🦔 Welcome back to another week of cutting through the noise! Markets just hit fresh record highs with the S&P 500 closing at 6,279 on July 3, while the VIX dropped to 16.38, its lowest level in four months. Nvidia and tech led the charge, but this calm might be deceiving.

Here's what everyone's missing: we're heading into the most critical week of 2025. The July 9 tariff deadline, Fed minutes, and Friday's jobs report that beat headline expectations (+147K vs 118K) are setting up potential fireworks. But dig deeper into those employment numbers, and you'll see why this week's policy decisions matter even more than the surface data suggests.

The Jobs Report Disconnect: While headlines celebrated 147,000 new jobs, I showed you last week how private sector job growth at just 1.1% annually puts us in historically dangerous territory. We've only seen this three times in recent decades: July 2007 (five months before recession), March 2001 (recession start), and September 1990 (two months after recession began). Government hiring is masking private sector weakness.

Market Breadth Warning Still Flashing: As I highlighted earlier this week, only 35-40% of S&P 500 stocks are trading above their 200-day moving average. While the index hits new highs, most individual stocks are struggling. This narrow leadership makes the market more fragile than headlines suggest.

THREE FORCES RESHAPING THE SECOND HALF

1. The Tariff Tango Continues, But Growth Stays Positive

Remember that April panic when tariffs were set to spike from 2.3% to over 25%? We're now sitting at around 15% effective tariff rate, with the big July 9 deadline approaching for the 90-day pause to expire.

The good news: Last week's Vietnam deal dropped their rate from 46% to 20%, showing the administration is still willing to negotiate. The concerning news: Even at 15%, we're talking about a massive increase from historical levels.

Here's what this means for your wallet: Companies have been burning through inventory stockpiled before the tariff announcements. Once that buffer runs out in the second half, expect price increases to start showing up on everything from electronics to clothing. This creates a classic squeeze where household purchasing power gets pinched just as companies see their profit margins compressed.

The jobs data tells the real story though. Friday's report blew past expectations with 147,000 new jobs (vs 118,000 expected), unemployment dropped to 4.1%, and initial jobless claims fell to a six-week low of 233,000. The 2-year Treasury yield jumped to 3.88% and the 10-year hit 4.35% as July Fed cut odds evaporated. The labor market is cooling but not cracking.

Nonfarm payroll chart showing moderation but continued growth

2. America First, But International Caught Up Fast

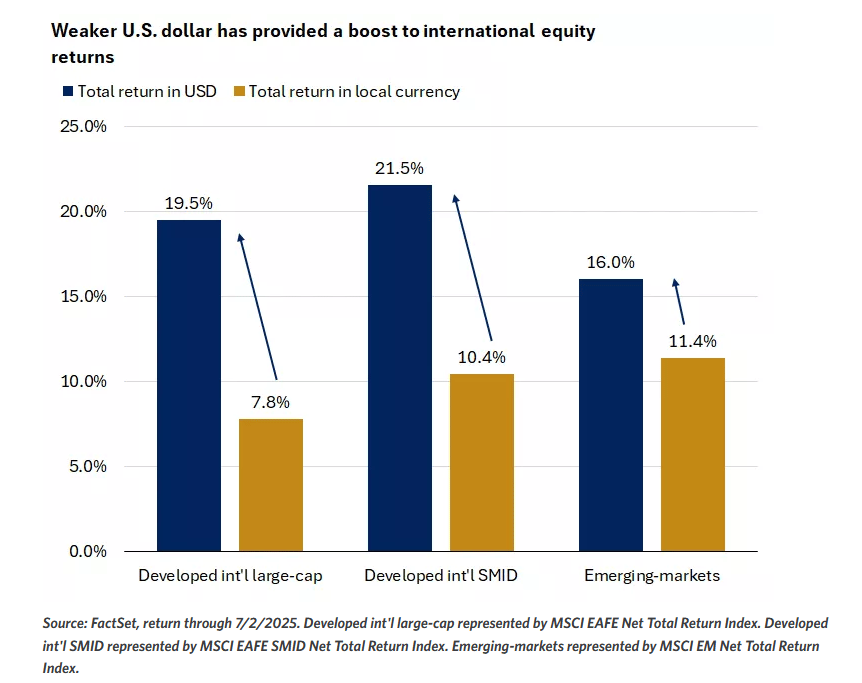

For 12 of the past 15 years, U.S. stocks crushed international markets. Not anymore. In the first half of 2025, international stocks led the charge with developed markets up 19.5% and emerging markets gaining 16%. The MSCI EAFE index sits at 2,656, up 17.4% year-to-date compared to the S&P 500's 6.8%.

GDP growth gap narrowing between US and international markets

What changed? Europe got aggressive with fiscal stimulus while the ECB cut rates deeper than expected. Meanwhile, the U.S. dollar weakened over 10% as growth concerns mounted and tariff uncertainty created policy paralysis.

International stock performance showing 19.5% gains for developed markets

But here's the plot twist: U.S. corporate profits are still expected to outpace international peers significantly. American companies have AI infrastructure advantages and will benefit from the "One Big Beautiful Bill" tax extensions that could add fiscal stimulus in 2026.

The dollar weakness was overdone. U.S. bond yields remain higher than most developed markets, and there's still no viable alternative to the dollar as global reserve currency. When that reverses, it will provide less tailwind for international returns.

3. Fed Cuts Coming, But Deficit Concerns Cap the Upside

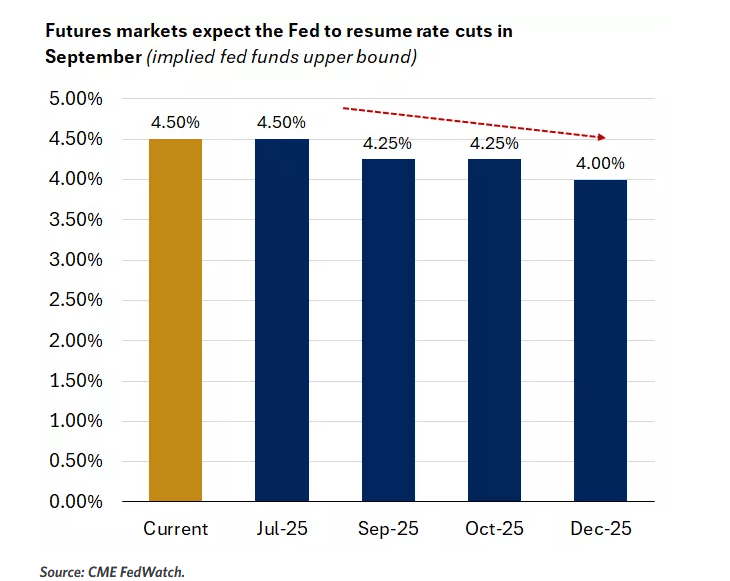

The Federal Reserve is stuck in a policy pickle. Tariffs create stagflation risk (higher inflation + slower growth), making rate cuts both necessary and dangerous. The June meeting kept projections at two cuts for 2025, but pushed out future easing expectations.

Bond markets are pricing in the first cut for September, which makes sense given the economic cooling we're seeing. But Friday's strong jobs report pushed those odds way down and sent yields higher across the curve.

Fed rate cut expectations showing September timing

Here's the constraint nobody talks about: The proposed tax bill could add $4.1 trillion to the national debt over the next decade. Federal debt as a percentage of GDP could jump from 100% today to 130%. That forces investors to demand higher yields to compensate for credit risk, especially on longer-term bonds. This creates a ceiling on how low yields can go even with Fed cuts.

THE REALITY CHECKS AHEAD

July 9 Tariff Deadline: The 90-day pause expires next week. Any escalation could derail the summer momentum, while further de-escalation would remove a major uncertainty overhang.

Inventory Depletion: Companies have been living off stockpiled goods. When those run out, tariff costs hit consumers directly through higher prices.

Dollar Reversal Risk: International outperformance relied heavily on dollar weakness. A stronger dollar would reverse those gains quickly.

Deficit Constraints: Even with Fed cuts, rising debt levels limit how much bond yields can fall, keeping financing costs elevated.

SECTOR ROTATION OPPORTUNITIES

The first half created some clear winners and losers, opening up opportunities for the second half:

Positioned for Outperformance:

Financials: Benefit from higher-for-longer rates and domestic focus

Healthcare: Defensive characteristics with reasonable valuations

Consumer Discretionary: Tax cut beneficiaries with pent-up demand

Lagging but Catching Up:

U.S. Large/Mid-Cap: Corporate earnings advantage should reassert itself

Value Sectors: Cheaper valuations after growth outperformance

Potential Headwinds:

Consumer Staples: Tariff cost pressures on margins

Materials: Trade uncertainty weighs on industrial demand

International: Dollar strength could reverse first-half gains

BOND MARKET STRATEGY

The 7-10 year Treasury space continues to offer the best risk-adjusted returns. You can lock in current yields for a reasonable duration while avoiding the deficit concerns that plague 30-year bonds and the reinvestment risk of shorter maturities.

High-yield credit spreads remain historically tight at a time when economic growth is slowing. Investment-grade bonds offer better value, especially in that 7-10 year sweet spot.

THE WEEK AHEAD: KEY CATALYSTS

July 9 Tariff Decision: The big one. Extension, escalation, or further de-escalation will set the tone for summer trading.

FOMC Minutes (July 9): Same day as tariff deadline. Fed insights could move rate cut expectations significantly.

Amazon Prime Day (July 8-11): Retail sector performance indicator during the key shopping event.

Key Earnings: Delta Air Lines, Conagra Brands, Levi Strauss reporting this week.

Crypto Watch: Bitcoin holding around $109,000 with steady ETF inflows into IBIT and ETHA.

HEDGIE'S TAKE: UNDERSTANDING THE FORCES, NOT PREDICTING THE OUTCOME

The second half setup is more complex than the first half recovery story. We have supportive fundamentals (resilient jobs, potential Fed cuts, tax stimulus coming) balanced against real constraints (tariff inflation, deficit concerns, policy uncertainty).

Here's what this means in practical terms:

The Real Jobs Story Behind the Headlines: That 147,000 job gain isn't just a number. Yes, it beat expectations, but here's the context most missed: Private sector job growth has decelerated from 3.7% in May 2023 to just 1.1% now. The BLS reported 74,000 private jobs while ADP showed 33,000 lost, a 107,000 difference that reveals underlying weakness. Government hiring is temporarily masking what's becoming broader private sector contraction.

Why Market Breadth Matters More Than Index Levels: When only 35-40% of S&P 500 stocks are healthy (above their 200-day average), it means the index is being carried by a handful of mega-cap stocks. This creates a fragile foundation where a few stock stumbles could bring down the whole market. Healthy bull markets typically see 70-80% of stocks participating.

The Housing Market Foundation Cracks: As I detailed in our housing analysis, 119,000 unsold completed homes (highest since 2009) combined with 4.04% mortgage delinquencies shows pressure from both ends. When people can't afford new homes AND existing homeowners struggle with payments, it creates systemic risks that ripple through the entire financial system.

Why the July 9 Date Matters So Much: Think of it as a pressure release valve. If tariffs get extended or reduced further, it removes a major uncertainty that's been weighing on business investment and consumer spending. If they escalate, we could see the kind of supply chain disruption that made inflation spike in the first place.

The Dollar Strength Reversal: When the dollar weakened 10% in the first half, it made everything from European vacations to imported cars cheaper for Americans. But it also made U.S. exports more competitive globally. Now that jobs data suggests the economy isn't falling apart, the dollar is finding its footing again. This could slow the international stock rally that beat U.S. markets in the first half.

Why Bond Yields Matter to Everyone: Whether you have a mortgage, car loan, or credit card debt, the direction of interest rates affects your monthly payments. The 10-year Treasury at 4.35% sets the benchmark for everything else. Higher yields mean higher borrowing costs but also better returns on savings accounts and CDs.

The Sector Rotation Story: When money moves from growth stocks (like tech) to value stocks (like banks and energy), it usually signals investors expect economic conditions to normalize rather than boom or bust. We're seeing early signs of this rotation as financials benefit from higher rates and energy responds to supply dynamics.

What to Watch For:

Private vs Public Job Growth: Is government hiring continuing to mask private sector weakness?

Market Breadth Recovery: Do more individual stocks start participating, or does narrow leadership persist?

Consumer Spending Under Pressure: Are people still spending despite job market softening and housing affordability crisis?

Corporate Margin Squeeze: Can companies pass tariff costs to customers or will profits get compressed?

Credit Conditions Tightening: Are banks still lending freely as economic conditions shift?

Housing Market Spillover: Do rising delinquencies start affecting mortgage-backed securities and regional banks?

The key insight: We're seeing multiple warning signals flash simultaneously. Narrow market leadership, private sector job growth deceleration, housing market stress from both supply and demand sides, and policy uncertainty creating additional headwinds. This isn't a momentum market anymore. It's becoming an environment where understanding these interconnected economic forces matters more than following daily headlines.

Key risks to monitor:

Tariff escalation beyond current 15% level creating supply chain chaos

Consumer spending dropping off a cliff as inflation squeezes budgets

Dollar strength completely reversing international market gains

Deficit concerns forcing long-term interest rates much higher

The summer months often bring lighter trading volume, which can make price swings more dramatic. But they're also when the most important policy decisions get made. Pay attention to the fundamentals, not just the daily market moves.

Until next week,

🦔 Hedgie

Weekly Market Stats:

Index | Close | Week | YTD |

|---|---|---|---|

Dow Jones | 44,829 | +2.3% | +5.4% |

S&P 500 | 6,279 | +1.7% | +6.8% |

NASDAQ | 20,601 | +1.6% | +6.7% |

MSCI EAFE | 2,656 | +0.1% | +17.4% |

10-yr Treasury | 4.35% | +0.1% | +0.5% |

Oil ($/bbl) | $67.02 | +2.3% | -6.6% |

Bitcoin | $109,000 | +1.2% | +145% |

VIX | 16.38 | -8.5% | -15.2% |

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.