Hi everyone, Hedgie here! The markets continue to show remarkable resilience despite looming challenges. Global equities reached all-time highs last week, with the S&P 500 now up nearly 20% from its April lows. This impressive recovery wasn't widely expected following the announcement of steep tariffs, yet solid fundamentals, easing trade tensions, and strong corporate earnings have provided support.

Looking ahead, summer brings several potential catalysts that could test this momentum. From tariff deadlines to Fed policy decisions and fiscal debates, markets face a season of uncertainty. However, the foundation remains strong, with healthy corporate profits, moderating inflation, and a resilient labor market.

Markets continue to demonstrate the classic "climbing a wall of worry" phenomenon. This phrase describes how markets can continue to rise despite apparent reasons for concern. The distinction between headline risks and fundamental economic conditions proves crucial. While headlines focus on potential problems, the underlying economic data continues to show strength in areas that truly drive market performance over time.

Understanding Market Sentiment vs. Economic Reality

Before diving into specific data points, the relationship between market sentiment and economic fundamentals deserves attention. Markets often react emotionally in the short term but align with economic reality over longer periods.

The initial market reaction to tariff announcements in April was sharp and negative, with the S&P 500 dropping nearly 8% in just two weeks. This reaction reflected fear rather than immediate economic damage. As investors digested the actual economic impact and recognized the strength in corporate earnings and consumer spending, markets recovered.

This pattern illustrates a valuable lesson for investors: distinguishing between market noise and economic signals helps avoid emotional decision making. The noise (daily headlines and short term volatility) can distract, but the signals (employment trends, corporate profits, and consumer behavior) provide a clearer picture of where the economy and markets are headed.

Labor Market: Gradual Cooling Without Collapse

May's jobs report confirmed our observations from recent months: a gradual cooling of the labor market without any signs of collapse. The economy added 139,000 jobs, slightly above expectations, while the unemployment rate held steady at 4.2%. This rate remains in the lowest 10% of all historical observations dating back to 1948.

Healthcare (+62,000) and leisure/hospitality (+48,000) led job creation, while manufacturing shed 8,000 jobs (potentially reflecting tariff headwinds) and federal government employment fell by 22,000.

The report wasn't without blemishes. Previous months saw sizable downward revisions, continuing a three month trend. The labor force participation rate also declined, possibly reflecting tighter immigration policies.

The pattern of modest hiring alongside limited firing persists, with wage growth continuing to outpace inflation. This creates a Goldilocks scenario for the Fed: enough cooling to ease inflation concerns without triggering unemployment fears.

Decoding the Jobs Report: The Numbers' True Meaning

To understand the labor market's health, we need to look beyond headline numbers. The job creation figure of 139,000 represents net new jobs, not gross hiring. In a typical month, millions of people are hired and leave jobs, with the difference being reported. The current pace exceeds the roughly 100,000 jobs needed monthly to keep up with population growth.

The unemployment rate of 4.2% measures the percentage of people in the labor force actively looking for work but unable to find it. It doesn't count those who have stopped looking (discouraged workers) or those working part time but wanting full time work (underemployed). This explains why the labor force participation rate matters so much alongside unemployment. Last month's decline indicates fewer people working or looking for work relative to the working age population. Sometimes unemployment falls not because more people found jobs, but because they stopped looking.

Wage growth running at 4.0% year over year with inflation at approximately 2.4% means real wage growth (adjusted for inflation) is positive at about 1.6%. Workers' purchasing power continues to increase, supporting consumer spending and economic growth.

Perhaps most telling are the revisions to previous months, which totaled -95,000 combined. These adjustments reflect more complete data becoming available after initial estimates. The consistent pattern of downward revisions suggests the labor market may be cooling faster than initially reported, a trend worth monitoring in coming months.

The Inflation-Employment Relationship: A Delicate Balance

The relationship between inflation and employment is central to understanding the Federal Reserve's policy decisions. Historically, economists believed in a trade off between the two (the Phillips Curve), where lower unemployment would lead to higher inflation as employers competed for scarce workers by raising wages.

In recent years, this relationship has weakened, allowing for periods of both low unemployment and low inflation. The current environment, with 4.2% unemployment and inflation moderating toward the Fed's 2% target, represents a relatively balanced situation.

However, the Fed remains vigilant about both sides of its dual mandate. If the labor market weakens too quickly, the Fed would likely accelerate rate cuts to support employment. Conversely, if inflation reaccelerates due to factors like tariffs increasing import prices, the Fed might delay rate cuts despite a cooling labor market.

Market Performance: Global Equities Hit New Highs

Last week the MSCI All Country World Index reached an all-time high, with the S&P 500 gaining 1.5% for the week. However, it remains about 3% below its record high and trails some international large cap peers.

Year to date, Latin America leads global markets with a stunning 24.8% return, followed by Europe ex UK at 12.4%. The U.S. has posted a modest 1.7% gain, while Japan remains the only major market in negative territory at -0.9%.

Despite these gains, the rally stands on solid ground. Trade tensions have eased, policy focus has shifted toward tax cuts, economic data remains resilient, and corporate profits continue growing at a healthy pace. That said, valuations have completed a full round trip, potentially fostering complacency as growth decelerates.

Understanding Global Market Divergence

The significant performance gap between different global markets highlights the importance of geographic diversification. Latin American markets entered 2025 with much lower valuations (lower P/E ratios) than U.S. markets, providing more room for expansion. Many economies in the region are commodity exporters, benefiting from resilient commodity prices despite global growth concerns.

Monetary policy cycles also play a crucial role. While the U.S. Federal Reserve has maintained higher rates, many emerging market central banks began cutting rates earlier, providing stimulus to their economies and markets. Currency effects amplify these differences. The U.S. dollar's strength or weakness significantly impacts returns for international investments when converted back to dollars. Recent dollar weakness has boosted returns for U.S. investors in foreign markets.

Japan's negative performance stands out as a special case. It reflects the Bank of Japan's shift away from ultra loose monetary policy, unwinding the "carry trade" that had supported Japanese assets for years, combined with concerns about export competitiveness amid trade tensions. This serves as a reminder that global markets don't move in lockstep, and different regions face unique economic circumstances.

Corporate Earnings: Strength Despite Headwinds

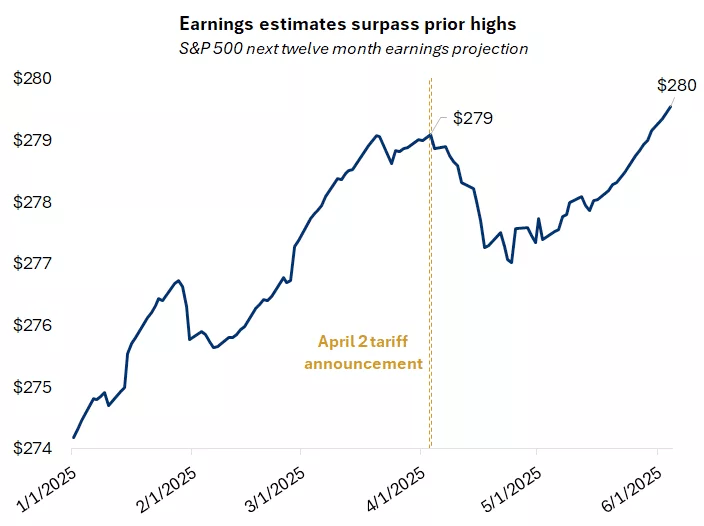

The first quarter earnings season wrapped up with S&P 500 companies delivering 12.5% year over year profit growth, the third consecutive quarter of double digit growth. While earnings estimates for 2025 have been revised down from 14% to 8.5%, the 2026 outlook remains steady, pointing to potential reacceleration.

The forward 12 month earnings estimate has recently reached a new high, providing a fundamental anchor for rising equity markets. While valuations have contributed to recent gains, earnings appear to have played an important role in supporting the rally from the bottom.

Much of the upside came from three growth sectors: information technology, communication services, and consumer discretionary, which together account for over 50% of the S&P 500. Tech earnings grew 20%, communication services surged 33%, and consumer discretionary rose 8%.

Results also highlighted robust spending on artificial intelligence, helping NVIDIA reclaim its title as the world's most valuable company.

The Earnings-Valuation Relationship: Finding the Balance

Corporate earnings and valuations form the two pillars of stock prices. Understanding their relationship helps contextualize market movements. At its simplest, a stock's price can be thought of as earnings per share multiplied by the price to earnings ratio. A stock's price can rise because the company earns more money, because investors are willing to pay more for each dollar of earnings, or through a combination of both factors.

The current market presents a notable dynamic. The S&P 500's P/E ratio has expanded from about 18x at the April lows to approximately 21x today. This valuation expansion accounts for roughly half of the market's 20% gain, with actual earnings growth and upward revisions to future earnings expectations accounting for the other half.

Historically, markets driven primarily by valuation expansion without earnings growth tend to be more vulnerable to corrections. The fact that today's market is supported by both factors provides a more balanced foundation, though the elevated valuations leave less room for error if earnings disappoint. Upcoming earnings seasons will be particularly important to watch as the market now prices in continued earnings strength, and any significant disappointments could trigger volatility.

Key Catalysts to Watch

Trade Developments

The July 9 expiration of the 90 day pause on "reciprocal" tariff rates and the August 12 end of China's 90 day pause pose potential catalysts for volatility. Bilateral negotiations remain complex, while new sectoral investigations on pharmaceuticals and semiconductors are underway.

A recent court decision challenging President Trump's authority to impose reciprocal tariffs affects about two thirds of the proposed tariff hikes, adding another wrinkle to the trade saga. Given these moving pieces, self imposed deadlines may be extended to allow more room for deals.

Understanding Tariffs and Their Economic Impact

Tariffs are essentially taxes on imported goods. When the U.S. imposes tariffs on Chinese products, for example, American importers (not Chinese exporters) pay these taxes to the U.S. government. These costs are typically passed on to consumers through higher prices or absorbed by companies through reduced profit margins.

The economic effects of tariffs span multiple areas. Imported goods become more expensive, potentially contributing to inflation. Companies may need to find alternative suppliers or restructure their operations, incurring transition costs. Trading partners often respond with their own tariffs on U.S. exports, hurting American exporters. Higher costs typically reduce overall trade activity between countries. Over time, tariffs may encourage domestic production as imports become less competitive, though this adjustment takes years rather than months.

The market impact of tariffs depends on their scope, magnitude, and duration. The current situation involves significant proposed tariffs but also includes negotiation periods and legal challenges that may moderate the final outcome. Markets have partially priced in some tariff implementation but remain sensitive to developments in trade negotiations.

Fed Meetings

Two months ago, the bond market fully priced in a rate cut at the Fed's June 18 meeting. That probability has now fallen to near zero as the economy continues to show resilience. The effects of tariffs may start appearing in economic data during the summer, but the Fed is unlikely to have enough clarity to act in June or even at the July 30 meeting.

A September move appears likely. We expect the Fed to cut interest rates twice this year as unemployment ticks higher and any inflation jump proves temporary.

How Fed Policy Affects Your Finances

The Federal Reserve's interest rate decisions ripple through the economy in ways that affect everyday finances. When the Fed cuts rates, borrowing costs for homes, cars, and credit cards typically decline, though not immediately or proportionally. The 10 year Treasury yield, which influences mortgage rates, has already fallen in anticipation of future Fed cuts.

Interest rates on savings products usually decline following Fed rate cuts, reducing income for savers. This creates a situation where borrowers benefit while savers receive less interest income. For the stock market, lower rates generally support higher valuations by reducing the "discount rate" applied to future earnings and making stocks more attractive relative to bonds.

The housing market tends to be particularly sensitive to rate changes. Lower mortgage rates typically boost housing affordability and demand, supporting home prices and construction activity. We've already seen mortgage applications increase as the 10 year Treasury yield has declined in recent weeks.

On the international front, rate cuts often lead to a weaker dollar, making U.S. exports more competitive but imported goods more expensive. This currency effect can partially offset the disinflationary impact of rate cuts.

Understanding these relationships explains why markets react strongly to changes in Fed expectations. The shift from anticipating a June rate cut to expecting a September cut has contributed to recent market volatility as investors adjust their expectations for various asset classes.

Fiscal Debates and the X-date

After the House passed the reconciliation bill ("Big Beautiful Bill") by a narrow margin, it has moved to the Senate, where debate about its provisions and their contribution to the deficit has intensified. The bill includes a boost in the debt ceiling, adding urgency for lawmakers ahead of the X date when the Treasury runs out of cash.

Treasury Secretary Bessent has urged Congress to increase or suspend the debt limit by mid July, putting pressure on Republicans to quickly agree on a sizable tax and spending package in the coming weeks.

The Debt Ceiling: Separating Politics from Economics

The debt ceiling represents the maximum amount of debt the U.S. government can legally issue. Raising the debt ceiling allows the government to pay for spending Congress has already authorized, not to approve new spending. This distinction often gets lost in political debates but remains crucial for understanding the economic implications.

U.S. Treasury securities form the foundation of the global financial system. A default would have far reaching consequences beyond U.S. borders, affecting everything from mortgage rates to pension funds to international financial stability. The exact date when the Treasury exhausts its extraordinary measures (the "X date") is difficult to predict precisely, creating a window of uncertainty that markets must navigate.

Markets typically follow a pattern of increasing volatility as the X date approaches, followed by relief rallies when resolution appears likely. Even without an actual default, prolonged uncertainty can increase borrowing costs and dampen economic activity. We saw this pattern play out during previous debt ceiling standoffs, most notably in 2011 when the U.S. credit rating was downgraded despite an eventual resolution.

The current situation is complicated by being tied to broader fiscal policy debates about tax cuts and spending priorities. Markets are currently assigning a low probability to an actual default but remain sensitive to developments in these negotiations. The coming weeks will be crucial as the mid July deadline approaches.

Investment Outlook: Resilience With Bouts of Volatility

Headline noise will continue through summer, but the bull market remains supported by solid fundamentals. The Atlanta Fed's GDP model points to 3.8% growth in the second quarter as the import surge reverses, labor market conditions remain healthy, and the Fed's preferred inflation measure hit a four year low.

Easier fiscal policy and Fed rate cuts may help reaccelerate growth in 2026, while political and economic realities may prevent the U.S. administration from following a very aggressive stance on trade.

We continue to recommend slightly overweighting equities over bonds, though bonds can help smooth volatility if it re emerges. While a significant bond rally appears unlikely without a recession, the 10 year yield has fallen below 4.5% despite the perfect storm of the U.S. debt downgrade, deficit concerns from the new tax bill, and rising Japanese bond yields.

From an investment style perspective, a balance between growth and value is warranted, as the recent earnings season reminded us of the earnings power of mega cap tech even as leadership broadens.

Market volatility is a normal part of investing, but it can trigger emotional responses that lead to poor decisions. During volatile periods, investors benefit from distinguishing between volatility and risk. Volatility refers to price fluctuations, while risk represents the permanent loss of capital. Long term investors should focus more on risk than volatility.

Your time horizon plays a crucial role in how you should view market movements. Short term fluctuations matter less the longer your investment timeframe. A 5% market drop feels significant today but becomes a barely noticeable blip over a 10 year chart. This perspective helps maintain discipline during market turbulence.

Asset allocation, your mix of stocks, bonds, and other investments, should align with your time horizon and risk tolerance. This allocation, rather than market timing, drives most long term returns. Market movements naturally alter your asset allocation over time. Periodically rebalancing back to target allocations helps maintain your risk profile and can enhance returns by systematically "buying low and selling high."

Focus on the elements within your control. You can't control market movements, economic data, or policy decisions. You can control your savings rate, investment costs, asset allocation, and emotional reactions to market events. This mindset helps maintain perspective during periods of uncertainty like the one we're entering this summer.

Sector Spotlight: Technology's Evolving Role

The technology sector continues to drive market performance, but its composition and growth drivers are evolving. While AI remains a significant theme, we're seeing a broadening of leadership within tech.

Semiconductor companies beyond NVIDIA are beginning to show strength as AI related demand spreads through the supply chain. Enterprise software companies are demonstrating how AI integration is enhancing their products and creating new revenue streams. And cloud infrastructure providers continue to benefit from the massive computing resources required for AI development and deployment.

However, the sector faces challenges, including regulatory scrutiny, potential impacts from tariffs on semiconductor supply chains, and the need to demonstrate tangible returns on massive AI investments. The coming quarters will be crucial in determining whether AI can deliver the productivity gains and revenue growth that current valuations anticipate.

For investors, distinguishing between companies with sustainable competitive advantages in AI and those simply benefiting from the current hype cycle remains essential. Companies that can demonstrate how AI translates into improved business outcomes for their customers are likely to maintain leadership positions.

Weekly Market Stats (as of 6/6/2025)

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 42,763 | 1.2% | 0.5% |

S&P 500 Index | 6,000 | 1.5% | 2.0% |

NASDAQ | 19,530 | 2.2% | 1.1% |

MSCI EAFE | 2,618.67 | 0.7% | 15.8% |

10-yr Treasury Yield | 4.50% | 0.1% | 0.6% |

Oil ($/bbl) | $64.65 | 6.3% | -9.9% |

Bonds | $97.28 | -0.8% | 2.6% |

Understanding Market Indexes: Their Significance

Market indexes serve as barometers for different segments of the financial markets. The Dow Jones Industrial Average tracks 30 large, publicly owned blue chip companies. Despite its prominence in financial media, its small sample size and price weighted methodology make it less representative of the broader market than other indexes.

The S&P 500 represents 500 of the largest U.S. companies, weighted by market capitalization. This provides a more comprehensive view of the U.S. large cap market and is the benchmark most professional investors use.

The NASDAQ is heavily weighted toward technology companies, reflecting the performance of over 3,000 companies listed on the Nasdaq stock exchange. Its performance often diverges from other indexes during tech driven market cycles, as we've seen this past week with its 2.2% gain outpacing other indexes.

The MSCI EAFE tracks large and mid cap stocks across 21 developed markets outside North America (Europe, Australasia, Far East). This provides insight into international developed market performance, which at 15.8% year to date has significantly outperformed U.S. markets.

The divergence between these indexes highlights the importance of diversification across different market segments. No single index captures the entire market, and different segments often perform differently based on economic conditions, sector exposure, and regional factors.

The Week Ahead

This week's economic calendar includes key inflation data with the Consumer Price Index (CPI) on Wednesday and the Producer Price Index (PPI) on Thursday. Markets will be watching these releases closely for signs of whether inflation continues to moderate or if tariff effects are beginning to appear in pricing data.

The Federal Reserve's June meeting concludes on Tuesday, with no rate change expected but significant focus on the updated dot plot and economic projections. Chair Powell's press conference will be scrutinized for hints about the timing of potential rate cuts later this year.

Retail sales data on Friday will provide insight into consumer spending patterns as we head into summer, with analysts looking for signs of whether higher income consumers are maintaining their resilience.

Decoding Economic Indicators: Key Elements to Monitor

When these economic reports are released, pay particular attention to the CPI core rate, which excludes volatile food and energy prices. This provides a clearer picture of underlying inflation trends, and the Fed pays particular attention to this measure when making policy decisions.

For the PPI report, comparing final demand versus intermediate goods prices can provide early signals of future consumer price trends. Rising intermediate goods prices often precede consumer price increases, serving as an early warning system for inflation pressures.

The Fed's dot plot will be especially important this meeting. Each Fed member's projection for future interest rates appears as a dot on this chart, with the median dot for each year providing insight into the committee's collective thinking about the path of rates. Any shift toward earlier or more aggressive cuts would likely boost market sentiment.

For retail sales, look beyond the headline number. Auto sales can be volatile month to month, so excluding them provides a clearer picture of broader consumer spending trends. The "control group" subset of retail sales feeds directly into GDP calculations and excludes food services, auto dealers, building materials stores, and gas stations, providing the cleanest read on consumer spending trends.

Stay tuned for next week's update as I analyze these important economic indicators and their market implications.

Hedgie

Remember, financial advice from a hedgehog should be taken with a grain of salt and several mealworms. Hedgie is not responsible for any prickly investment decisions you make.