Hey everyone, Hedgie here! Welcome to this week's market breakdown. I hope you all had a wonderful Memorial Day weekend. Since the markets were closed yesterday for Memorial Day, I'm getting this newsletter out to you Tuesday morning instead of our usual Monday schedule. I'm going to walk you through everything that happened in the markets last week and explain what it means for regular investors like you. This was a week where the bond market took center stage, with rising yields creating headwinds for stocks as fiscal concerns returned to the spotlight.

All three major indices finished the week with modest declines, with the S&P 500 down 2.6%, the Dow down 2.4%, and the Nasdaq down 2.5%. This pullback came after the previous week's strong rally, as investors digested new fiscal policy developments and fresh trade tensions. As of Monday afternoon when this newsletter was prepared, stock futures were pointing to a strong higher open on Tuesday (S&P 500 futures +1.27%, Nasdaq futures +1.47%, Dow futures +1.09%) as traders look ahead to key economic data releases this week.

Note: This newsletter was prepared on Monday afternoon for Tuesday morning release due to the Memorial Day holiday. Market conditions may have changed by the time you're reading this.

FISCAL FEARS AND BOND MARKET JITTERS: WHAT HAPPENED LAST WEEK

Last week brought several significant developments that shifted market focus from trade optimism to domestic fiscal concerns:

The "One Big Beautiful Bill" Passes the House

The biggest domestic policy news came Thursday when the House passed the reconciliation bill by the narrowest of margins - just one vote. This legislation, dubbed the "One Big Beautiful Bill," primarily extends the 2017 tax cuts and includes several new proposals that were highlighted during the Trump campaign.

The bill includes tax breaks for tips, overtime pay, and seniors, while raising the state and local tax (SALT) deduction cap to $40,000 from the current $10,000 for those earning under $500,000. To help offset costs, the bill includes reductions to renewable energy incentives, tightened eligibility for health and food aid programs, and Medicaid work requirements.

When accounting for all provisions, the Congressional Budget Office estimates the bill would add nearly $3 trillion to the budget deficit over the next decade. Many of the tax cuts are front-loaded for 2025-2028, while spending cuts are backloaded, likely pushing the deficit to 7% of GDP in the next two years.

The bill now moves to the Senate, where it faces an uncertain path and possible revisions. Congress has set a goal of having a final bill signed into law by July 4th.

This chart shows the new tax bill passed by the House is expected to add almost $3 trillion to the deficit over the next decade. Source: Congressional Budget Office and CRFB estimates.

Moody's Completes the Credit Rating Trifecta

Adding to fiscal concerns, Moody's became the last of the "Big Three" rating agencies to downgrade U.S. debt, citing a lack of progress from numerous past Congresses and administrations to address rising fiscal deficits and growing interest costs as a percentage of GDP. This one-notch downgrade means the U.S. has now lost its last triple-A credit rating, joining downgrades from Standard & Poor's in 2011 and Fitch in 2023.

While this downgrade was widely expected and doesn't have direct market implications (major index providers had already moved U.S. government bonds to the double-A bucket), it does shine a spotlight on the worsening fiscal outlook at a time when Congress is considering legislation that could push deficits even higher.

30-Year Treasury Yields Spike Above 5%

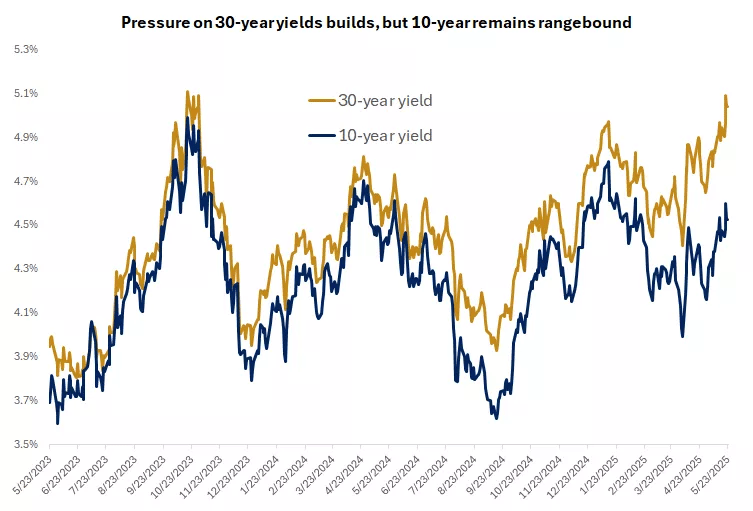

The bond market's reaction to these fiscal developments was swift and decisive. The 30-year Treasury yield climbed above 5% for the first time since 2023, reaching levels not seen for an extended period since 2007. The 10-year Treasury yield also rose to 4.51%, while shorter-dated yields increased but not as dramatically.

This steepening of the yield curve reflects investor concerns about long-term fiscal sustainability. When the government needs to borrow more money, bond investors demand higher compensation for the perceived risk of holding long-term debt. The recent jump in yields partly reflects these emerging fiscal concerns, though global factors are also at play.

This chart shows that the 10- and 30-year Treasury yields have stayed rangebound over the past two years, but the gap is widening as longer-term bonds are more sensitive to fiscal concerns. Source: Bloomberg, Edward Jones.

Fresh Tariff Threats Resurface

Just as markets were digesting fiscal news, fresh tariff threats emerged late in the week. The administration threatened 50% tariffs on the European Union and a 25% levy on Apple, serving as a reminder that trade developments remain a key market driver. These threats caused additional market volatility and highlighted that despite recent progress, trade policy uncertainty persists.

The timing of these announcements, coming after a period of relative calm following the China trade truce, caught many investors off guard and contributed to the week's negative sentiment.

Bitcoin Hits New Record Highs

In a bright spot for cryptocurrency enthusiasts, Bitcoin climbed for the sixth consecutive week and briefly hit a record high of nearly $112,000 on Thursday. As of Friday afternoon, Bitcoin was trading around $109,000, up nearly 6% for the week and well above its recent low of around $75,000 in early April.

This rally has been driven by continued institutional adoption, regulatory clarity, and growing acceptance of cryptocurrencies as an alternative store of value amid concerns about traditional currency debasement.

Gold Rebounds Strongly

The precious metals market also saw significant action, with gold climbing nearly 6% for the week to around $3,360 per ounce. This rebound recovered all the ground lost in the previous week's decline and extended gold's year-to-date rally that recently pushed the metal to a record high of more than $3,400.

Gold's strength reflects its traditional role as a hedge against currency debasement and fiscal irresponsibility. As concerns about government debt and spending mount, investors often turn to gold as a store of value.

WHAT THIS MEANS FOR YOUR INVESTMENTS

Impact on Your Portfolio

The bond market's message is becoming increasingly clear. Rising long-term yields signal that people are demanding higher compensation when lending money to the government over extended periods. This affects more than just bond prices. When the 30-year Treasury yield rises above 5%, it influences mortgage rates, corporate borrowing costs, and how attractive different investments look compared to each other.

The steepening yield curve creates both challenges and opportunities. While existing bond holders see their values decline as yields rise, new bond buyers can now lock in higher yields over longer periods. This becomes particularly relevant if you're retired or nearing retirement and need income from your investments.

The fiscal policy developments suggest we're entering a period where government spending and taxation will be major market themes. The proposed tax bill, while potentially stimulative in the short term, raises questions about long-term fiscal sustainability that bond markets are already pricing in.

Technology and growth stocks face headwinds from higher long-term rates. When people can earn 5% on "risk-free" 30-year Treasuries, they demand higher returns from riskier investments. This typically pressures valuations of companies that promise future growth but generate limited current cash flow.

The resurgence of tariff threats reminds us that trade policy remains unpredictable. Companies with global supply chains or significant international exposure continue to face uncertainty about future operating conditions.

Different Investment Horizons

If you're just starting your investment journey, this environment offers both lessons and opportunities. Higher bond yields provide better income opportunities than we've seen in years, but the volatility in both stocks and bonds underscores the importance of diversification and dollar-cost averaging.

Those in the middle of their careers should consider reviewing their asset allocation. The combination of higher yields and market volatility may have pushed portfolios away from target allocations. You might want to take advantage of higher bond yields by increasing fixed income allocations, or use any market weakness to add to equity positions.

People nearing or in retirement will find the higher yields available in bonds welcome news when it comes to income generation. However, the fiscal concerns driving these higher yields also create inflation risks that could erode purchasing power over time. You might consider maintaining some inflation protection through TIPS or I-Bonds while taking advantage of the attractive yields now available in intermediate and long-term bonds.

THE BOND MARKET'S WARNING SIGNAL: A DEEPER DIVE

The bond market's behavior last week deserves special attention because it's sending important signals about the economic and fiscal outlook. When the 30-year Treasury yield rises above 5%, it's not just a number - it represents a fundamental shift in how investors view long-term risks.

Historically, bond yields have been influenced more by economic growth and Federal Reserve policy than by fiscal concerns. But we may be entering a period where fiscal policy becomes a more dominant driver of long-term rates. The combination of large deficits, growing debt, and rising interest costs creates a challenging dynamic.

Interest payments on federal debt as a percentage of GDP are now at 3%, matching the highs of the late 1980s and early 1990s. With interest rates still elevated and more debt being issued, these costs will likely continue rising. This creates a feedback loop where higher deficits require more borrowing, which pushes yields higher, which increases the cost of servicing existing debt.

This chart shows that interest costs to service the existing government debt are becoming a larger burden to the budget. Source: FactSet, S&P 500 Index.

The global context also matters. The 30-year yield on Japanese bonds hit record highs last week, and long-term bonds in Germany, the UK, and Australia were also under pressure. This suggests that fiscal concerns aren't unique to the United States, though our situation may be more acute given the scale of our deficits and debt.

This environment requires careful consideration of how rising yields affect different parts of a portfolio. While higher yields create opportunities when buying new bonds, they also change how attractive different asset classes look compared to each other and can pressure valuations of interest-sensitive investments like real estate and utilities.

CRYPTOCURRENCY AND GOLD: ALTERNATIVE STORES OF VALUE

The strong performance of both Bitcoin and gold last week highlights an important theme: investors are increasingly seeking alternatives to traditional currencies and government bonds as stores of value.

Bitcoin's rally to new record highs near $112,000 represents a remarkable recovery from its April lows around $75,000. This 49% gain in less than two months demonstrates the cryptocurrency's continued volatility, but also its appeal as a hedge against traditional financial system risks.

The institutional adoption of Bitcoin continues to grow, with more corporations adding it to their balance sheets and more financial institutions offering cryptocurrency services. This mainstream acceptance has helped reduce some of the regulatory uncertainty that previously weighed on prices.

Gold's 6% weekly gain to around $3,360 per ounce shows that traditional safe haven assets remain relevant even in the digital age. Gold has been used as a store of value for thousands of years, and its recent strength suggests investors still view it as a hedge against currency debasement and fiscal irresponsibility.

The simultaneous strength in both Bitcoin and gold is noteworthy because these assets appeal to similar concerns but through different mechanisms. Both offer alternatives to government-issued currencies and both have limited supplies that can't be arbitrarily increased by central banks or governments.

The lesson isn't necessarily to rush into either asset, but to understand why they're performing well. Both represent hedges against the very fiscal and monetary policies that are driving concerns in traditional bond markets.

LOOKING AHEAD: WHAT TO WATCH THIS WEEK

The market faces several important events this week that could influence the direction of both stocks and bonds:

Tuesday brings the S&P/Case-Shiller Home Price Index and the Conference Board's Consumer Confidence Index. These reports will provide insights into how rising mortgage rates and economic uncertainty are affecting the housing market and consumer sentiment.

Wednesday features the release of minutes from the Federal Reserve's May 6-7 meeting. While the Fed kept rates unchanged as expected, investors will be looking for clues about how policymakers are assessing the impact of fiscal policies on inflation and growth, and whether their thinking about potential rate cuts has evolved.

Thursday delivers the second estimate of first-quarter GDP, weekly unemployment claims, and pending home sales data. The GDP revision will show whether the economy maintained its momentum through the first quarter, while the employment and housing data will provide current snapshots of these key sectors.

Friday brings the Personal Consumption Expenditure (PCE) Price Index, the Fed's preferred inflation measure, along with the University of Michigan's final consumer sentiment reading for May. The PCE report could ease recent uncertainty over inflation's trajectory, as the most recent reading showed inflation at 2.3% annually in March.

Several Fed officials are also scheduled to speak throughout the week, including Philip Jefferson, John Williams, Alberto Musalem, and Beth Hammack. Their comments could provide additional insights into the Fed's current thinking, particularly regarding how fiscal developments might influence monetary policy.

The bond market will be watching all of these developments closely, as any signs of stronger growth or higher inflation could push yields even higher, while weaker data might provide some relief from recent selling pressure.

Last week's market action highlighted how quickly investor focus can shift from one set of concerns to another. Just two weeks ago, markets were celebrating progress on trade relations. Last week, the focus turned to domestic fiscal policy and its implications for long-term interest rates.

This shift underscores an important reality about investing: multiple factors influence markets simultaneously, and the relative importance of these factors can change rapidly. Trade policy, fiscal policy, monetary policy, economic growth, and geopolitical developments all matter, but their relative influence varies over time.

The bond market's reaction to fiscal developments serves as a reminder that markets ultimately care about sustainability. While governments have more flexibility than corporations or individuals when it comes to borrowing, that flexibility isn't unlimited. When debt levels and deficits reach certain thresholds, markets begin demanding higher compensation for perceived risks.

These developments reinforce several key principles. Diversification across asset classes, geographies, and time horizons remains crucial. The ability to adapt to changing conditions while maintaining a long-term perspective is essential. Understanding how different economic and policy developments affect various parts of a portfolio helps in making informed decisions.

The current environment also highlights the importance of having a plan and sticking to it. Market volatility can create emotional responses that lead to poor investment decisions. Having clear investment objectives and a well-thought-out strategy helps navigate periods of uncertainty.

As we move forward, the interplay between fiscal policy, monetary policy, and market reactions will likely remain a central theme. The bond market's message about fiscal sustainability is worth heeding, but markets can overreact in both directions.

The wisest hedgehogs prepare for various scenarios rather than betting on any single outcome. They maintain diversified portfolios, stay informed about developments that could affect their investments, and make adjustments based on changing conditions rather than short-term market movements.

As always, I know that was a lot… but thank you so much for reading! If you haven't followed me on X, you can find the link below where I'll be updating you daily on what is happening in the financial world. Thank you for reading!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.

The 5 Advantages of a Gold IRA

With everything going on in the world today - inflation, tariffs, market volatility - it’s more important than ever to stay informed.

That’s why you need to get all the facts when it comes to protecting your retirement savings.

Did you know that Gold IRAs can help safeguard your money?

Request a free digital copy of The Beginner’s Guide To Gold IRAs to arm you with the facts.

In the Beginner’s Guide to Gold IRAs, you’ll get…

The Top 5 Advantages to a Gold IRA

How To Move Your 401K To Gold Penalty Free

A Simple Checklist For How to Get Started

Don’t miss this opportunity to get the facts about how a Gold IRA can help you protect and diversify your retirement savings.

*Offer valid on qualified orders of Goldco premium products only. Receive up to 10% in free silver based on purchase amount; cannot be combined with other offers. Additional terms apply—see your customer agreement or contact your representative for details.