Hey everyone, Hedgie here! Welcome to this week's market breakdown. I'm going to walk you through everything that happened in the markets this week and explain what it means for regular investors like you. This was a week of cautious optimism as the White House announced a trade deal with China, though details remain sparse, and markets processed mixed economic signals.

All three major indices finished the week slightly lower, with the S&P 500 down 0.5%, the Dow down 0.2%, and the Nasdaq down 0.3%. This modest pullback comes after the impressive recovery rally we've seen over the past few weeks, with the S&P 500 having recouped all of its tariff-related losses from early April. As of Sunday evening when this newsletter was prepared, stock futures were pointing to a positive open on Monday (S&P 500 futures +0.7%, Nasdaq futures +0.8%, Dow futures +0.6%) as traders react to the weekend's US-China trade deal announcement.

Note: This newsletter was prepared on Sunday evening for Monday morning release. Market conditions may have changed by the time you're reading this.

The market recovery between the 50-day and 200-day moving averages

The S&P 500 has recovered impressively from the April tariff announcement, now trading between the 50-day and 200-day moving averages. This chart shows how the market has recouped its losses despite ongoing trade uncertainties.

TRADE BREAKTHROUGH AND ECONOMIC SIGNALS: WHAT HAPPENED THIS WEEK

This week brought several significant developments that could shape market dynamics in the weeks ahead:

US-China Trade Deal Announced, Details Pending

The biggest news came Sunday evening when the White House announced a "trade deal" with China following weekend negotiations in Geneva. Treasury Secretary Scott Bessent described the talks as "productive" and promised more details in a Monday morning briefing. US Trade Representative Jamieson Greer called the discussions "very constructive" and noted that the quick agreement suggests "the differences were not so large as maybe thought."

While specifics remain unclear, Chinese Vice Premier He Lifeng said the meeting "achieved substantial progress and reached important consensus," including establishing a consultation mechanism for trade and economic issues. This development follows President Trump's Saturday social media post suggesting an 80% tariff on China "seems right," which many interpreted as a negotiating tactic ahead of the talks.

The announcement represents the first potential breakthrough in the trade standoff that began with Trump's April 2 tariff announcement. Markets have been gradually recovering as the administration has shown more willingness to negotiate, with the S&P 500 having recouped its tariff-related losses by early May. This weekend's news could further ease concerns about a prolonged trade war, though investors will be watching closely for details on Monday.

Earlier in the week, the US reached a trade deal with the UK, which could serve as a framework for future negotiations. Under this agreement, the 10% baseline tariff on most UK imports will remain, but the first 100,000 vehicles from the UK will be subject to only the 10% rate (beyond which a 25% rate applies), and US tariffs on UK steel and aluminum will be eliminated. While economically limited in scope (the UK represents about 4% of US exports and 2% of imports), the deal demonstrates that trade talks are progressing.

Fed Holds Rates Steady, Flags Inflation and Unemployment Risks

The Federal Reserve concluded its May meeting on Wednesday, maintaining its target range for the federal funds rate at 4.25%-4.5%, as widely expected. This marks the third consecutive meeting that the Fed has held interest rates steady, partly due to concerns about the potential impact of tariffs.

The FOMC updated its statement to reflect increased risks to both sides of its dual mandate…the potential for higher unemployment and higher inflation. Fed Chair Powell acknowledged that the economy is in a good place, but the Fed remains in a wait-and-see mode given the uncertainty around trade policies.

Market expectations for rate cuts have shifted, with the probability of a June rate cut now around 17%, down from 34% a week ago and 60% a month ago. Bond markets are currently pricing in three cuts this year, likely starting in July, and an additional cut next year. The healthy labor market, with unemployment at 4.2%, gives the Fed flexibility to remain on the sidelines longer to assess the potential impact of tariffs on inflation and the economy.

Services Sector Shows Mixed Signals

The services sector, which accounts for roughly 72% of the US economy, showed mixed but generally positive readings in April. The Institute for Supply Management (ISM) Services PMI was stronger than expected, rising to 51.6 from 50.8 in March, indicating expansion for the tenth consecutive month. Employment was a key driver behind the increase, rising to 49.0 from 46.2, though still reflecting contraction.

Meanwhile, the S&P US Services Purchasing Managers' Index (PMI) fell to 50.8 in April but remained above the key 50.0 mark reflecting expansion. Uncertainty over government policies, particularly trade, weighed on demand and business expectations.

Most services sectors tend to be less exposed to tariffs, which generally apply to goods rather than services. However, services can still be impacted by trade tensions if consumers pull back on spending due to weaker sentiment or if input costs rise.

China's Economy Shows Signs of Strain

China's economic indicators revealed concerning trends ahead of the trade talks. Consumer prices in China fell 0.1% year-over-year in April, marking the second straight month of decline and highlighting weak domestic demand. Even more worrying, producer prices plunged 2.7% year-over-year, pointing to deepening deflationary pressures despite Beijing's stimulus efforts.

This deflationary environment in China creates an interesting dynamic for global markets. On one hand, Chinese deflation could help cool global inflation by reducing prices of exported goods. On the other hand, it signals dangerously weak domestic demand in the world's second-largest economy. The fact that producer prices are falling faster than consumer prices shows Chinese manufacturers are absorbing cost pressures rather than passing them to consumers, this is a sign of intense competition and excess capacity.

Corporate Earnings Season Winds Down

With about 90% of S&P 500 companies having reported first-quarter results, the earnings season has been generally positive. According to FactSet, 78% of companies have beaten EPS estimates, above the 5-year and 10-year averages of 77% and 75%, respectively. However, only 62% are beating revenue estimates, which is below the 5-year and 10-year averages of 69% and 64%.

This week, we heard from several consumer-focused companies. Disney posted solid earnings and strong performance, while companies more exposed to consumer spending expressed caution about the impact of tariffs and trade uncertainty.

Guidance for future quarters has weakened as companies point to uncertainty around consumer spending and the tariff environment. The earnings growth forecast for Q2 has fallen to 5.8%, down substantially from the 11.3% expected at the end of last year.

The chart shows the path of the fed funds rate and PCE inflation as well as Fed projections through 2027. The Fed's most recent projection for the fed funds rate laid out expectations for two more cuts this year, while bond markets are pricing in three cuts, likely starting in July.

Bond Market and Commodities

Treasury yields finished the week up about 10 basis points. The 10-year Treasury yield closed around 4.38%, up from 4.31% the previous week. The 10-year/2-year spread is approximately 50 basis points, the widest since February 2022, when the spread was in the process of collapsing into negative territory as the Fed quickly raised rates to combat inflation.

The 10-year/2-year Treasury yield spread has widened to around 50 basis points, the widest since early 2022. This steepening yield curve creates opportunities in intermediate-term bonds.

In the commodities space, oil prices rebounded strongly, with crude oil up 4.6% for the week to $60.98 per barrel. This recovery came after OPEC+ announced a 411,000 barrel per day production increase in June, which initially sent prices below $60 to test early April lows. However, prices rallied throughout the week as multiple US producers announced they are pulling back on capital spending plans.

Oil prices have rebounded from their early-week lows following the OPEC+ announcement, as US producers scale back capital spending plans.

Gold continued its upward trend, rising $23 to $3,329 per ounce, as investors sought safe-haven assets amid ongoing economic uncertainty. Bitcoin had another strong week, up over 5% and breaking back above $100,000 for the first time since February.

Bitcoin has broken back above the $100,000 level for the first time since February, continuing its strong performance as investors seek alternative assets.

WHAT THIS MEANS FOR YOUR INVESTMENTS

Impact on Your Portfolio

These market forces have several practical implications for regular investors:

1. Trade tensions easing but uncertainty remains: The US-China trade deal announcement is positive, but without specific details, markets may remain cautious. The UK trade deal provides a template for what agreements might look like, but negotiations with countries where the US has large trade deficits could be more challenging.

2. Fed policy on hold longer: The resilient job market means the Federal Reserve may wait longer before cutting interest rates. Markets are now pricing in three cuts this year instead of four, with the first cut more likely to come in July or September rather than June. This could mean higher-for-longer interest rates, which may create headwinds for growth stocks and rate-sensitive sectors.

3. Sector considerations: The week's performance showed interesting sector divergences. Industrials and Consumer Discretionary led the market, with electrical equipment names, airlines, and machinery particularly strong. Auto and auto parts also performed well. Meanwhile, Healthcare struggled due to concerns about potential drug pricing regulations, and Communication Services was mixed despite Disney's strong earnings.

4. China's deflation has global implications: China's deflationary environment could help ease inflation pressures in the US by reducing the cost of imported goods. However, it also signals weak demand in the world's second-largest economy, which could impact global growth. The trade deal could allow Chinese goods to flow more freely to the US, potentially helping ease US inflation while giving Chinese manufacturers much-needed relief.

5. Commodities sending mixed signals: The rebound in oil prices suggests improving demand expectations, while gold's continued strength indicates ongoing uncertainty. These cross-currents reflect the complex economic environment investors are navigating.

United States ISM Services PMI

The chart shows the path of S&P and ISM PMI Services since 2023. The services sector, accounting for roughly 72% of the economy, has been slowing but remains in expansion territory. Most services sectors tend to be less exposed to tariffs, which generally apply to goods rather than services.

What This Means for Different Types of Investors

If you're just starting your investing journey, the recent market volatility has created some attractive entry points in quality companies. The improving trade outlook could benefit sectors with international exposure, but don't overlook domestically-focused sectors like financials and healthcare, which are less affected by tariffs and could benefit from potential deregulation.

For those in the middle of your career, this is a good time to review your asset allocation. With bonds stabilizing and international markets continuing to show strength, ensure you have appropriate exposure to these asset classes. The steepening yield curve (with the 10-year/2-year spread at 50 basis points) creates opportunities in intermediate-term bonds, which offer attractive yields with less interest rate risk than longer-term bonds.

For investors nearing or in retirement, the potential easing of trade tensions could reduce inflation pressures over time, which would be positive for fixed income. However, the Fed's cautious approach means interest rates may remain higher for longer than previously expected. Consider maintaining some inflation protection through TIPS or I-Bonds, while also taking advantage of the attractive yields currently available in short and intermediate-term bonds.

CHINA'S DEFLATION: A DEEPER DIVE

China's latest inflation report deserves special attention because it reveals a fascinating economic divergence that could reshape the global economic narrative. While the US battles inflation, China is fighting the opposite problem… deflation.

Consumer prices in China fell 0.1% year-over-year in April, marking the second straight month of decline, while producer prices plunged 2.7%. This deflationary environment exists despite Beijing's efforts to stimulate domestic demand and consumption.

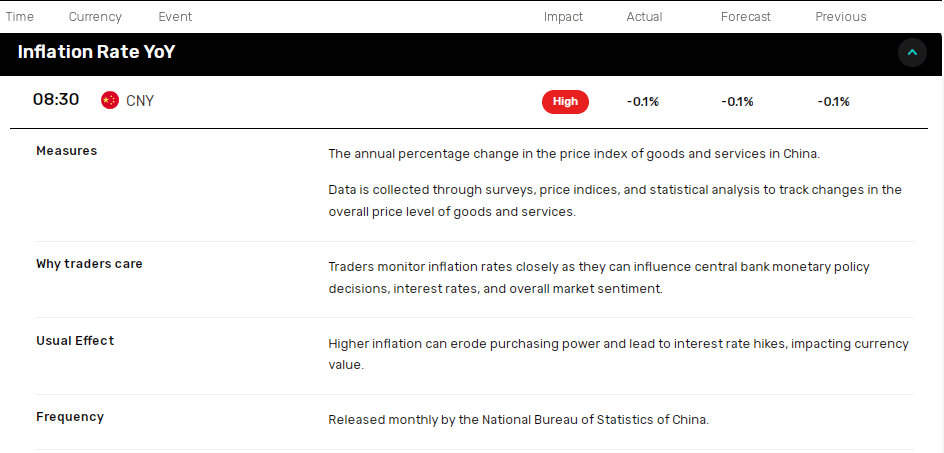

China's Inflation Rate YoY

China's inflation data shows concerning trends with consumer prices falling 0.1% year-over-year and producer prices dropping 2.7%, highlighting weak domestic demand despite stimulus efforts.

For American consumers and investors, this creates several important dynamics:

1. Potential inflation relief: Chinese deflation could help cool US inflation by reducing the prices of exported goods. If the trade deal allows more Chinese products to enter the US market at lower tariff rates, this could help ease price pressures for American consumers.

2. Supply chain implications: Chinese manufacturers are clearly struggling with excess capacity and weak demand, which explains their willingness to absorb cost pressures rather than pass them on to consumers. This creates opportunities for US companies that source components or finished goods from China, as they may be able to negotiate better prices.

3. Global growth concerns: Weak demand in the world's second-largest economy is a warning sign for global growth. China has been a major driver of global economic expansion for decades, and its current struggles could have ripple effects throughout the world economy.

4. Investment considerations: The divergent inflation environments create both risks and opportunities. Chinese stocks could benefit from a trade deal that opens access to US markets, while US companies that compete directly with Chinese imports might face renewed pressure. However, US companies that use Chinese components in their supply chains could benefit from lower costs.

The economic contrast between our countries actually creates potential complementarity. The US economy runs hot with strong demand but high prices, while China has excess production capacity but weak domestic consumption. A trade agreement could theoretically help balance both economies, though political considerations obviously complicate matters.

LOOKING AHEAD: WHAT TO WATCH NEXT WEEK

The market is gearing up for another important week with several key events to monitor:

1. US-China trade deal details: Monday's briefing from Treasury Secretary Bessent will be crucial for understanding the specifics of the trade agreement reached over the weekend. Markets will be looking for concrete details on tariff reductions, implementation timelines, and enforcement mechanisms.

2. CPI inflation data: Tuesday's Consumer Price Index report for April will be closely watched after the Fed flagged inflation risks in its latest meeting. This data will help investors gauge whether price pressures are easing or intensifying in the wake of tariff implementations.

3. Retail sales: Thursday's retail sales report will provide insights into consumer spending patterns, which remain a key driver of economic growth. With mixed signals from recent earnings reports about consumer health, this data point takes on added importance.

4. Consumer sentiment: Friday's University of Michigan consumer sentiment survey will show whether the improving trade outlook and strong job market are boosting consumer confidence, or if inflation concerns continue to weigh on sentiment.

5. Earnings reports: While the bulk of earnings season is behind us, several notable companies will report this week, including Walmart, Cisco, Alibaba, and Deere. These reports will provide additional insights into consumer spending, technology investment, and the impact of trade policies on various sectors.

The market's cautious reaction to recent positive developments reflects the complex environment investors are navigating. On one hand, the US-China trade deal announcement represents a significant potential breakthrough that could reduce economic uncertainty and ease inflation pressures. On the other hand, the lack of specific details and the mixed economic signals we're receiving warrant continued vigilance.

This environment is particularly challenging due to the unusual combination of factors at play. We're seeing deflationary pressures in China while inflation concerns persist in the US. We're seeing the Fed flag risks to both sides of its mandate… employment and inflation. We're seeing oil prices rebound while economic growth forecasts moderate.

For long-term investors, these cross-currents reinforce the importance of diversification and a disciplined approach. Trying to time the market based on conflicting economic indicators or incomplete information about trade deals is likely to lead to poor results. Instead, focus on building a portfolio that can weather various economic scenarios.

The best approach during times like these is to:

1. Maintain global diversification across asset classes and regions

2. Consider sectors less exposed to tariffs, such as financials and healthcare

3. Use market volatility as an opportunity to rebalance your portfolio

4. Focus on your long-term investment goals rather than short-term market movements

5. Remember that economic cycles are normal, and markets have historically rewarded patient investors

The trade breakthrough, if substantiated by meaningful details, could mark an important turning point for markets. However, the path forward is unlikely to be smooth or straightforward. As always, the wisest hedgehogs don't panic or get overly excited by headlines, instead they prepare for various scenarios and maintain a long-term perspective.

This is me being cautious!

I think that’s enough from me for today! I hope it was helpful. If you haven't followed me on X, you can find the link below where I'll be updating you daily on what is happening in the financial world. Thank you for reading and please reach out if you have any questions or comments!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.