Hey everyone, Hedgie here! Welcome to this week's market breakdown. I'm going to walk you through everything that happened in the markets this week and explain what it means for regular investors like you. This was a week of significant recovery as markets rallied strongly following the announcement of a 90-day tariff truce between the US and China, while economic data provided a mixed picture of the economy.

All three major indices finished the week with impressive gains, with the S&P 500 up 5.3%, the Dow up 3.4%, and the Nasdaq up a remarkable 7.2%. This powerful rally has pushed the S&P 500 back into positive territory for 2025, up 1.3% year-to-date. As of Sunday evening when this newsletter was prepared, stock futures were pointing to a slightly lower open on Monday (S&P 500 futures -0.2%, Nasdaq futures -0.3%, Dow futures -0.1%) as traders digest the week's dramatic moves and look ahead to upcoming economic data.

Note: This newsletter was prepared on Sunday evening for Monday morning release. Market conditions may have changed by the time you're reading this.

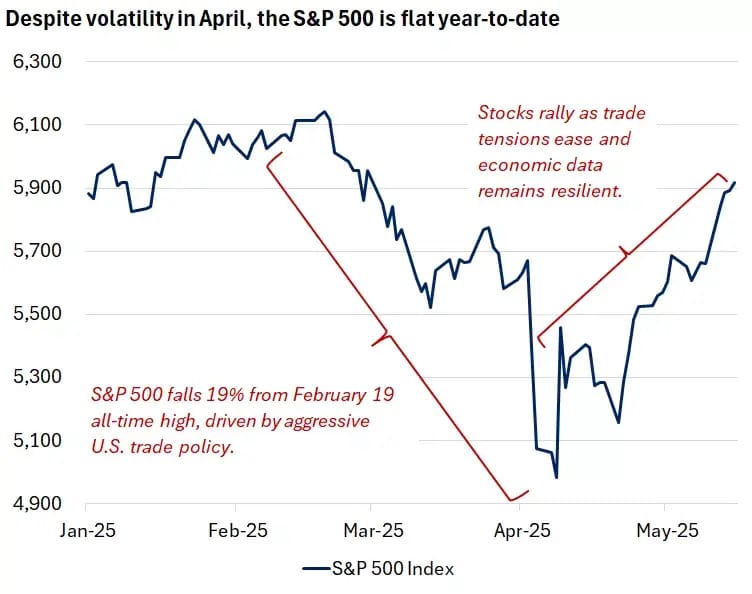

S&P 500 Index from January to May 2025

The S&P 500 has surged back into positive territory for 2025, with last week's 5.3% gain representing one of the strongest weekly performances in recent years. The index has now fully recovered from the April tariff announcement.

TRADE TRUCE AND ECONOMIC DATA: WHAT HAPPENED THIS WEEK

This week brought several significant developments that reshaped market dynamics:

US-China Trade Truce Fuels Market Rally

The biggest market catalyst came early in the week when the US and China announced a 90-day tariff reduction agreement following weekend negotiations in Switzerland. Under the deal, the US will reduce tariffs on most Chinese imports from 145% to 30%, while China will cut its tariffs on US goods from 125% to 10%. The agreement also includes China easing some non-tariff trade restrictions, such as those on rare-earth minerals.

This temporary truce represents a significant de-escalation in trade tensions that had been building since President Trump's April 2 "Liberation Day" tariff announcement. Markets responded enthusiastically to the news, with the Nasdaq Composite leading the charge as technology stocks, which are particularly sensitive to trade issues, surged higher.

In addition to the China agreement, the US administration announced plans to ease trade restrictions related to artificial intelligence chips, which helped enable trade agreements between US tech companies and other countries. This news, alongside the announced deal between NVIDIA and Saudi Arabia for AI chip sales, provided an extra boost to tech-oriented segments of the market.

While the 90-day window is just a temporary reprieve as negotiations continue toward a more permanent arrangement, it signals that both sides recognize the impracticality of extreme tariffs and are willing to work toward a more sustainable trade relationship.

Inflation Continues to Cool in April

Tuesday brought welcome news on the inflation front, with the Consumer Price Index (CPI) rising just 2.3% year-over-year in April, below expectations and the slowest annual pace since early 2021. On a month-over-month basis, both headline and core CPI (excluding food and energy) rose 0.2%, also below estimates.

Even more surprising was Thursday's Producer Price Index (PPI) report, which showed wholesale prices unexpectedly dropped 0.5% in April compared to March, versus expectations for a 0.2% increase. The report revealed that a significant portion of the decline was attributable to falling margins, suggesting companies have been absorbing some of the costs of higher tariffs rather than passing them on to consumers.

These inflation readings provide further evidence that price pressures continue to moderate, potentially giving the Federal Reserve more flexibility to consider rate cuts later this year if economic conditions warrant.

Year-over-year change in U.S. core CPI and three-month annualized change

This chart shows the year-over-year change in U.S. core CPI and the three-month annualized change in U.S. core CPI. U.S. core CPI has moderated in recent months.

Consumer Spending and Sentiment Show Signs of Caution

Retail sales grew just 0.1% in April, a notable deceleration from March's upwardly revised 1.7% gain. The modest growth suggests consumers may be becoming more cautious with their spending, possibly due to uncertainty around trade policies and their potential impact on prices and the broader economy.

This caution was further reflected in the University of Michigan's preliminary consumer sentiment reading for May, which declined for a fifth consecutive month to 50.8, down from 52.2 in April. According to the survey, nearly three-quarters of consumers spontaneously mentioned tariffs, up from 60% in April, indicating that trade policy uncertainty continues to weigh heavily on consumer minds. Inflation expectations for the year ahead jumped to 7.3%, up from 6.5% in April, suggesting consumers remain concerned about future price increases despite the recent moderation in actual inflation data.

Year-over-year change in U.S. core CPI and three-month annualized change

This chart shows the year-over-year and monthly change in U.S. retail sales and the level of the University of Michigan Consumer Sentiment Index. Retail sales growth has been positive on a monthly basis in three consecutive months despite a decline in consumer sentiment.

Bond Market Dynamics

Treasury yields rose across most maturities during the week, with the 10-year Treasury yield climbing to 4.44%, up about 10 basis points from the previous week. The 10-year/2-year spread widened to approximately 50 basis points, the widest since February 2022, creating a steeper yield curve that could signal improving economic growth expectations.

Investment-grade and high-yield corporate bonds outperformed Treasuries in the risk-on environment, as the positive trade news boosted investor confidence and appetite for riskier assets.

Global Markets Respond Positively

International markets also benefited from the improved trade outlook. European stocks posted solid gains, with the pan-European STOXX Europe 600 Index rising 2.1%. Japan's Nikkei 225 Index advanced 0.7%, while China's CSI 300 Index gained 1.1% as investors welcomed the trade truce but tempered their expectations for additional stimulus measures from Beijing now that trade tensions have eased.

WHAT THIS MEANS FOR YOUR INVESTMENTS

Impact on Your Portfolio

These market developments have several practical implications for regular investors:

The trade truce significantly reduces the immediate economic risks associated with escalating tariffs. While the 30% US tariff on Chinese goods is still higher than pre-April levels, it's far less disruptive than the 145% rate that briefly took effect. This middle ground aligns with what many economists consider a manageable level that would cause some inflation and growth moderation but avoid pushing the economy into recession.

The technology sector's strong performance highlights how trade policy particularly impacts this area of the market. The Nasdaq's 7.2% weekly gain outpaced other indices as investors recognized that reduced trade tensions benefit semiconductor companies, hardware manufacturers, and other tech firms with global supply chains and international revenue exposure.

The inflation data suggests price pressures continue to moderate despite tariff concerns. This gives the Federal Reserve more flexibility in its policy decisions. While the Fed is likely to remain cautious and monitor how trade policies ultimately impact inflation, the probability of rate cuts later this year remains intact, with markets currently pricing in two to three cuts starting around July or September.

The divergence between actual economic data (which remains relatively solid) and sentiment measures (which show increasing concern) creates an interesting dynamic. Historically, what consumers and businesses do matters more than what they say, but persistent negative sentiment can eventually impact spending and investment decisions if it continues.

The steepening yield curve, with the 10-year/2-year spread at 50 basis points, creates opportunities in intermediate-term bonds, which now offer attractive yields with less interest rate risk than longer-term bonds. This environment may benefit financial companies, which typically perform better when the yield curve steepens.

What This Means for Different Types of Investors

If you're just starting your investing journey, this market environment presents both opportunities and challenges. The recent volatility has created more attractive entry points in quality companies, particularly in technology and other sectors that benefit from improved trade relations. However, it's important to maintain diversification and not overcommit to any single sector, as policy uncertainty could lead to more volatility ahead.

For those in the middle of your career, this is an excellent time to review your asset allocation. The steepening yield curve creates opportunities in intermediate-term bonds, while the strong performance of US stocks relative to international markets might have pushed your portfolio out of balance. Consider rebalancing to maintain your target allocations and ensure you're not taking on more risk than intended.

For investors nearing or in retirement, the potential easing of trade tensions could reduce inflation pressures over time, which would be positive for fixed income. However, the Fed's cautious approach means interest rates may remain higher for longer than previously expected. Consider maintaining some inflation protection through TIPS or I-Bonds, while also taking advantage of the attractive yields currently available in short and intermediate-term bonds.

THE 90-DAY TRADE WINDOW: A DEEPER DIVE

The 90-day trade truce between the US and China deserves special attention because it represents a critical juncture in the evolving trade relationship between the world's two largest economies.

What makes this temporary agreement particularly significant is that it involves China, which accounts for approximately 13% of US imports and 7% of US exports. This is a much larger trading relationship than the one with the UK (which represents about 2% of US imports and 4% of exports), with which the US reached a trade deal earlier this month.

Share of 2024 U.S. goods exports and imports by largest trading partners

This chart breaks down the share of 2024 U.S. goods exports and imports by its largest trading partners.

The 90-day window serves several important purposes:

Provides immediate relief to businesses and consumers who were facing dramatically higher costs due to the extreme tariffs. The reduction from 145% to 30% for US tariffs on Chinese goods still represents a significant increase from pre-April levels, but it's a much more manageable level that allows trade to continue while negotiations proceed.

Creates a structured timeframe for more comprehensive negotiations. Both sides have incentives to reach a longer-term agreement before the 90-day period expires, as a return to extreme tariffs would be disruptive for both economies.

Allows businesses to plan with slightly more certainty in the near term. While 90 days isn't a long planning horizon for many companies, it at least provides some breathing room to adjust supply chains, inventory management, and pricing strategies.

For investors, this 90-day window creates an interesting dynamic. On one hand, the reduced tariffs and possibility of a more permanent agreement are clearly positive for market sentiment, as evidenced by last week's rally. On the other hand, the temporary nature of the agreement means uncertainty will likely increase again as we approach the end of the 90-day period if no permanent deal is reached.

The key question is whether this temporary truce will lead to a more sustainable trade relationship or simply delay an eventual escalation. The answer will depend on how negotiations progress over the coming months and whether both sides can find common ground on issues beyond tariff rates, such as intellectual property protection, market access, and technology transfer.

LOOKING AHEAD: WHAT TO WATCH NEXT WEEK

The market is gearing up for another important week with several key events to monitor:

We'll get more insight into the health of the global economy with the release of preliminary Purchasing Managers' Index (PMI) data on Thursday. These surveys of manufacturing and service sector activity will provide an early look at economic conditions in May for major economies including the US, eurozone, UK, and Japan. Given that April's global PMI fell to a 17-month low, these readings will be closely watched for signs of whether economic momentum is stabilizing or continuing to weaken.

The housing market will be in focus with existing home sales data on Tuesday and new home sales on Thursday. These reports will help gauge whether higher mortgage rates and economic uncertainty are weighing on housing activity, which has shown resilience despite challenging conditions.

The Federal Reserve will release the minutes from its May meeting on Wednesday. While the Fed kept rates unchanged at that meeting, as expected, investors will be looking for clues about how policymakers are assessing the impact of trade policies on inflation and growth, and whether their thinking about the timing of potential rate cuts has evolved.

Several Fed officials are scheduled to speak throughout the week, including Philip Jefferson, John Williams, Alberto Musalem, and Beth Hammack. Their comments could provide additional insights into the Fed's current thinking, particularly in light of the trade developments and recent inflation data.

While earnings season is winding down, we'll still hear from several notable companies, including Walmart, Cisco, Alibaba, and Deere. These reports will offer perspectives on consumer spending, technology investment, and the impact of trade policies across various sectors.

The market's powerful response to the US-China trade truce highlights how central trade policy has become to the economic and market outlook. The 5.3% weekly gain in the S&P 500 represents one of the strongest weekly performances in recent years and has pushed the index back into positive territory for 2025.

What makes this environment particularly interesting is the contrast between improving market sentiment and still-cautious consumer and business confidence. The University of Michigan consumer sentiment index remains near multi-year lows despite the positive developments on trade, suggesting that Americans remain concerned about the economic outlook even as investors bid up stock prices.

This divergence creates both opportunities and risks. On one hand, if consumer sentiment eventually improves and spending accelerates, it could provide further fuel for the market rally. On the other hand, if sentiment remains depressed and begins to more significantly impact spending and investment decisions, economic growth could slow more than expected.

The 90-day trade truce also creates a timeline that investors will be watching closely. As we approach the end of this period in early August, market volatility could increase if a more permanent agreement doesn't appear to be taking shape.

For long-term investors, these cross-currents reinforce the importance of diversification and a disciplined approach. Trying to time the market based on trade headlines or economic data points is likely to lead to poor results. Instead, focus on building a portfolio that can weather various economic scenarios.

The best approach during times like these is to maintain global diversification across asset classes and regions to reduce portfolio volatility and capture opportunities wherever they arise. Consider how the steepening yield curve affects fixed income allocations, as intermediate-term bonds now offer attractive yields with less interest rate risk than longer-term bonds. Use the current market strength as an opportunity to rebalance your portfolio if recent performance has pushed your allocations away from your targets. Stay focused on your long-term investment goals rather than short-term market movements or policy developments. Remember that economic and market cycles are normal, and patient, disciplined investors have historically been rewarded over time.

The trade truce rally is certainly welcome news after the volatility we experienced in April, but the path forward is unlikely to be smooth or straightforward. As always, the wisest hedgehogs don't panic during downturns or get overly excited during rallies. They prepare for various scenarios and maintain a long-term perspective.

That does it for me! I hope this was helpful. If you haven't followed me on X, you can find the link below where I'll be updating you daily on what is happening in the financial world. Thank you for reading!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.

What do liberals, conservatives, and independents all have in common?

They all use Ground News.

Ground News is a news comparison platform with over 50,000 sources, allowing readers to compare coverage on any story while gaining insight into a news source’s political bias, credibility, and ownership.

Over 1M+ readers from all political stripes, from Munich to Manhattan, trust Ground News to stay informed and broaden their worldview.