What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Hey everyone, Hedgie here. We had a wild week last week, let's get into it.

The Greenland Whiplash

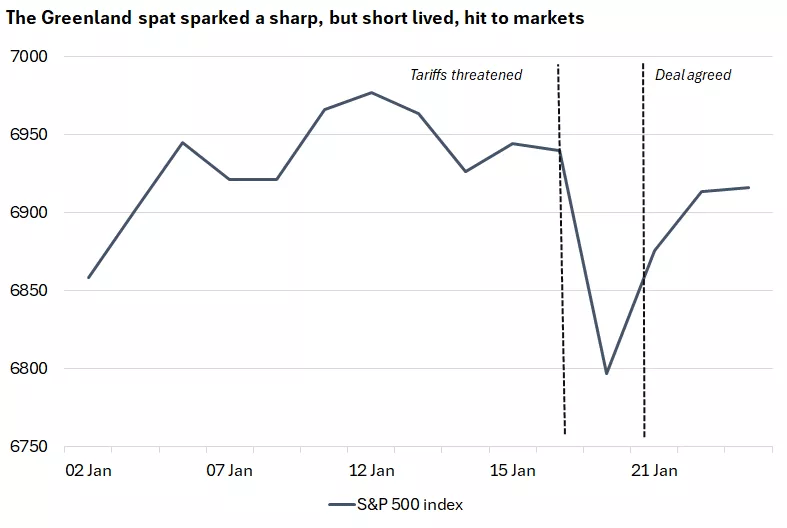

Last week gave us the sharpest single-day S&P drop since the Liberation Day tariffs in April. The trigger: Trump threatened 10% tariffs on eight European trading partners by February 1, escalating to 25% by June, unless a Greenland deal materialized. Then a NATO arrangement emerged, tariffs were shelved, and markets rebounded.

The speed of the reversal is the story. We went from near-crisis to resolution in days. But some things didn't snap back. The dollar finished the week down 1.2% against a trade-weighted basket, its worst week since June, and kept falling even after the deal was announced.

S&P 500 decline after tariff threats and partial rebound after deal

Fund flows into Europe and Japan are significantly outpacing flows into US equities this year. The US has accounted for less than 2% of developed market equity inflows in 2026. International investors aren't panicking, but they're diversifying.

US accounting for less than 2% of developed market equity flows in 2026

Gold hit 15% year-to-date gains on top of 65% last year. When both the dollar and Treasuries sell off during a risk-off event, and gold keeps climbing, that's a signal about where global capital sees safety.

The Fed Holds, Everyone Waits

The Fed meets this week and will almost certainly hold rates steady after three consecutive cuts in late 2025. The economic data gives them cover: unemployment claims continuing at low levels, consumer confidence at a five-month high, consumer spending pointing to another strong gain through the end of 2025.

Decline in US unemployment insurance claims

The central bank hinted at staying on hold in January, so no surprises expected. Most FOMC members projected further cuts in 2026 back in December, with rates still considered modestly restrictive. Expect Powell to emphasize data dependence and reveal nothing.

The direction for rates is lower. Signs of gradual cooling in inflation as tariff pressures fade, plus a sluggish labor market, should keep the Fed in easing mode. One or two 25 basis point cuts are most likely this year.

Earnings Season: The AI Litmus Test

About 80% of early S&P reporters beat profit estimates, similar to last quarter. The release calendar intensifies this week with Meta, Apple, Tesla, and Microsoft all reporting.

Markets have shown signs of rotation. The Magnificent Seven are flat year-to-date while small caps have significantly outperformed. The Russell 2000 is leading large caps by a wide margin.

Russell 2000 outperforming large caps and Magnificent Seven YTD

Tech is still expected to deliver the strongest earnings growth across the S&P this year, but the gap with other sectors is narrowing. The outperformance of smaller companies and pro-cyclical sectors suggests investors are getting more confident about earnings potential outside the mega-caps.

Two things to watch: confirmation that AI spending is generating returns, and signs that improving economic conditions and lower interest rates are lifting profitability across broader segments of the market. If both happen, the broadening thesis holds. If AI disappoints while everything else delivers, the rotation accelerates.

My Take

Markets rebounded from the Greenland scare like nothing happened, but the dollar didn't. International capital is quietly repositioning. Fund flows into Europe and Japan are outpacing US inflows by a wide margin. Gold is up 15% year-to-date on top of 65% last year. When traditional safe havens like Treasuries and the dollar sell off together during a risk-off event, that tells you something about how global investors are thinking about US policy risk.

The fundamentals underneath look solid. Unemployment claims are low, consumer confidence is at a five-month high, spending held up through year-end. The Fed has room to cut but no urgency to move. The data supports staying on hold this week and waiting to see how inflation and labor trends develop.

The interesting story is the rotation. Small caps outperforming the Magnificent Seven is a shift worth watching. For years, mega-cap tech dominated. Now investors are betting on a broadening in earnings growth. If lower rates and improving economic conditions lift profitability outside the usual names, the market leadership could look very different by year-end.

The case for diversification is getting stronger. US equities have dominated for years, but concentration risk is real. International earnings are growing. The dollar looks vulnerable to policy volatility. Maintaining exposure to large caps and AI while adding mid-cap US equities and international positions makes sense in this environment.

Stay sharp out there.

— Hedgie 🦔

Week Ahead

Fed decision Wednesday, hold expected. Mega-cap earnings from Meta, Apple, Tesla, Microsoft.

Weekly Market Stats

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 49,099 | -0.5% | 2.2% |

S&P 500 Index | 6,916 | -0.4% | 1.0% |

NASDAQ | 23,501 | -0.1% | 1.1% |

MSCI EAFE | 2,995.99 | 0.1% | 3.6% |

10-yr Treasury Yield | 4.23% | 0.0% | 0.1% |

Oil ($/bbl) | $61.28 | 3.3% | 6.7% |

Bonds | $100.11 | 0.1% | 0.2% |

Source: FactSet, Morningstar Direct, Bloomberg. Bonds represented by the iShares Core U.S. Aggregate Bond ETF.

Disclaimer: I'm a hedgehog on the internet, not a financial advisor. Nothing in this newsletter is financial advice. I share what I'm seeing and thinking, but you should always do your own research and consult with a qualified professional before making any investment decisions.