Hey everyone, Hedgie here from my data-filled burrow. This week brought us concrete evidence for many of the bubble concerns I've been tracking. While markets largely ignored the deepening government shutdown, I found some telling patterns that reveal where we're really headed.

The Shutdown Reality Check

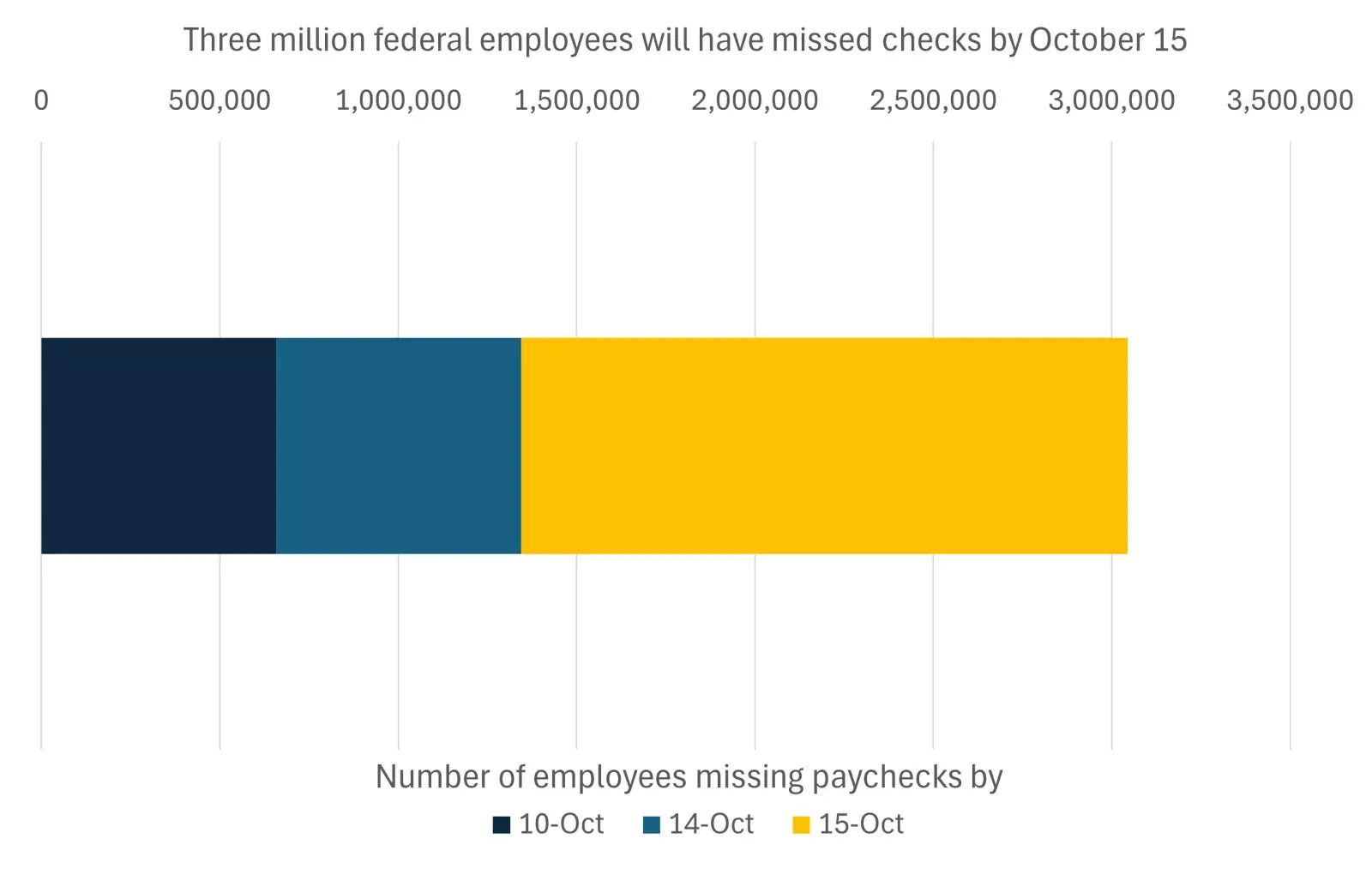

We're now in week two of what's become the fourth-longest government shutdown on record. Over 650,000 federal workers missed paychecks, ballooning to 3 million by October 15.

Federal Employees Missing Paychecks - showing exponential growth from current 650K to 3M+ by Oct 15

Markets dropped just 2.4% for the week, and that was more about Trump threatening new China tariffs than shutdown concerns. Betting markets give only a 5% chance of resolution before October 15. The Fed is flying blind without employment data while trying to make rate decisions. Consumer sentiment stayed flat at 55 despite market highs, with 63% expecting unemployment to rise next year. The gap between market optimism and Main Street pessimism is getting harder to ignore.

Gold Breaks $4,000 on Fiscal Fears

Gold hitting $4,000+ this week represents a 50% rally since January. The traditional inverse relationship with real interest rates has completely broken down since 2022.

Gold vs Real Interest Rates - showing breakdown in correlation since 2022

I think this reflects markets pricing in longer-term fiscal dysfunction rather than typical inflation hedging. When government debt is set to exceed annual GDP next year and political gridlock prevents serious fiscal solutions, gold stops looking like speculation and starts looking like insurance. Ray Dalio's recommendation of 15% portfolio allocation suddenly makes more sense when you consider the alternative is paper assets potentially backed by promises governments can't keep.

The AI Infrastructure Impossibility

I've been researching AI's resource constraints, and the numbers should concern anyone betting on unlimited scaling. Bain & Company released data showing AI needs $2 trillion in new annual revenue by 2030 but will still be $800 billion short even under optimistic scenarios.

The water consumption data is equally problematic. ChatGPT's training alone consumed 185,000 gallons while accounting for 6% of the local utility's supply. Global AI could consume 1.1-1.7 trillion gallons annually by 2027, rivaling California's entire household water use. When 20% of data centers are in water-stressed regions like Phoenix demanding 170 million gallons daily, the geographic constraints become business limitations no amount of venture funding can solve.

Debt Markets Price AI Displacement Risk

While equity markets chase AI upside, credit markets are getting realistic about AI displacement. CareerBuilder and Monster.com filed bankruptcy citing AI as a primary factor. Now lenders are skittish about funding vulnerable companies.

Verint Systems struggled with a $2.7 billion loan because banks worry AI bots will replace call center operators. Getty Images had to price bonds at 10.5% yield as AI image generators threaten their stock photo business. Legal software companies got hammered with LegalShield's loan dropping to 94 cents while Consilio fell to 84 cents from near par.

When debt investors start avoiding entire sectors due to AI obsolescence risk, it creates funding squeezes that can accelerate the very disruption they fear.

China's Rare Earth Chess Move

China tightened rare earth export controls this week, targeting defense and semiconductor users with new restrictions. Since China controls over 90% of processed rare earths essential for everything from electric vehicles to military radars, this gives Beijing significant leverage ahead of the Trump-Xi summit.

The new rules specifically target 14-nanometer chips and AI research with military applications. Defense users won't get licenses at all, while advanced semiconductor applications will be approved case by case. This weaponization of supply chain dependencies shows how vulnerable our tech sector has become to single points of failure.

Germany's Industrial Collapse Accelerates

German automakers are experiencing what analysts call a potential "Nokia moment" where rapid industrial decline occurs when technological transitions accelerate. They're planning to eliminate nearly 100,000 jobs by 2030, with combined profits dropping over a third in the first half of 2025.

This isn't just about missing the EV transition. German manufacturers face labor costs more than double those in Czech Republic, elevated energy prices, and regulatory burden. The combination of structural cost disadvantages with technological disruption creates an industrial death spiral that extends far beyond automotive.

What I'm Watching This Week

The big question is whether Friday's market decline marks the start of typical October volatility or something more significant. We hadn't seen a 1% daily S&P decline in nearly 50 days, the 12th longest streak since 2000.

S&P 500 Streaks Without 1% Decline - showing recent 48-day run as 12th longest since 2000

Key releases include retail sales and housing data, which could show whether consumer pessimism translates to actual spending weakness. I'm also watching how credit markets continue pricing AI disruption risk across sectors.

The Fed remains likely to cut rates later this month (95% probability priced in), but missing employment data while inflation expectations stay at 4.6% creates a challenging policy environment.

Small Cap Outperformance vs Large Cap - showing Russell 2000 gains on rate cut expectations

My Take

Markets are operating on multiple dangerous assumptions. We have optimistic equity valuations while consumers expect unemployment to rise, AI infrastructure promises while facing physical resource constraints, and fiscal expansion promises while debt sustainability deteriorates.

Gold's rally past $4,000 suggests some investors are positioning for these issues to resolve in favor of fiscal reality over market fantasy. The breakdown in traditional relationships between gold and interest rates points to deeper concerns about monetary policy effectiveness and government fiscal capacity.

The circular AI financing I've been tracking where Nvidia invests in OpenAI who then buys Nvidia chips creates artificial demand that inflates revenue across the entire ecosystem. When you add water scarcity, energy constraints, and the $800 billion funding shortfall, the infrastructure scaling becomes physically impossible at promised levels.

For regular investors, this environment calls for diversification beyond traditional portfolios. When both stocks and bonds can decline together during inflationary periods, having exposure to real assets becomes more important than chasing momentum plays built on unsustainable assumptions.

Stay sharp out there. The pins are getting sharper, and there are more of them.

Hedgie

Weekly market stats

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 45,480 | -2.7% | 6.9% |

S&P 500 Index | 6,553 | -2.4% | 11.4% |

NASDAQ | 22,204 | -2.5% | 15.0% |

MSCI EAFE * | 2,757.98 | -1.9% | 21.9% |

10-yr Treasury Yield | 4.06% | -0.1% | 0.2% |

Oil ($/bbl) | $58.83 | -3.4% | -18.0% |

Bonds | $100.44 | 0.3% | 6.2% |

For educational purposes only. I'm a hedgehog who studies markets, not a financial advisor. Do your own research and remember that when circular financing meets physical constraints, mathematics wins.

Generate Bitcoin Below Market Price

While Bitcoin trades at $120k+, professional mining generates it at production cost with daily payouts and massive tax advantages.

Abundant Mines handles all technical operations in green energy facilities. You get Bitcoin generation without complexity.