Hey everyone, Hedgie here. This week brought confirmation from the Fed Chair himself that the labor market problems I've been documenting are real, and credit stress is surfacing across multiple points simultaneously. We're not preparing for a crisis anymore. We're in the early stages of one unfolding.

Powell Confirms Job Creation "Pretty Close to Zero"

Fed Chair Jerome Powell said job creation is "pretty close to zero" once you adjust for statistical overcounting. He noted companies are announcing layoffs or hiring pauses, many explicitly citing AI. "Much of the time they're talking about AI and what it can do," Powell said, warning large employers signal they won't need to add headcount for years.

The Fed cut rates to 3.75%-4%, citing downside risks to employment even as inflation remains 50% above the 2% target. Then Powell made clear a December cut is "far from guaranteed," sending Treasury yields up 10 basis points to 4.09%.

Powell described the economy as K-shaped: higher-income households and corporations benefit from stock markets and AI productivity gains, while lower-income consumers struggle. "We have upside risks to inflation, downside risks to employment," Powell said. "This is very difficult for a central bank, because one calls for rates to be lower, one calls for rates to be higher."

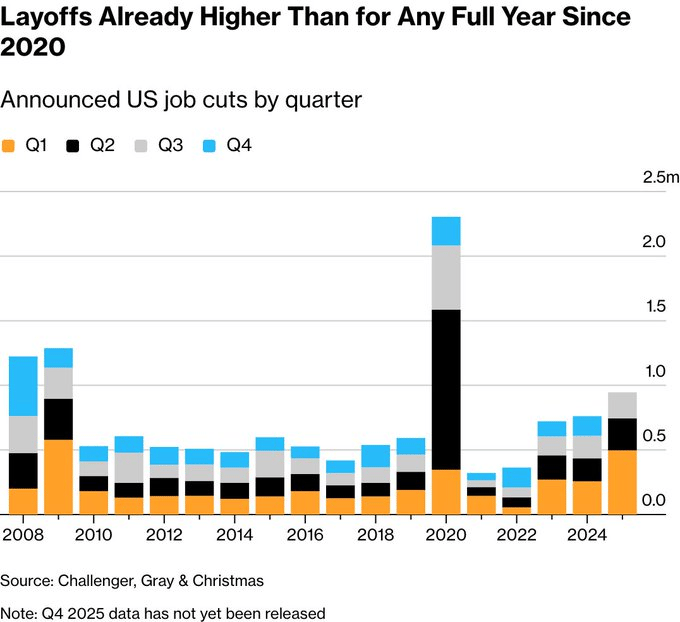

The Layoff Surge

U.S. employers announced almost 950,000 job cuts through September, the highest year-to-date total since 2020. Excluding COVID, this surpasses full-year layoffs for every year since 2009. October brought Amazon (14,000 jobs), Target (1,800), Starbucks (900), and Paramount (1,000). More than 17,000 layoffs were explicitly tied to AI.

Allianz Trade economist Dan North: "We're not just in a low hire, low fire environment anymore. We're firing." Southwest Airlines announced its first large-scale layoffs in company history.

Credit Stress Across Multiple Points

Zombie Companies Hit 2022 Highs

Companies that can't cover interest expenses hit the highest level since early 2022, with almost 100 added in October. Examples include Altice USA whose bonds now trade below 80 cents, yielding close to 20%. Companies face a 2027 maturity wall with no clear path to refinance.

Private Credit: The First Cockroaches

JPMorgan CEO Jamie Dimon called the failures of Tricolor Holdings and First Brands the first "cockroaches" after his bank took losses. "Everyone should be forewarned on this one," Dimon said. Moody's warns of banks' $300 billion exposure to private credit, noting "negative effects may only become apparent years later."

The historical pattern repeats: In the 1920s, margin accounts created indirect bank exposure, collapsing in 1929. In the 1980s, junk bonds grew from $10 billion to $189 billion before crashing. In the 2000s, mortgage-backed securities led to 2008. Private credit is the latest iteration.

Money Markets Under Strain

Overnight repo rates traded as high as 4.32%, outside the Fed's 3.75%-4% target range for the first time since 2019 outside month-end periods. Think of repo markets as the financial system's plumbing. When rates spike above normal, the system is running low on cash.

The Fed's Standing Repo Facility saw $20.4 billion in usage, the most since 2021. The Fed announced it will stop shrinking its balance sheet December 1st because stress signals got too intense. The 2019 repo spike required the Fed to inject $500 billion.

AI Spending Surges, Economics Don't

Alphabet, Meta, and Microsoft spent $78 billion in capex last quarter, up 89% year-over-year. Microsoft hit $34.9 billion but Azure revenue growth didn't accelerate. Meta warned 2026 spending would be "notably larger" while Reality Labs lost $4.4 billion on $470 million revenue.

Microsoft disclosed community opposition as an operational risk after dropping Wisconsin data center plans. Oracle faced New Mexico protests. Households in Ohio already pay an extra $15 monthly due to data centers, with Carnegie Mellon projecting 8% nationwide increases by 2030.

OpenAI restructured from nonprofit to for-profit while losing $8 billion in six months, securing $30 billion from SoftBank, and committing $250 billion to Azure. This is circular financing where Microsoft provides 20% of Nvidia's revenue while being OpenAI's largest investor.

The K-Shaped Economy

Health insurance hit $27,000 for family plans, up 6%. Auto loan delinquencies reached 6.5%. Gen Z faces 1.2 million applications for 17,000 UK graduate roles. Tech companies cut workers aged 21-25 from 15% to 6.8% of headcount since 2023.

What I'm Watching

Government Shutdown: The CBO estimates the shutdown reduced Q4 GDP growth by 1%, rising to 2% by month-end, equating to $40 billion in impact.

Corporate Earnings: Two-thirds of S&P 500 companies beat expectations. Apple and Amazon's results pushed indexes to new records, with the rally since April approaching 40%.

My Take

I don't think we're early anymore. We're watching credit stress surface across multiple points simultaneously.

Powell confirmed job creation is effectively zero and companies cite AI for layoffs. Zombie companies hit 2022 highs facing a 2027 maturity wall. Private credit at $4 trillion with Dimon calling failures the first cockroaches. Repo markets spiking outside target ranges. These aren't isolated incidents.

AI companies spent $78 billion in quarterly capex, up 89%, while Azure revenue growth doesn't accelerate. OpenAI loses $8 billion in six months but secures $30 billion contingent on restructuring and commits $250 billion to Azure. This is circular financing assuming future demand will materialize at margins current evidence doesn't support.

Markets hit records while auto delinquencies reach 6.5%, health insurance costs $27,000 annually, and 58% of recent graduates can't find stable work. Powell described it: higher-income households benefit from stock markets while lower-income consumers pull back.

The historical pattern of financial innovation creating systemic risk through indirect bank exposure is repeating. After margin accounts (1929), junk bonds (1989), and mortgage-backed securities (2008), each crisis tightened bank regulations. But there's always someone else to take the risk.

The difference this time: governments already used their fiscal capacity in 2008 and COVID. Now with debt at 110% of GDP and political paralysis, the capacity to cushion the next crisis is severely limited.

Physical constraints emerge as business limitations. Microsoft discloses community opposition as operational risk. When your growth strategy requires power the grid can't provide and communities won't accommodate, that's a constraint capital can't solve.

I think the structure is already cracking. The timing of when it fully matters remains uncertain, but conditions are converging: zombie companies facing refinancing walls, private credit showing pre-2008 warning signs, repo markets under strain, labor markets deteriorating, and AI spending justified by projected returns current economics don't support.

Markets can stay irrational longer than expected. But when Powell confirms the policy bind, credit stress surfaces across multiple points, and physical constraints emerge as business limitations, the pins are getting sharper.

Stay sharp out there. The early stage of recognition is the most important time to pay attention.

Hedgie

Weekly Market Stats

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 47,563 | 0.8% | 11.8% |

S&P 500 Index | 6,840 | 0.7% | 16.3% |

NASDAQ | 23,725 | 2.2% | 22.9% |

MSCI EAFE | 2,797.54 | -0.5% | 23.7% |

10-yr Treasury Yield | 4.09% | 0.1% | 0.2% |

Oil ($/bbl) | $60.86 | -1.0% | -15.1% |

Bonds | $100.54 | -0.6% | 6.8% |

Source: FactSet, 10/31/2025.

The Week Ahead: ISM Services PMI, ISM Manufacturing PMI, and ADP employment survey Wednesday. BLS jobs report likely delayed due to shutdown.

For educational purposes only. I'm a hedgehog who studies markets, not a financial advisor. Do your own research and remember that when credit stress surfaces across multiple points while governments lack fiscal capacity, the structure is already cracking.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.