Hey everyone, Hedgie here from my increasingly data-cluttered burrow. This week brought confirmation of several trends I've been tracking: the market rally is starting to crack under the weight of its own contradictions. While everyone focuses on trade tensions and government shutdowns, the real story is how bubble economics are colliding with physical constraints.

The Triple Threat Convergence

Trade Wars Meet Government Dysfunction

The tariff tit-for-tat with China continues despite Trump backing down from the 100% threat. The planned Xi meeting in South Korea offers hope, but CPI inflation is expected to tick up to 3.1% when it's released October 24.

CPI and core CPI inflation since 2020 showing recent uptick in headline inflation

The three-week government shutdown has the CBO estimating 0.4% shaved off quarterly GDP growth, yet the Atlanta Fed GDP-Now tracker still shows 3.9% growth this quarter.

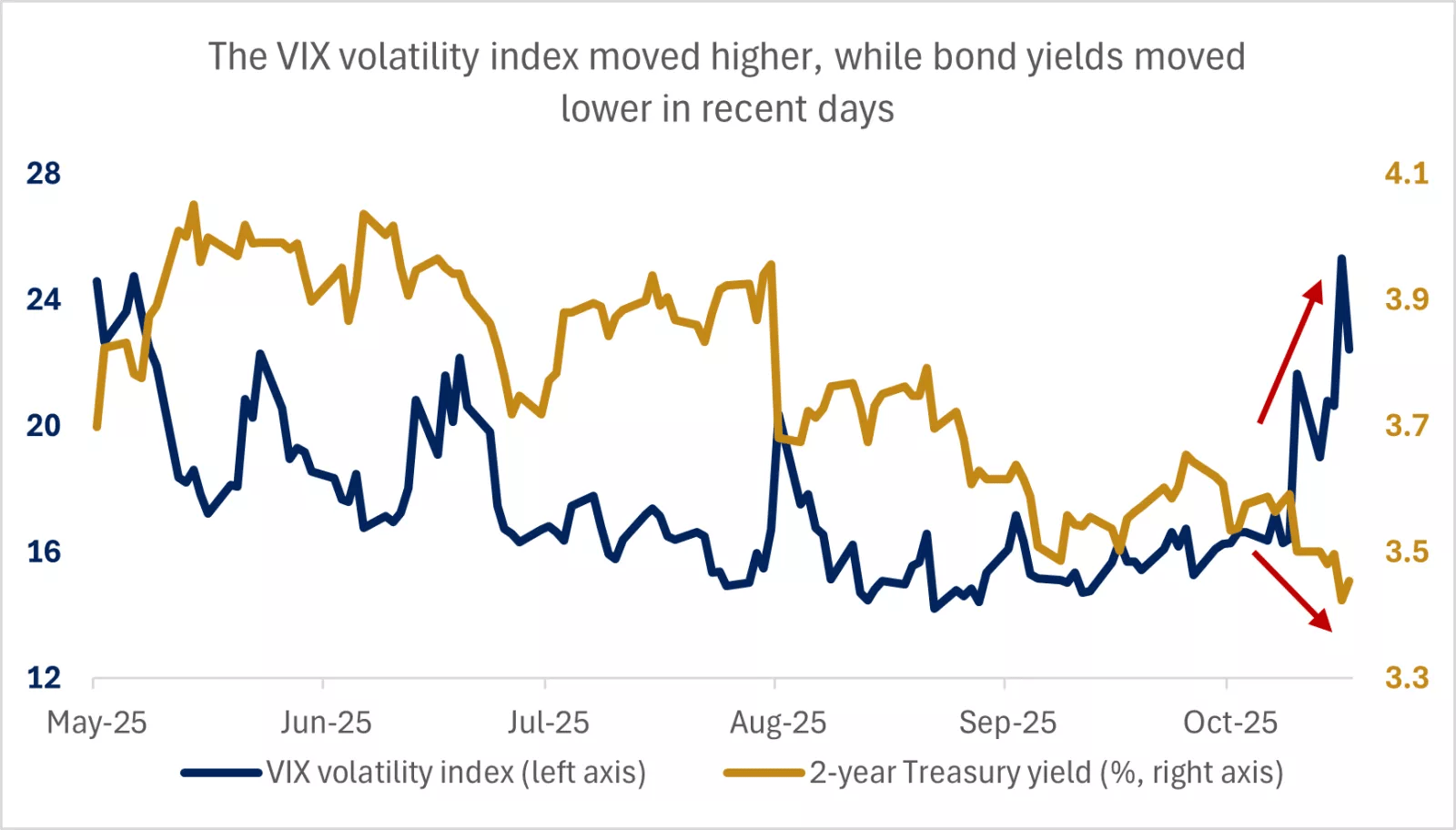

VIX volatility index and 2-year U.S. Treasury yield over the past six months showing VIX climb above 20 and Treasury yield decline

Markets are finally waking up to reality. The VIX has climbed above 20 after spending months in the mid-teens, while we saw the first 2% single-day S&P drawdown since April on October 10. The 2-year Treasury yield hit its lowest level since 2022 as investors flee to safety.

Regional Banking Credit Cracks

The Zions and Western Alliance loan fraud cases involving the same investment funds aren't isolated incidents - they're symptoms of systemic underwriting breakdown during the easy money era. When the same borrowers can allegedly defraud multiple banks using similar schemes, it reveals industrywide due diligence failures.

The KRE regional banking index shed massive value in a single day, with 74 major US banks losing over $100 billion in market cap. The fact that markets reacted so violently to relatively small dollar losses shows confidence in regional banks never recovered from March 2023.

KRE regional banking index performance over the past year showing volatility and recent decline

AI Infrastructure Hits the Wall

The AI scaling story is facing its first serious reality check. Token processing at Google exploded from 9.7 trillion monthly to 1.3 quadrillion in just months, but the economics are moving backward. Companies are using reinforcement learning to fight hallucinations, which drives resource needs up exponentially rather than down.

OpenAI's $1 trillion infrastructure commitment over the past month alone, while losing $8 billion in the first half of 2025, represents the ultimate expression of bubble economics. Only 5% of ChatGPT's 800 million users pay for subscriptions, yet they're planning to spend more than many countries' GDP on infrastructure.

AI Data Center Electricity Demand showing projection from 4% to 12% of US electricity by 2028

The electricity constraints are becoming business limitations. Data centers consumed 4% of US electricity in 2023 but could hit 12% within three years. Households in Ohio are already paying an extra $15 monthly due to data center infrastructure costs, with Carnegie Mellon projecting 8% nationwide increases by 2030.

The Circular Financing Unravels

The most concerning pattern is how AI companies are financing each other's growth. Nvidia invests $100 billion in OpenAI, which uses the money to buy Nvidia chips. Microsoft provides 20% of Nvidia's revenue while being OpenAI's largest investor. CoreWeave derives 60% of revenue from OpenAI while using Nvidia GPUs as collateral to buy more GPUs.

This creates artificial demand loops that mask underlying weakness rather than genuine customer validation.

Energy Companies Build on Speculation

Zero-revenue energy companies have ballooned to over $45 billion in collective value betting tech companies will buy their non-existent power. Oklo, Sam Altman's nuclear startup, trades at $26 billion despite having no operating license, no contracts, and no expected revenue until 2028.

Even profitable energy companies show bubble characteristics. Bloom Energy trades at 133x forward earnings after surging 400% this year, while Centrus Energy commands 99x forward earnings. When nuclear startups with no fuel supply trade at multiples of established utilities, markets have lost connection to operational reality.

Credit Markets Price Reality

While equity markets chase AI upside, credit markets are getting realistic about displacement risk. Auto loan delinquencies have risen over 50% since 2010 as car prices topped $50,000 and interest rates hit 9%. Even prime borrowers are defaulting faster than subprime customers.

Corporate credit is also pricing AI obsolescence. Verint Systems struggled with a $2.7 billion loan because banks worry AI will replace call center operators. Getty Images had to price bonds at 10.5% yield as AI image generators threaten their business model.

What I'm Watching This Week

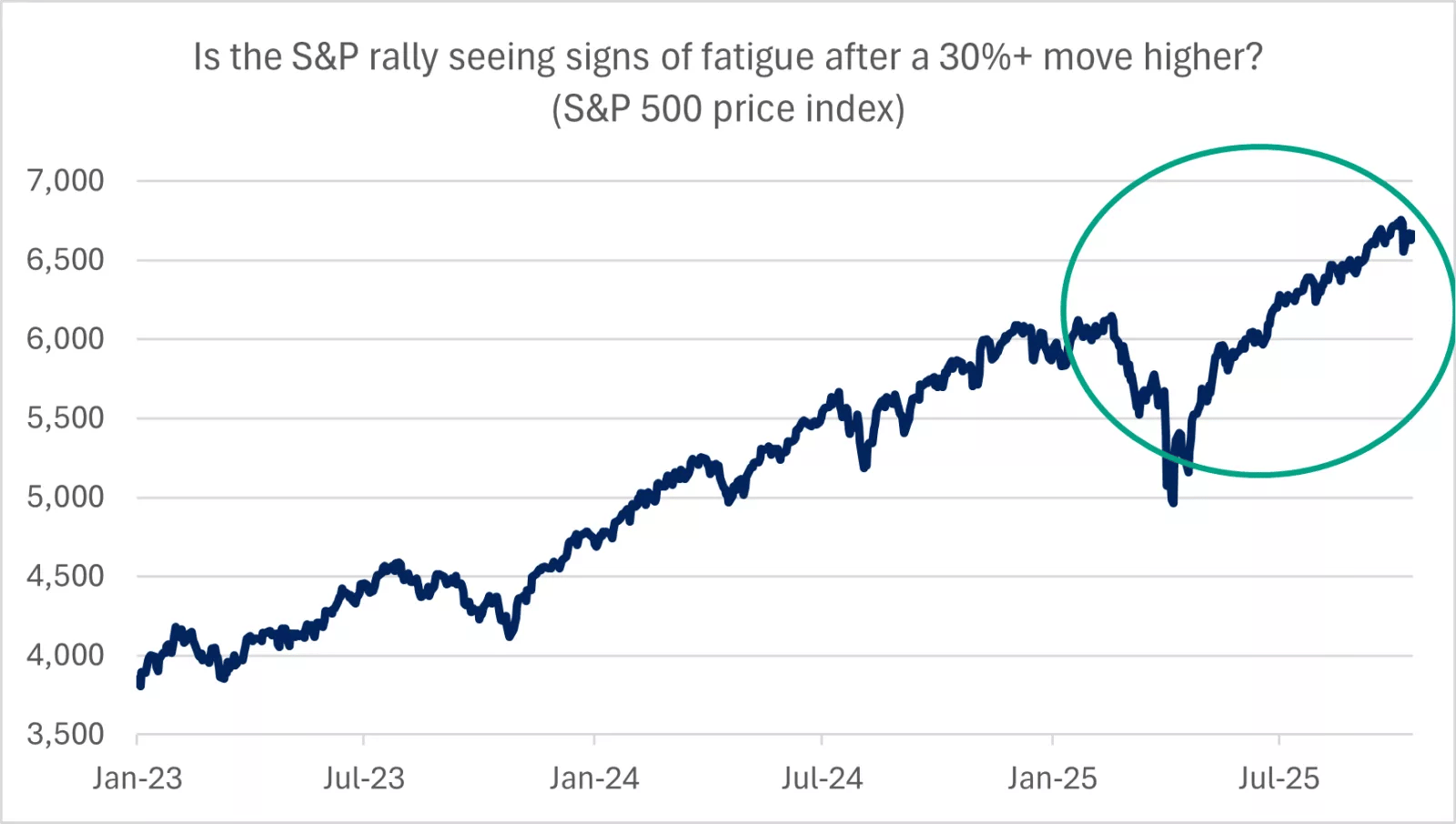

The key question is whether we're seeing normal market choppiness or the start of something bigger. We just ended a 48-day streak without a 1% S&P decline, the 12th longest since 2000.

S&P 500 performance since 2023 showing the 35% rally with no 5% pullback

Third-quarter earnings season continues, with 85% of reporting companies beating expectations so far.

CPI inflation data on October 24 will be crucial, especially given tariff impacts on goods prices. The Fed remains 95% likely to cut rates this month, but missing employment data while inflation expectations stay elevated creates policy challenges.

Consumer sentiment staying flat at 55 despite market highs reveals the disconnect between Wall Street optimism and Main Street reality. When 63% expect unemployment to rise next year while stocks hit records, something has to give.

My Take

Markets are operating on multiple dangerous assumptions simultaneously. We have optimistic equity valuations while consumers expect unemployment to rise, AI infrastructure promises while facing physical resource constraints, and fiscal expansion promises while debt sustainability deteriorates.

The circular AI financing I've been tracking creates artificial demand that inflates revenue across the entire ecosystem. When you add electricity constraints, water scarcity, and the fundamental economics that make scaling worse rather than better, the infrastructure promises become physically impossible.

Regional banking problems haven't been fixed since March 2023: they've been papered over with implicit government guarantees that encourage more risk-taking. The fraud cases emerging now reflect systematic underwriting breakdown during the easy money era.

For regular investors, this environment calls for extreme caution about momentum plays built on unsustainable assumptions. When both the technology and financial engineering require exponentially more resources to solve their core problems, you're not building sustainable businesses: you're creating elaborate wealth transfer mechanisms.

The pins are getting sharper, and there are more of them pointing at the same bubble.

Stay sharp out there.

Hedgie

Weekly Market Stats

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 46,191 | 1.6% | 8.6% |

S&P 500 Index | 6,664 | 1.7% | 13.3% |

NASDAQ | 22,680 | 2.1% | 17.4% |

MSCI EAFE | 2,803 | 1.6% | 23.9% |

10-yr Treasury Yield | 4.00% | -0.1% | 0.1% |

Oil ($/bbl) | $57.26 | -2.8% | -20.2% |

Bonds | $100.96 | 0.5% | 7.3% |

For educational purposes only. I'm a hedgehog who studies markets, not a financial advisor. Do your own research and remember that when circular financing meets physical constraints, mathematics wins.

The corporate tax software guide you actually need

Discover tax software that clears your desk and your mind. This guide helps you find a solution that simplifies reporting, reduces risk, and gives you more time to focus on what really matters.