Global HR shouldn't require five tools per country

Your company going global shouldn’t mean endless headaches. Deel’s free guide shows you how to unify payroll, onboarding, and compliance across every country you operate in. No more juggling separate systems for the US, Europe, and APAC. No more Slack messages filling gaps. Just one consolidated approach that scales.

🦔 Hi everyone, Hedgie here! The S&P 500 closed at 6,940, down 0.4% for the week but still up 1.4% year-to-date. The Dow finished at 49,359, down 0.3% for the week, and the NASDAQ slipped 0.7% to close at 23,515. A quiet pullback after last week's record highs, but the bigger story is what's happening beneath the surface.

Headlines vs. Fundamentals

The news tape has been relentless. In the past two weeks: the U.S. captured Venezuela's leader Nicolás Maduro, protests erupted in Iran with new sanctions and military threats, the White House floated taking over Greenland, the DOJ launched a criminal investigation into Fed Chair Powell, a proposal to ban institutional investors from buying single-family homes, Fannie Mae and Freddie Mac instructed to buy $200 billion in mortgage bonds, and a proposed one-year 10% credit card rate cap.

That's a lot. And yet markets have barely flinched.

If you only watched the headlines, you'd expect chaos. If you watched the charts, you'd think nothing happened. The fundamentals are doing what fundamentals do: anchoring markets while the headlines scream.

Four Pillars Holding Things Up

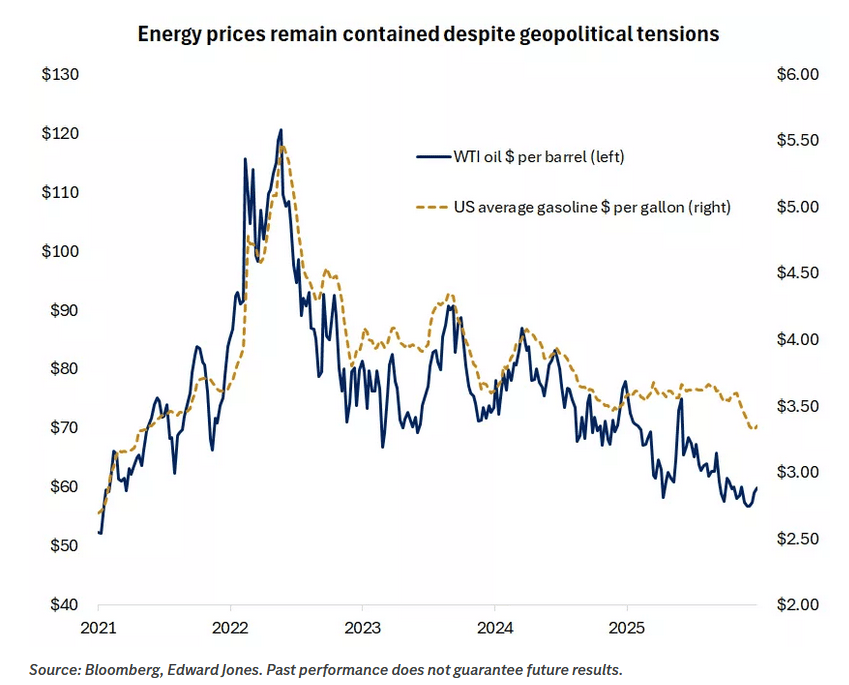

1. Energy prices are low

WTI crude is around $59/barrel. Gas is at $3.35/gallon. That's a meaningful tailwind for consumers and takes pressure off inflation. The International Energy Agency projects global oil markets will be oversupplied in 2026, which creates a buffer against geopolitical shocks. Even if tensions with Iran escalate, there's enough supply slack to absorb a spike.

Oil and gas prices near five-year lows

2. Inflation is moderating

December CPI came in at 2.7% headline, 2.6% core. Not enough for a January rate cut, but it keeps the door open for spring. The Fed investigation into Powell is noise until it isn't. His term expires in May, and whoever replaces him still only gets one vote on a 12-member committee. The institution has structural safeguards that make dramatic policy shifts difficult.

CPI headline and core holding steady

3. Growth is still solid

GDP grew 3.8% in Q2 and 4.3% in Q3 last year. Q4 estimates point to another 2%+ expansion. Jobless claims are historically low. The unemployment rate actually dropped in December. And there's a $100-150 billion tax refund boost coming this quarter from last year's retroactive tax cuts that weren't reflected in 2025 withholding. That's real money hitting consumer wallets soon.

GDP growth expected to remain around 2%

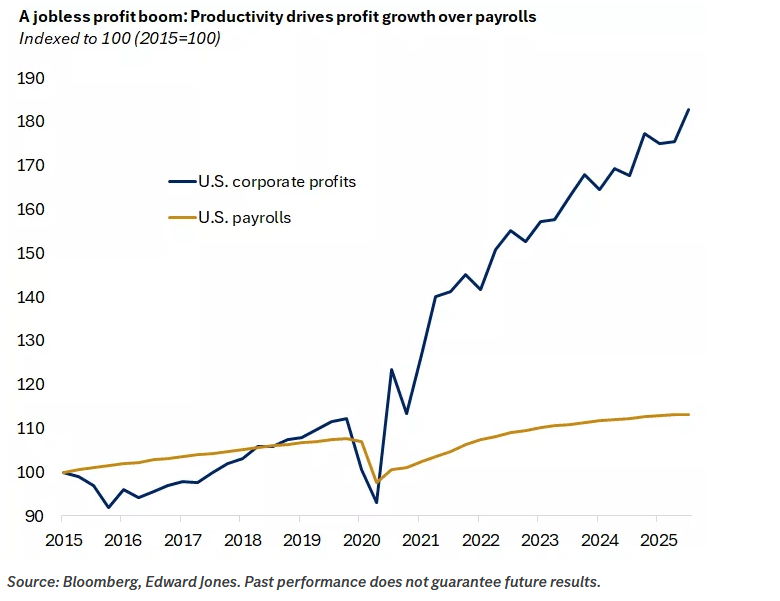

4. Corporate profits keep growing

The S&P 500 is on track for its 10th consecutive quarter of year-over-year profit growth. Q4 estimates call for 8% earnings growth. 2026 consensus estimates have been revised higher, pointing to nearly 15% EPS growth with all 11 sectors expected to contribute.

Here's the part worth paying attention to: profits have accelerated without a meaningful increase in headcount. The data shows a "jobless profit boom." Companies are doing more with less. Shareholders benefit. Workers, not so much.

Corporate profits vs. payrolls divergence

The Rotation Is Real

Market leadership is shifting. Small and mid-caps are outperforming. Value stocks are beating growth. International equities are outpacing U.S. mega-caps. Cyclical sectors like materials, industrials, and consumer discretionary are leading.

This is a change from the past three years of narrow, mega-cap-led gains. The common thread is that these areas benefit from an improving economic outlook and the prospect of Fed easing. If the rotation persists, it suggests the bull market is broadening rather than exhausting itself at the top.

AI Productivity Paradox

Two stories crossed my desk this week that capture the contradiction at the heart of the AI boom.

A Stanford working paper claimed AI "substantially reduces wage inequality while raising average wages by 21%." The researchers modeled a "simplification" channel where AI lowers barriers to complex work, letting lower-skilled workers compete for jobs that previously required higher skills. In their model, most workers benefit.

Meanwhile, a Forrester analyst said the productivity gains simply aren't showing up in the macro data. Bureau of Labor Statistics numbers tell the story: productivity grew 2.7% annually from 1947-1973 before PCs, dropped to 2.1% from 1990-2001 after PCs went mainstream, and fell further to 1.5% from 2007-2019. An MIT study found 95% of companies that integrated AI saw zero meaningful revenue growth.

Here's what I keep coming back to: even when productivity gains do show up, they stopped flowing to workers decades ago. Since the late 1970s, productivity growth has diverged from worker compensation. The gains go to capital owners and high-skill labor. That gap existed before AI and AI is accelerating it.

JPMorgan says AI doubled productivity gains in certain operations from 3% to 6%. Other banks say AI lets them accomplish more with the same headcount. Notice the framing. Same headcount. Not higher wages, not more hiring. Companies are using AI to do more with fewer workers, not to share the gains.

Memory Chip Shortage Spreading

Data centers will consume 70% of all memory chips produced in 2026. The AI demand is so intense that manufacturers have downsized or discontinued production of legacy chips entirely. The shortage is spreading beyond computing into cars, TVs, consumer electronics, and smart appliances.

Samsung has raised memory prices up to 60% since September. IDC forecasts a 5% drop in smartphone sales and 9% drop in PC sales this year due to skyrocketing RAM prices. A TrendForce analyst who has tracked memory for 20 years says "this time really is different."

This is where the AI infrastructure buildout hits the real economy. Companies are pouring hundreds of billions into data centers to chase productivity gains that may or may not materialize, and in the process they're vacuuming up components that everything else needs. IDC calls it a "permanent reallocation" of capacity toward AI. If they're right, this isn't a shortage that resolves. It's a structural shift where AI infrastructure gets fed first and everyone else gets what's left.

What I'm Watching

The credit card rate cap proposal. A 10% cap versus current average rates of 20-25% would be a material hit to card lenders and could lead to a pullback in credit availability. It requires an act of Congress where appetite appears limited, so it's probably dead on arrival. But the fact that it's being proposed tells you something about the political pressure building around consumer debt.

The Supreme Court tariff ruling. Expected this month on the legality of tariffs imposed under the International Emergency Economic Powers Act. If struck down, refunds get issued and that's a short-term boost. But the administration will likely use alternative authorities to levy similar tariffs, so don't expect material policy change.

The Fed transition. Powell's term expires in May. Kevin Warsh and Kevin Hassett are viewed as frontrunners. The criminal investigation is theater unless it becomes something more.

The national debt. BlackRock CEO Larry Fink warned this week that markets are focused on the wrong thing. Everyone's watching the Fed. Almost nobody's talking about the $38.4 trillion national debt. Interest payments hit $355 billion last quarter, up 15% from a year ago. Nearly $1 trillion was added to the debt in just four months. The bond market is calm right now, but gold at record highs and the yield curve steepening aren't signs of a system that feels secure.

My Take

The fundamentals are holding. Low energy prices, moderating inflation, solid growth, broadening earnings. As long as those stay intact, the bull market probably continues.

But underneath the surface, the pattern I've been tracking all year remains. Profits are booming while hiring stays flat. Companies are using productivity gains to expand margins, not payrolls. Workers got their smallest share of GDP since 1947 last quarter. The top 10% now account for 49% of consumer spending, the highest on record.

Markets can stay calm while that happens. The economy can grow while that happens. But at some point the consumer who isn't getting hired or getting raises stops being able to spend. The pillars are holding for now. Just don't mistake market calm for economic health. They're not the same thing.

Stay sharp out there.

Hedgie

Week Ahead: PCE inflation and S&P Global PMI data.

Weekly Market Stats:

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 49,359 | -0.3% | 2.7% |

S&P 500 Index | 6,940 | -0.4% | 1.4% |

NASDAQ | 23,515 | -0.7% | 1.2% |

MSCI EAFE | 2,992.06 | 1.4% | 2.8% |

10-yr Treasury Yield | 4.23% | 0.1% | 0.1% |

Oil ($/bbl) | $59.32 | 0.3% | 3.3% |

Bonds | $100.05 | -0.1% | 0.2% |

Disclaimer: I'm a hedgehog on the internet, not a financial advisor. Nothing in this newsletter is financial advice. I share what I'm seeing and thinking, but you should always do your own research and consult with a qualified professional before making any investment decisions.