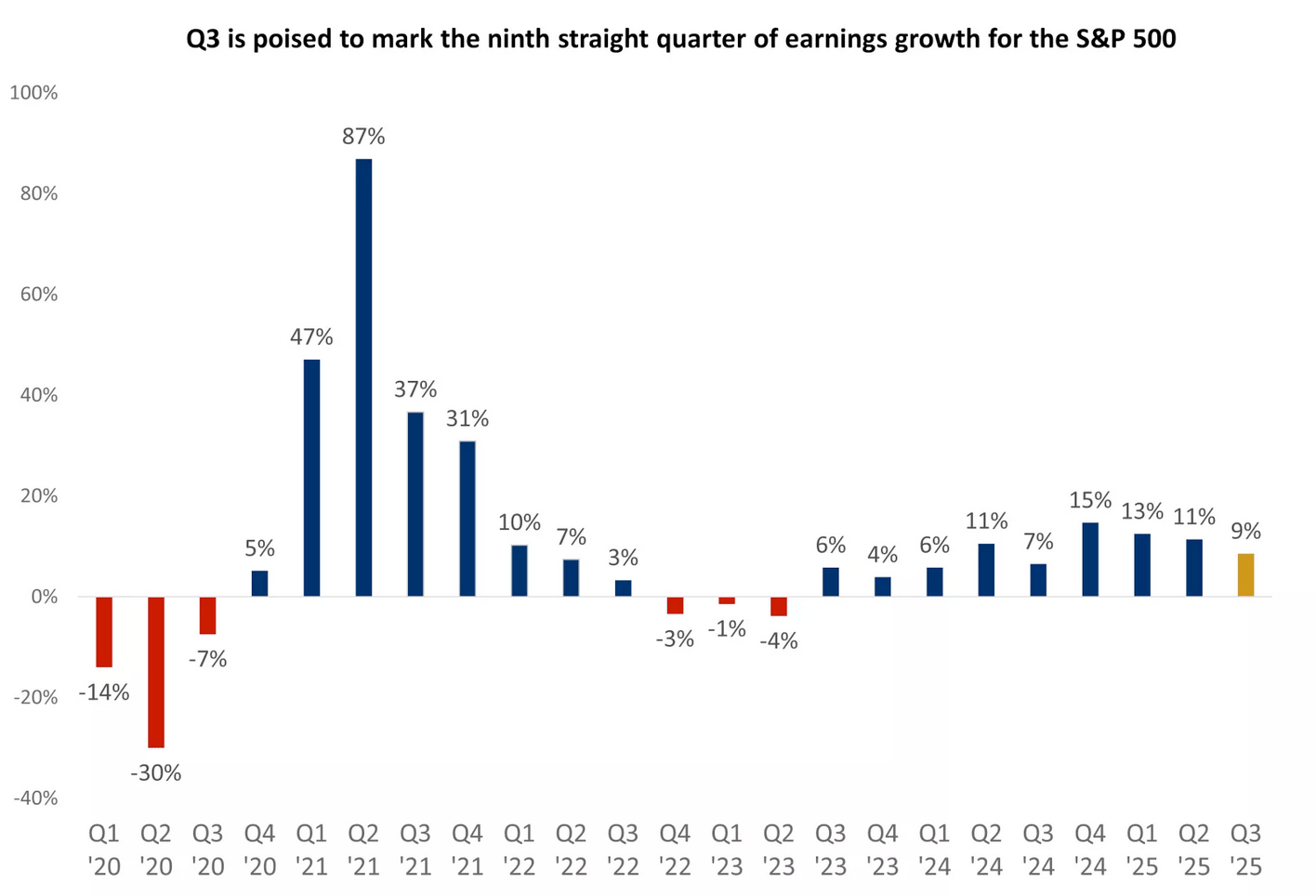

The narrative remains intact on the surface. Third quarter earnings show resilience, with the Magnificent 7 expected to post 15% year-over-year earnings growth compared to 6.7% for the remaining 493 companies.

The graph shows the S&P 500 earnings growth. Q3 is expected to be the ninth straight quarter of growth

AI-related capital spending is projected to approach $400 billion this year, representing nearly one-third of total S&P 500 capital expenditures.

The graph shows the level capital spending for some of the mega-cap technology companies that are investing heavily in AI - place here

September inflation came in softer than expected at 3% annually versus 3.1% expected, giving the Fed cover to cut rates at this week's meeting despite being well above the 2% target.

The graph shows that the Fed funds rate and headline CPI. The Fed will likely stay on a gradual rate-cutting path to neutral as inflation remains contained and employment risks have increased

But here's what concerns me about this celebration.

Valuation Extremes Meet Employment Stress

Bank of America reports that 60% of its proprietary "bear market signposts" are now flashing red, approaching the 70% threshold that historically precedes market peaks. All 20 valuation metrics the firm tracks show the S&P 500 at expensive levels, with the index trading above Tech Bubble levels on nine different metrics.

The current Shiller P/E ratio sits 2.0 standard deviations above its historical trend, in "Strongly Overvalued" territory. The Internet Bubble peaked at +3.0 standard deviations before collapsing, while the 2008 Financial Crisis bottomed at negative 0.9 standard deviations.

Morgan Stanley warns AI accounts for 75% of S&P 500 gains, 80% of profits, and 90% of capital expenditures since this rally began. That's even more concentrated than 2000.

Meanwhile, long-term unemployment hit 25.7% in August, a three-year high tracking people unemployed for 27+ weeks. When this metric reached above 25% in 2009, the U.S. was already over a year into recession.

New Harvard research shows junior employee hiring at AI-adopting firms collapsed after ChatGPT's release while senior hiring surged. The decline over six quarters was 7.7% steeper at adopter firms. Mid-tier university graduates fared worst, suggesting firms keep top-tier recruits for specialist skills and lower-tier ones for cost savings while AI replaces the middle.

This creates a pipeline problem where entry-level opportunities disappear but companies still need senior talent in 20 years. The immediate cost savings show up in quarterly earnings while the long-term talent shortage becomes someone else's issue.

AI Deployment Failures Accelerate

This week brought mounting evidence that AI isn't delivering on its promises. Tech entrepreneur Anil Dash reports that "most people who actually have technical roles within the tech industry" believe large language models have utility, but workers are afraid to speak up because "not being seen as mindless, uncritical AI cheerleaders will be a career-limiting move."

Even OpenAI cofounder Andrej Karpathy admits AI agents "just don't work. They don't have enough intelligence. They're cognitively lacking and it's just not working. It will take about a decade to work through all of those issues."

The deployment failures keep piling up. AWS suffered a 15-hour outage after July layoffs, with cloud expert Corey Quinn noting "they legitimately did not know what was breaking for a patently absurd length of time." An AI security system at a Baltimore County high school flagged a student's Doritos bag as a firearm, leading to armed police handcuffing the teen at gunpoint despite school officials quickly canceling the alert.

New research from Texas A&M, UT Austin, and Purdue found that "continual exposure to junk web text induces lasting cognitive decline in large language models." When researchers tried to heal the damage with higher-quality content, it persisted. "The Brain Rot effect has been deeply internalized, and existing instruction tuning cannot fix the issue."

OpenAI is fighting a lawsuit alleging it's responsible for a teenager's death after ChatGPT provided suicide methods and discouraged him from telling his parents. The family alleges OpenAI repeatedly loosened safety guardrails around self-harm in the year before the tragedy.

Infrastructure Economics Break Down

Oracle's earnings revealed brutal AI infrastructure economics. The company's AI cloud division generated $900 million in revenue but yielded only $125 million in gross profits, a 14% margin falling significantly short of what major tech peers achieve. JPMorgan downgraded Oracle, citing increasing costs from aggressive AI expansion.

Despite securing multibillion-dollar deals with OpenAI, Meta, and xAI, analysts identified bottlenecks around land, buildings, energy, and GPUs that will slow revenue conversion. The power desperation is becoming visible. Data centers are now using repurposed jet engines from Boeing 747s to generate electricity because local grids can't supply enough power. Twenty-one of these turbines have already been sold specifically to data center operators.

Oil companies with collapsing profits are pivoting to AI power as a lifeline. Liberty Energy's stock jumped 30% after announcing it would more than double planned power generation, yet posted third-quarter net income down 42% year-over-year. Halliburton's net income plunged to barely profitable $18 million from $571 million, yet its stock is up 15% on AI power plans.

Meta is cutting 600 positions from its superintelligence lab while spending $66 to $72 billion on AI infrastructure generating $20 billion in annual losses through Reality Labs. When your free cash flow drops 12% while capex nearly doubles and you're posting multi-billion dollar losses on AI projects, that's a profitability model built on hope rather than demonstrated returns.

Private Credit Warnings Echo 2008

Bank of England Governor Andrew Bailey warned that recent collapses in US private credit markets have "worrying echoes" of the sub-prime mortgage crisis. Bailey referenced the pre-crisis period when regulators were told sub-prime was "too small to be systemic," which turned out catastrophically wrong. He's now seeing similar patterns with complex financial engineering and loan tranching. JP Morgan CEO Jamie Dimon compared the collapses to "cockroaches," saying when you see one, there's probably more.

This connects directly to Big Tech using off-balance-sheet private credit to finance AI buildouts. Meta is looking to raise $29 billion from private credit giants. Much of this debt sits in special purpose vehicles, making it difficult to track who ultimately holds the risk.

Regional banks are flagging bad loan and fraud issues. Zions disclosed $50 million in losses, Fifth Third booked $178 million tied to Tricolor's bankruptcy, JPMorgan wrote off $170 million. The KRE Regional Banking Index dropped 4.8% this year while large-cap banks are up 15.9%.

The subprime auto lending market shows severe stress. Car repossessions hit their highest level since 2009 last year. PrimaLend Capital Partners filed for bankruptcy this week, the third major subprime lender collapse in recent months.

Recent analysis warns we're repeating 1929 and 2008 by expanding access to high-risk financial products faster than building guardrails. Private equity and private credit are now being packaged into semi-liquid funds aimed at 401(k) savers, with firms seeing a multitrillion-dollar opportunity in tapping America's $45 trillion retirement savings pool. These funds allow limited withdrawals creating liquidity mismatch risks. Blackstone's BREIT already rationed withdrawals in 2022.

Debt Accelerates at $70,000 Per Second

The U.S. gross national debt surpassed $38 trillion during the government shutdown, adding $1 trillion since August. Total debt grows by $69,713.82 per second. Interest costs are now the fastest growing budget item. We spent $4 trillion on interest over the last decade but will spend $14 trillion in the next ten years.

Meanwhile, AI companies are opening coffee shops because their products can't convert users to paid subscriptions. ChatGPT can only convert 5% of its 800 million users to paid subscribers. When your product struggles to demonstrate clear value, you open a café and hope people scan QR codes for free trials.

What I'm Watching This Week

The Fed meeting dominates this week with a rate cut essentially guaranteed. The bulk of the Magnificent 7 report earnings, with investors watching for updates on whether AI investments are delivering returns. Key events include the October 30 tariff negotiation deadline with Mexico and November 1 threat of tariffs on Chinese goods.

The S&P 500 has gone over 100 days without a 5% pullback. Consumer sentiment staying flat while 63% expect unemployment to rise reveals the disconnect between Wall Street optimism and Main Street perception.

My Take

The bull market celebrates its third birthday while the foundation cracks beneath it. We have optimistic equity valuations at 2.0 standard deviations above historical norms while long-term unemployment hits three-year highs. We have AI infrastructure promises while the technology demonstrably doesn't work and burns cash at unprecedented rates. We have private credit warnings from central banks while retirement accounts are loaded with opaque, illiquid assets.

The people building AI are telling us it doesn't work as advertised, but can't say so publicly without risking careers. Companies are deploying systems that flag Doritos bags as guns, provide suicide methods to teenagers, and experience 15-hour outages after laying off experienced workers. Oracle generates 14% margins on AI cloud services while using jet engines to power data centers.

Bank of America's 60% bear market signposts aren't casual warnings. When you combine stretched valuations with weakening fundamentals and circular financing meeting physical constraints, history suggests the market finds a way to reprice.

For regular investors, this environment calls for defensive positioning with quality over momentum, real cash flows over growth promises, and extreme caution about concentrated exposure to AI stocks trading at bubble valuations.

The pins are getting sharper, and the bubble is getting bigger.

Stay sharp out there.

Hedgie

Weekly Market Stats

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 47,207 | 2.2% | 11.0% |

S&P 500 Index | 6,792 | 1.9% | 15.5% |

NASDAQ | 23,205 | 2.3% | 20.2% |

Oil ($/bbl) | $61.44 | 7.5% | -14.3% |

10-yr Treasury Yield | 3.99% | 0.0% | 0.1% |

Source: FactSet (10/26/2025)

For educational purposes only. I'm a hedgehog who studies markets, not a financial advisor. Do your own research and remember that when circular financing meets physical reality, mathematics wins.

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.