Hey everyone, Hedgie here! Welcome to this week's market breakdown. I'm going to walk you through everything that happened in the markets this week and explain what it means for regular investors like you. This was a week of continued recovery as job growth surprised to the upside and trade tensions showed further signs of easing.

All three major indices finished the week higher, with the S&P 500 up 2.9%, the Dow up 3.0%, and the Nasdaq surging 3.4%. As of Sunday evening when this newsletter was prepared, stock futures were pointing to a negative open on Monday (S&P 500 futures -0.75%, Nasdaq futures -0.76%, Dow futures -0.72%) as traders digest the latest jobs report and prepare for a busy week of economic data.

Note: This newsletter was prepared on Sunday evening for Monday morning release. Market conditions may have changed by the time you're reading this.

JOBS SURPRISE AND TRADE PROGRESS: WHAT HAPPENED THIS WEEK

This week we saw several key developments that point to continued economic resilience despite trade concerns:

Strong Jobs Report Calms Recession Fears

The April jobs report released on Friday showed the U.S. economy added 177,000 jobs, significantly above the expected 138,000. This positive surprise helped calm fears about an imminent recession following the negative GDP reading for Q1. The unemployment rate remained steady at 4.2%, which is still historically low despite being up from the 3.4% low we saw in 2023.

Wage growth moderated slightly to 3.8% annually, below the expected 3.9%, which is good news for inflation concerns. This suggests that while the job market remains healthy, wage pressures that could fuel inflation are easing somewhat. The combination of solid job growth with moderating wage gains represents a "goldilocks" scenario for the economy.

The jobs report was particularly reassuring because it came after Wednesday's GDP report showed the U.S. economy contracted by 0.3% in the first quarter. That negative reading was largely due to a surge in imports as companies rushed to purchase goods ahead of tariff implementation, rather than a fundamental weakness in consumer spending or business investment.

The graph shows that while the unemployment rate has moved higher since 2023, it remains historically low, and job growth continues at a healthy pace despite some slowing from late 2024.

Trade Tensions Continue to Ease

Following last week's positive developments on trade, we saw further signs that the U.S. and China may be working toward a resolution. On Friday, China's Commerce Ministry announced it was "evaluating" the possibility of holding trade talks with Washington after the U.S. sent messages through "relevant parties" expressing interest in negotiations.

This follows reports that China has started exempting some U.S. goods from tariffs covering roughly $40 billion worth of imports. While not officially confirmed, the list of exempted products reportedly includes pharmaceuticals and industrial chemicals, suggesting a potential thaw in trade relations.

President Trump also continued to roll back some of his initial tariffs on cars and auto parts, and Commerce Secretary Howard Lutnick announced that a major trade deal was nearing the finish line. These developments have helped ease market concerns about a full-blown trade war, though uncertainty remains about the final outcome.

Corporate Earnings Show Resilience

First-quarter earnings season is now about 70% complete, and the results have been better than expected. Approximately 76% of S&P 500 companies have reported positive earnings surprises, above the 10-year average beat rate of 75%. Earnings growth for Q1 is on track for 12.5% year over year, above the 11.5% expected at the end of last year.

However, guidance for the second quarter has weakened as companies point to uncertainty around consumer spending and the tariff environment. The earnings growth forecast for Q2 has fallen to 5.8%, down substantially from the 11.3% expected at the end of last year.

The graph shows that estimates for S&P 500 earnings per share growth in 2025 have fallen relative to expectations at the end of 2024.

This past week, we heard from several tech giants and consumer companies. Microsoft and Meta pointed to continued capital expenditure in artificial intelligence and datacenter growth, committing upward of $152 billion in capital expenditures to support AI capacity. This alleviated concerns of a capex slowdown in the tech sector.

On the other hand, companies more exposed to tariffs and consumer spending expressed caution. Amazon and Apple provided soft guidance and reported weaker sales in China, citing tariffs and trade uncertainty. Consumer companies like McDonald's reported negative same-store sales and pointed to declining traffic, joining other food service companies like Starbucks and Chipotle in highlighting softer consumer demand, particularly among low-income consumers.

Bond Market Stabilizes

U.S. Treasury yields fluctuated throughout the week in response to economic data releases. Yields were generally lower through Thursday but increased on Friday following the better-than-expected jobs report. The 10-year Treasury yield closed around 4.31%, relatively unchanged for the week but down from the recent high of 4.59% in mid-April.

The bond market is now pricing in three rate cuts in 2025, down from four before the jobs report. The probability of a June rate cut has declined from 55% to about 33%, according to the CME FedWatch Tool, as the resilient job market reduces the urgency for the Federal Reserve to cut rates.

The graph shows that the probability of a Federal Reserve interest rate cut in June has declined following the better-than-expected nonfarm payrolls report for April.

International Markets Continue to Outperform

While U.S. markets have rebounded nicely over the past two weeks, international markets continue to lead in year-to-date performance. The MSCI EAFE Index, which tracks developed markets outside the U.S. and Canada, rose 0.9% for the week and is now up 9.7% for the year, significantly outperforming U.S. indices.

European markets were particularly strong, with Germany's DAX gaining 4.63%, Italy's FTSE MIB adding 4.13%, and France's CAC 40 advancing 3.57%. The UK's FTSE 100 rose a more modest 2.15%.

Economic growth in the eurozone accelerated in the first quarter to 0.4% from 0.2% in the previous three months, double the consensus estimate of economists. Spain's economy grew by 0.6% and Italy by 0.3%, exceeding forecasts, while Germany and France returned to growth after previous contractions.

Economic Warning Signs Remain

Despite the positive jobs report and market rebound, some concerning economic signals persist:

Negative GDP Growth

The U.S. economy contracted at an annual rate of 0.3% in the first quarter, the first negative reading since 2022. While this was largely due to a surge in imports ahead of tariff implementation, it still represents a significant slowdown from previous quarters. Personal consumption rose by 1.8% in Q1, down from 4% in Q4 but still above forecasts of 1.2%.

Business Activity Slows

S&P Global's Flash Purchasing Managers' Index (PMI) survey data for April indicated that U.S. business activity growth slowed to the lowest level in 16 months. While manufacturing activity unexpectedly increased, services activity growth slowed sharply, dragging the overall index down to 51.2 from 53.5 in March.

Housing Market Weakness

The housing market continues to show signs of weakness. Sales of previously owned U.S. homes dropped 5.9% in March, the steepest monthly drop since November 2022. The 4.02 million seasonally adjusted home sales during the month were the lowest for March since 2009, reflecting the impact of high mortgage rates on affordability.

Consumer Sentiment Declines

Consumer sentiment extended its steep year-to-date decline, falling for the fourth month in a row. The University of Michigan's final reading for April was 52.2, down from 57.0 in March, as survey participants cited concerns about higher tariffs and inflationary pressures. At year-end 2024, the index was at 74.0.

Even more concerning, expectations for inflation in the year ahead surged to 6.5%, up from 5% in March and the highest reading since 1981. This jump in inflation expectations could complicate the Fed's job, as consumer expectations can become self-fulfilling if people begin to demand higher wages or rush to purchase goods before prices rise further.

University of Michigan: Consumer Sentiment (UMCSENT)

WHAT THIS MEANS FOR YOUR INVESTMENTS

Impact on Your Portfolio

These market forces have several practical implications for regular investors:

1. Economic resilience amid uncertainty: The strong jobs report suggests the U.S. economy remains resilient despite trade tensions and the negative Q1 GDP reading. This reduces the likelihood of a deep recession in the near term, which is positive for risk assets like stocks.

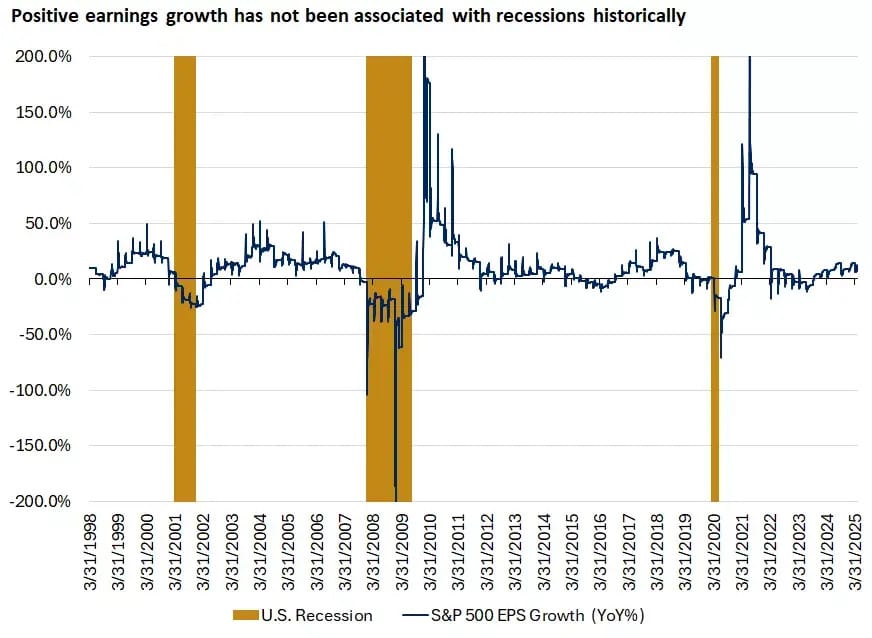

2. Earnings growth moderating but still positive: While earnings guidance for future quarters has weakened, the fact that earnings growth remains positive is historically inconsistent with recessionary environments. As long as corporate earnings continue to grow, even at a slower pace, it provides fundamental support for stock prices.

3. Fed rate cuts likely delayed: The resilient job market means the Federal Reserve may wait longer before cutting interest rates. Markets are now pricing in three cuts this year instead of four, with the first cut more likely to come in September rather than June. This could mean higher-for-longer interest rates, which may create headwinds for growth stocks and rate-sensitive sectors.

4. International diversification pays off: The continued outperformance of international markets highlights the importance of global diversification. Investors with significant exposure to international stocks have likely seen better year-to-date performance than those concentrated in U.S. equities.

5. Sector considerations: Companies with significant exposure to tariffs and consumer spending are facing more challenges than those in sectors like technology that are investing heavily in AI and other growth initiatives. This suggests a more selective approach to sectors and individual stocks may be warranted.

The graph shows that the year-over-year percent change in S&P 500 earnings per share has historically declined during recessionary periods. Current earnings growth remains positive, suggesting we're not in a recession yet.

What This Means for Different Types of Investors

If you're just starting your investing journey, the recent market volatility has created some attractive entry points in quality companies. The tech sector's rebound shows the resilience of growth stocks, but don't overlook international markets, which continue to outperform the U.S. this year. Consider a globally diversified approach rather than concentrating solely on U.S. stocks, especially tech names.

For those in the middle of your career, this is a good time to review your asset allocation. The recent market swings might have thrown your target allocations out of balance. With bonds stabilizing and international markets outperforming, ensure you have appropriate exposure to these asset classes. Sectors less exposed to tariffs, such as financials and healthcare, may offer opportunities as they're less vulnerable to trade tensions.

For investors nearing or in retirement, the stabilization in the bond market provides some relief after the volatility earlier this year. The yield curve has steepened, with the spread between 2-year and 10-year yields widening to 50 basis points and the 10-year/30-year spread expanding to 46 basis points. This creates opportunities in intermediate-term bonds, which offer attractive yields with less interest rate risk than longer-term bonds.

AUTO MARKET DYNAMICS: A DEEPER DIVE

The auto market deserves special attention this week because of the significant impact of tariffs on both new and used car prices. The U.S. imposed 25% tariffs on imported auto parts on Saturday, following the 25% tariffs on imported cars that took effect in early April.

These tariffs will have a broad impact because even cars made in the United States often have engines, transmissions, batteries, or other components produced in other countries. The administration has exempted parts from Canada and Mexico as long as they meet the requirements of the North American trade agreement, but components from other countries will face the full tariff.

The impact is already visible in the used car market. CARFAX reports that used car sales are surging at twice the rate of last spring, while prices have jumped nearly double compared to last year. Used vans and minivans have seen the biggest price increases, up $800 in March alone, while used SUVs are up $400-500.

The chart shows that after steadily declining from their 2022 peak through early 2025, used car prices have begun trending upward again in March-April. This reversal coincides with the announcement and implementation of auto tariffs.

For consumers, these market changes present several considerations:

1. New vehicle price increases: New cars will likely become more expensive as manufacturers pass on tariff costs. Even American-made vehicles will see price increases since many contain imported parts.

2. Used car market pressure: The traditional refuge of the used market during new car price increases is also experiencing upward price pressure. According to industry analysis, nearly 80% of vehicles priced under $30,000 will be affected by tariffs in some form.

3. Repair and insurance costs: The tariffs on new auto parts will also increase the cost of repairs and insurance premiums, as replacement parts become more expensive.

4. Timing considerations: Some manufacturers, including Ford and Hyundai, have indicated they won't immediately raise prices due to existing inventory. This creates a potential window for purchases before price increases take effect.

5. Inflation impact: These auto price increases will likely contribute to inflation despite falling oil prices. Transportation costs make up about 18% of the Consumer Price Index, so higher vehicle prices and repair costs can significantly impact overall inflation numbers.

The auto market situation highlights the real-world impact of trade policies on consumers. While the administration's goal is to promote domestic manufacturing, the immediate effect is higher prices across the board for vehicles and related services.

LOOKING AHEAD: WHAT TO WATCH NEXT WEEK

The market is gearing up for another important week with several key events to monitor:

1. Federal Reserve meeting: The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday. While no change in interest rates is expected, investors will closely analyze the Fed's statement and Chair Powell's press conference for clues about the timing of future rate cuts.

2. ISM Services PMI: Monday's release will provide insights into the health of the services sector, which makes up the majority of the U.S. economy. After the manufacturing PMI showed unexpected strength, investors will be watching to see if services activity stabilizes after the sharp slowdown reported in the flash PMI.

3. Earnings reports: While the bulk of earnings season is behind us, several notable companies will report this week, including Disney, Uber, and Airbnb. These reports will provide additional insights into consumer spending and travel trends.

4. Trade developments: Any announcements regarding trade negotiations between the U.S. and China will be closely watched. Markets would likely respond positively to concrete progress toward a deal.

5. Consumer credit: Friday's consumer credit report will show whether Americans continued to increase their borrowing in March. With auto loan delinquencies rising to 8.1% nationally (the highest level since the 2008 financial crisis), signs of stress in consumer credit could raise concerns about the health of household finances.

The chart shows auto loan delinquency trends going back to 2003. Early delinquencies (30-90 days late) have surged to around 8% from about 5% in 2021-2022, approaching the levels seen during the 2008 financial crisis. This rapid increase over just 2-3 years is occurring while unemployment remains relatively low, which is unusual compared to previous cycles.

The market rebound over the past two weeks reflects growing optimism that the worst-case scenarios for trade and the economy may be avoided. The S&P 500 has recovered about 8% from its recent lows, narrowing its year-to-date loss to about 3%. However, we're still receiving mixed signals that warrant caution.

👍 On the positive side:

1. Job growth remains solid, with unemployment still at historically low levels

2. Corporate earnings for Q1 have exceeded expectations

3. Trade tensions appear to be easing, with both the U.S. and China showing willingness to negotiate

4. The Fed has room to cut rates later this year if economic conditions deteriorate

👎 On the negative side:

1. Q1 GDP turned negative for the first time since 2022

2. Consumer sentiment continues to decline, with inflation expectations rising

3. Auto loan delinquencies have surged to financial crisis levels

4. Corporate guidance for future quarters has weakened considerably

What makes this environment challenging is the unusual combination of factors at play. We're seeing consumer financial stress indicators like auto loan delinquencies rise to concerning levels while the job market remains strong. We're seeing negative GDP growth but resilient corporate earnings. We're seeing high inflation expectations but moderating wage growth.

For long-term investors, these mixed signals reinforce the importance of diversification and a disciplined approach. Trying to time the market based on conflicting economic indicators is likely to lead to poor results. Instead, focus on building a portfolio that can weather various economic scenarios.

The best approach during times like these is to:

1. Maintain global diversification across asset classes and regions

2. Consider sectors less exposed to tariffs, such as financials and healthcare

3. Use market volatility as an opportunity to rebalance your portfolio

4. Focus on your long-term investment goals rather than short-term market movements

5. Remember that economic cycles are normal, and markets have historically rewarded patient investors

In times like these, the wisest hedgehogs don't panic, they prepare. Build your financial burrow with diverse materials, keep some extra acorns in reserve, and remember that even the most confusing economic signals eventually resolve into clearer trends.

I apologize for the long newsletter this week but I hope it was helpful. If you haven't followed me on X, you can find the link below where I'll be updating you daily on what is happening in the financial world. Thank you for reading and have a great week!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.