Hey everyone, Hedgie here! Welcome to this week's market breakdown. What a week it's been! We saw some fantastic earnings results from the tech giants, but tariff headlines continue to create uncertainty. I'm going to walk you through everything that happened and explain what it means for your investments. The big story this week was how corporate earnings, particularly in technology, helped offset ongoing trade policy concerns.

The S&P 500 had a strong week, gaining 1.88% and pushing the index to 5,912. The Dow climbed 1.6% to 42,270, while the Nasdaq led the way with a 2.01% gain to 19,114. For the year, we're seeing mixed results with the S&P 500 slightly positive at 0.5%, the Dow down 0.6%, and the Nasdaq down 1.0%. The Russell 2000 also participated in the rally, advancing 1.3% for its seventh positive week in eight.

However, as I'm writing this Sunday evening, stock futures are pointing to a weaker start for Monday, with S&P 500 futures down 0.3%, Nasdaq-100 futures also declining 0.3%, and Dow futures off 108 points. This pullback after such strong May performance isn't entirely surprising, as markets often consolidate after significant gains.

Note: This newsletter was prepared Sunday evening for Monday morning release. Market conditions and futures may have changed by the time you're reading this.

MAY'S REMARKABLE PERFORMANCE SETS THE STAGE

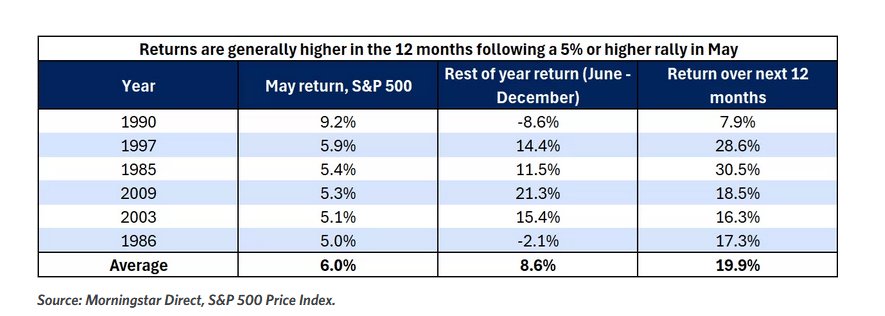

Before diving into this week's earnings and policy developments, let's appreciate just how remarkable May's performance was. The S&P 500 climbed 6.15% for the month, breaking a three-month losing streak with its best monthly performance since November 2023. The Nasdaq was even more impressive, surging 9.56% for its best month since November 2023 and second positive month in a row. Even the Dow, often seen as more conservative, rose 3.94% to break its own three-month losing streak.

The Russell 2000 small-cap index gained 5.2%, also breaking a three-month losing streak with its best performance since November 2024. This broad-based strength across market capitalizations suggests the rally wasn't just driven by a few large technology stocks, but reflected genuine optimism about corporate prospects.

This table shows that historically, when the S&P 500 moves higher by 5% or more in May, returns are generally higher in the following 12 months.

TECH EARNINGS SEASON DELIVERS STRONG RESULTS

NVIDIA Leads the Charge Despite China Headwinds

The biggest story this week was NVIDIA's earnings report, which showed just how resilient the AI revolution remains despite geopolitical challenges. The company exceeded both revenue and earnings estimates and grew its data-center business by an impressive 73%. This growth came even as NVIDIA faces trade restrictions in China, proving that global demand for AI infrastructure remains incredibly strong.

What really caught my attention was how NVIDIA emphasized that demand from major technology customers like Microsoft, Meta, and Amazon continues to drive their data-center revenues. This isn't just about one company doing well - it's about an entire ecosystem of AI investment that's creating a virtuous cycle of growth.

The $330 Billion AI Investment Commitment

Speaking of that ecosystem, we got confirmation this week that four tech giants - Microsoft, Meta, Google, and Amazon - have reaffirmed their capital expenditure plans for north of $330 billion this year. That's not a typo. These companies are collectively spending more than the GDP of many countries on AI infrastructure and development.

This massive investment commitment tells us several important things. First, these companies see AI as a fundamental shift, not a passing trend. Second, they're willing to sacrifice short-term profits for long-term positioning. Third, the competitive dynamics in AI are so intense that none of these companies can afford to fall behind.

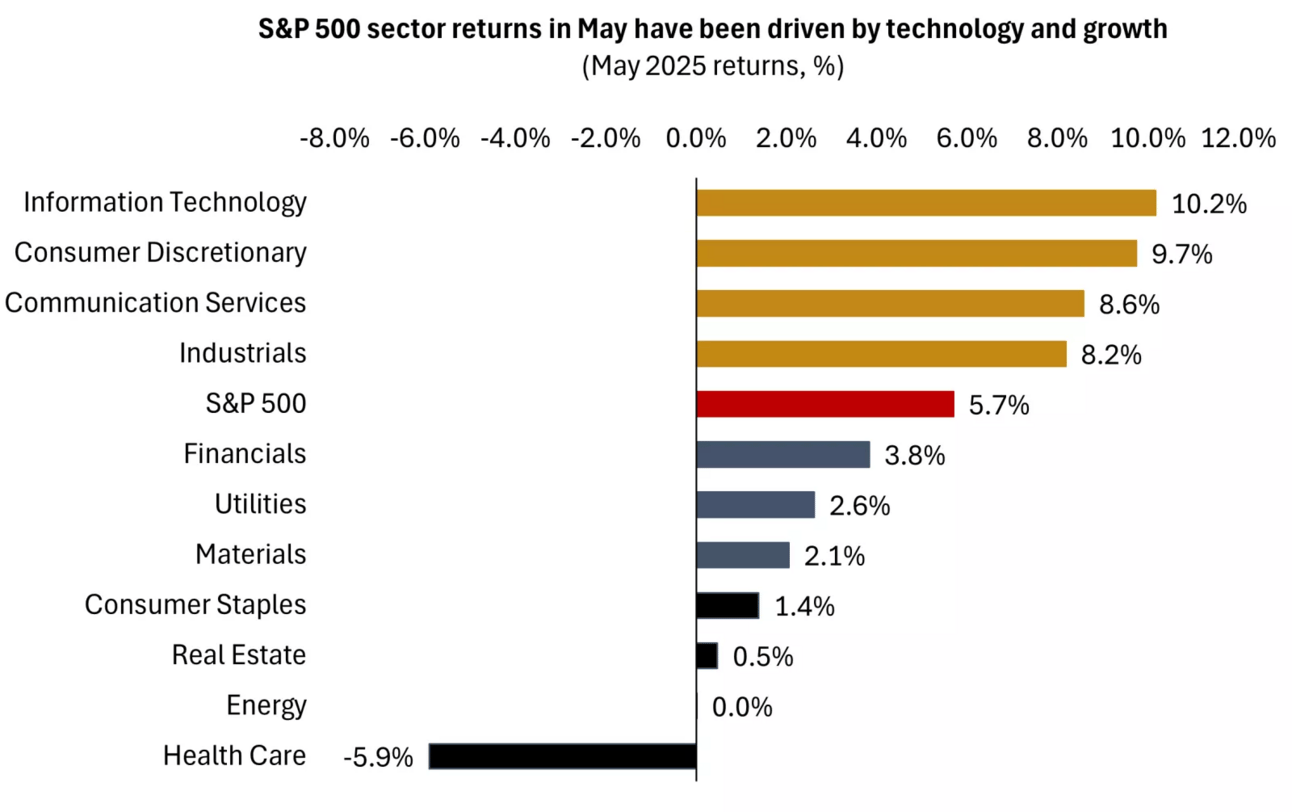

This chart shows how technology and growth sectors led the market higher in May 2025, with the S&P 500 gaining about 6% for the month.

Technology Sector Performance Leads Markets Higher

The positive earnings reports translated directly into stock performance, with technology and growth sectors leading the market higher in May. The S&P 500 gained about 6% for the month, recovering from earlier weakness and turning slightly positive for the year.

This technology-led rally helped alleviate investor concerns that tariff uncertainty and previous large investments might slow down AI spending. Instead, we're seeing the opposite - companies are doubling down on their AI investments because they continue to see attractive returns on these expenditures.

CORPORATE EARNINGS GROWTH REMAINS ON TRACK

Broad-Based Earnings Strength

Beyond technology, S&P 500 companies have delivered solid results across the board in the first quarter of 2025. Corporate earnings season has outperformed expectations, driven by positive surprises not just in tech but also in healthcare and other sectors.

The resilience in corporate earnings is particularly impressive given the challenging backdrop of trade uncertainty and higher interest rates. Companies have shown they can navigate these headwinds while continuing to grow their businesses and maintain profitability.

Mid-Single Digit Growth Expected for 2025

Looking ahead, S&P 500 earnings growth remains on track for mid- to high-single-digit annual growth in 2025. While earnings estimates have been revised downward this year due to tariff and trade uncertainty, investors still forecast positive earnings growth for nine of the 11 S&P 500 sectors.

This broad-based earnings growth is supported by a solid labor market and inflation rates that have remained relatively contained. The latest PCE inflation reading came in at 2.1% year-over-year for April, below the forecast of 2.2% and moving closer to the Fed's 2.0% target.

This chart shows S&P 500 2025 earnings growth potential by sector, with nine of the 11 sectors expected to show positive growth year-over-year.

Looking Toward 2026 Acceleration

What's particularly encouraging is the potential for earnings growth to reaccelerate in 2026. This could happen as the Federal Reserve potentially cuts rates modestly in the back half of this year, a new tax bill goes into effect in 2026, and corporations gain more clarity on tariffs and the operating environment.

Markets are forward-looking, and we could start seeing better news priced in ahead of an actual inflection in growth. This is why maintaining a long-term perspective remains so important, even when short-term headlines create volatility.

TARIFF LEGAL BATTLES CREATE ONGOING UNCERTAINTY

The tariff situation became even more complex this week with dueling court rulings that left the policy in legal limbo. On Wednesday, the U.S. Court of International Trade struck down much of President Trump's steep levies, ordering his administration to stop collecting them. However, just one day later, a federal appeals court granted the administration's request to temporarily pause that ruling, effectively reinstating the duties.

This legal back-and-forth highlights the ongoing uncertainty around trade policy, but Trump's top economic advisors remain optimistic. Commerce Secretary Howard Lutnick said on Fox News over the weekend that the tariffs are "not going away," while National Economic Council Director Kevin Hassett told ABC News he's "very confident that the judges will uphold this law."

Potential Trump-Xi Meeting This Week

Adding to the intrigue, Hassett suggested that Trump and China's President Xi Jinping could discuss trade as early as this week, though no date has been set. This comes as trade tensions escalated last week, with Trump writing on Truth Social Friday that China has "TOTALLY VIOLATED ITS AGREEMENT WITH US."

TARIFF UNCERTAINTY CONTINUES BUT INVESTOR FATIGUE SETTING IN

Mixed Progress on Trade Negotiations

While earnings provided positive news, tariff headlines continued to create uncertainty. The administration delayed 50% tariffs on European allies, pushing the implementation to July 9th alongside other major trading partners. This delay provides some breathing room for negotiations.

However, progress with China appears more challenging. The White House indicated that progress is "a bit stalled" and may require leaders from both nations to come together for next steps. The administration also announced plans to broaden restrictions on China's technology sector, though details remain limited.

Legal Challenges Continue

On the domestic legal front, a federal appeals court overturned a lower court ruling that had revoked Trump administration tariffs imposed under the International Emergency Economic Powers Act. For now, tariffs have been reinstated globally, but further hearings are scheduled and the case could ultimately reach the Supreme Court.

Market Skepticism About Continued Momentum

Despite May's strong performance, some strategists are cautious about whether this momentum can continue. Morgan Stanley's Chris Toomey expressed skepticism on CNBC's "Closing Bell" Friday, saying "We're probably still range-bound. The concern we've got is that while I think we've taken [out] the worst-case scenario with regards to the 'liberation day' [tariffs], we're in a situation where I think the market's right now probably pricing in the best-case scenario."

Toomey noted that "Everyone's talking about the fact that there's probably going to be 10% tariffs across the board, 30% for China. I think that's kind of baked in." This suggests that while markets have rallied on hopes for moderate tariff outcomes, there may be limited upside if that's indeed what materializes.

This chart shows the Bloomberg U.S. trade policy uncertainty index over the last 18 months, highlighting the ongoing volatility in trade policy expectations.

Despite the ongoing tariff uncertainty, companies have shown remarkable ability to navigate these challenges. They've built inventories ahead of potential tariff-led price increases and have generally kept consumer prices contained. This operational flexibility has helped maintain corporate profitability even in an uncertain trade environment.

WHAT THIS MEANS FOR YOUR INVESTMENTS

Technology Sector Positioning

The strong technology earnings and massive AI investment commitments suggest this sector remains well-positioned for continued growth. However, valuations have risen with performance, so new investments should be made thoughtfully as part of a diversified strategy.

The $330 billion in AI capital expenditures from major tech companies creates opportunities not just for these companies themselves, but for their suppliers, partners, and the broader technology ecosystem. This includes semiconductor companies, cloud infrastructure providers, and software companies building AI applications.

Sector Diversification Remains Important

While technology has led recent performance, it's important to maintain diversification across sectors. Areas like financials and healthcare are less exposed to tariffs and should benefit if economic growth reaccelerates. These sectors also tend to perform well when interest rates stabilize or decline.

The current environment suggests balancing growth-oriented technology investments with more defensive sectors that can provide stability during periods of uncertainty.

International Exposure Considerations

The strong performance of international markets, with the MSCI EAFE up 14.9% year-to-date, highlights the importance of global diversification. While U.S. markets have faced headwinds from trade uncertainty, international markets have benefited from different dynamics.

However, tariff policies could affect international investments differently, so it's important to understand how trade policies might impact various geographic exposures in your portfolio.

BOND MARKET AND INTEREST RATE ENVIRONMENT

Treasury Yields Show Stability Amid Volatility Concerns

The 10-year Treasury yield ended the week at 4.39%, down slightly by 0.1% for the week but up 0.5% year-to-date. The 3-month Treasury yield sits above 4.3%, while the 2-year Treasury yield is around 3.9%. This relative stability in yields has provided a more supportive environment for both stocks and bonds.

Interestingly, investors are following Warren Buffett's lead by leaning into shorter-term Treasury bills. As Joanna Gallegos, CEO of BondBloxx, noted on CNBC's "ETF Edge," "There's lots of concern and volatility, but on the short and middle end, we're seeing less volatility and stable yields."

Last month saw Treasury yields spike amid concerns that a new U.S. tax bill would exacerbate the country's budget deficit, with the 30-year Treasury yield reaching its highest level since October 2023. The current preference for shorter-duration bonds reflects investor caution about long-term fiscal sustainability.

The bond market, represented by the iShares Core U.S. Aggregate Bond ETF, gained 0.9% for the week and is up 2.3% year-to-date. This performance shows that fixed income investments can provide both income and capital appreciation when yields stabilize.

Fed Policy Outlook

With inflation moving closer to the Fed's 2.0% target and economic growth remaining solid, the Federal Reserve appears to be in a position where it could potentially cut rates modestly in the back half of the year. This would provide additional support for both economic growth and market performance.

The combination of stable inflation, solid corporate earnings, and potential monetary policy support creates a generally favorable environment for investors, even with ongoing trade policy uncertainty.

LOOKING AHEAD: KEY EVENTS TO WATCH

Critical Economic Data This Week

This week brings several important economic releases that could provide insight into how tariffs have affected the U.S. economy. The key May nonfarm payrolls reading on Friday will be particularly crucial, as it will show whether the labor market remains resilient amid ongoing trade uncertainty.

The employment data will be especially important given recent concerns about labor market moderation. Strong job growth would support consumer spending and economic growth, while weaker data might increase expectations for Fed rate cuts. ISM PMI data will also provide insights into manufacturing sector health.

Weekly Market Stats

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 42,270 | 1.6% | -0.6% |

S&P 500 Index | 5,912 | 1.9% | 0.5% |

NASDAQ | 19,114 | 2.0% | -1.0% |

MSCI EAFE | 2,599 | 0.8% | 14.9% |

10-yr Treasury Yield | 4.39% | -0.1% | 0.5% |

Oil ($/bbl) | $60.92 | -1.0% | -15.1% |

Bonds | $98.10 | 0.9% | 2.3% |

Source: FactSet, 5/30/2025. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results.

Earnings Season Continues

While the major technology companies have reported, earnings season continues with reports from other sectors. These results will help determine whether the positive earnings momentum can broaden beyond technology.

Healthcare, financial services, and consumer discretionary companies will provide insights into how different parts of the economy are performing and whether the positive earnings trends can continue.

Trade Policy Developments

The July 9th deadline for European tariffs and ongoing negotiations with China will remain key focus areas. Any progress on trade deals could provide additional market support, while escalation of trade tensions could create headwinds.

The legal challenges to tariff policies will also continue to work through the court system, potentially creating additional uncertainty or clarity depending on the outcomes.

INVESTMENT STRATEGY IN THE CURRENT ENVIRONMENT

Stay Invested and Diversified

The current environment reinforces the importance of staying invested and maintaining diversification. While uncertainty exists around trade policy, corporate earnings remain solid and the economic fundamentals are generally supportive.

The strong May performance, with the S&P 500 up about 6% for the month, demonstrates how quickly markets can recover from earlier weakness. Trying to time these moves is extremely difficult, which is why maintaining consistent investment exposure remains important.

Quality Focus

In uncertain environments, focusing on quality investments becomes even more important. Companies with strong balance sheets, consistent earnings growth, and competitive advantages are better positioned to navigate challenges and capitalize on opportunities.

The technology companies reporting strong earnings this week exemplify this quality focus - they have dominant market positions, strong cash flows, and are investing in future growth opportunities.

Long-Term Perspective

While short-term volatility will continue, maintaining a long-term perspective remains crucial. The massive AI investments being made today will likely drive economic growth and productivity improvements for years to come.

Similarly, while trade policy uncertainty creates near-term challenges, the underlying strength of the U.S. economy and corporate sector provides a solid foundation for long-term investment success.

FINAL THOUGHTS: RESILIENCE IN UNCERTAIN TIMES

This week's market action demonstrated the resilience of both corporate America and financial markets in the face of ongoing uncertainty. Strong earnings results, particularly in technology, showed that companies continue to execute their strategies and grow their businesses despite challenging conditions.

The massive AI investment commitments from major technology companies represent a bet on the future that could drive economic growth and productivity improvements for years to come. While these investments require significant capital today, they're laying the foundation for tomorrow's economic expansion.

Trade policy uncertainty remains a challenge, but companies have shown remarkable ability to adapt and navigate these conditions. The combination of operational flexibility, strong balance sheets, and innovative capabilities has allowed many businesses to maintain growth even in uncertain times.

For investors, this environment reinforces several key principles. Diversification across sectors, geographies, and asset classes remains important. Focusing on quality investments with strong fundamentals provides better protection during uncertain periods. Maintaining a long-term perspective helps avoid the emotional decisions that can derail investment success.

The market's ability to focus on positive earnings results while managing ongoing policy uncertainty shows the importance of fundamentals over headlines. While news flow will continue to create short-term volatility, the underlying strength of corporate earnings and economic growth provides the foundation for long-term investment success.

As we move into the summer months, the combination of solid earnings growth, potential Fed policy support, and massive technology investments creates a generally constructive environment for investors. While challenges remain, the resilience demonstrated by both companies and markets this week provides confidence in the ability to navigate whatever uncertainties lie ahead.

Remember, the wisest hedgehogs focus on what they can control - maintaining diversified portfolios, staying informed about important developments, and making thoughtful adjustments based on changing conditions rather than short-term market movements.

Thanks for reading, and I'll see you next week with another market update!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.