Hiring in 8 countries shouldn't require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

🦔 Hi everyone, Hedgie here! The S&P 500 closed at 6,966, up 1.6% for the week and 1.8% year-to-date. The Dow hit 49,504, up 2.3% for the week, and the NASDAQ gained 1.9% to close at 23,671. Both the S&P and Dow surpassed record highs from two weeks ago, while the NASDAQ sits within 1.2% of its historic peak from November. Markets had a fast start to 2026, but beneath the surface the economic data tells a different story.

The Jobs Picture Keeps Deteriorating

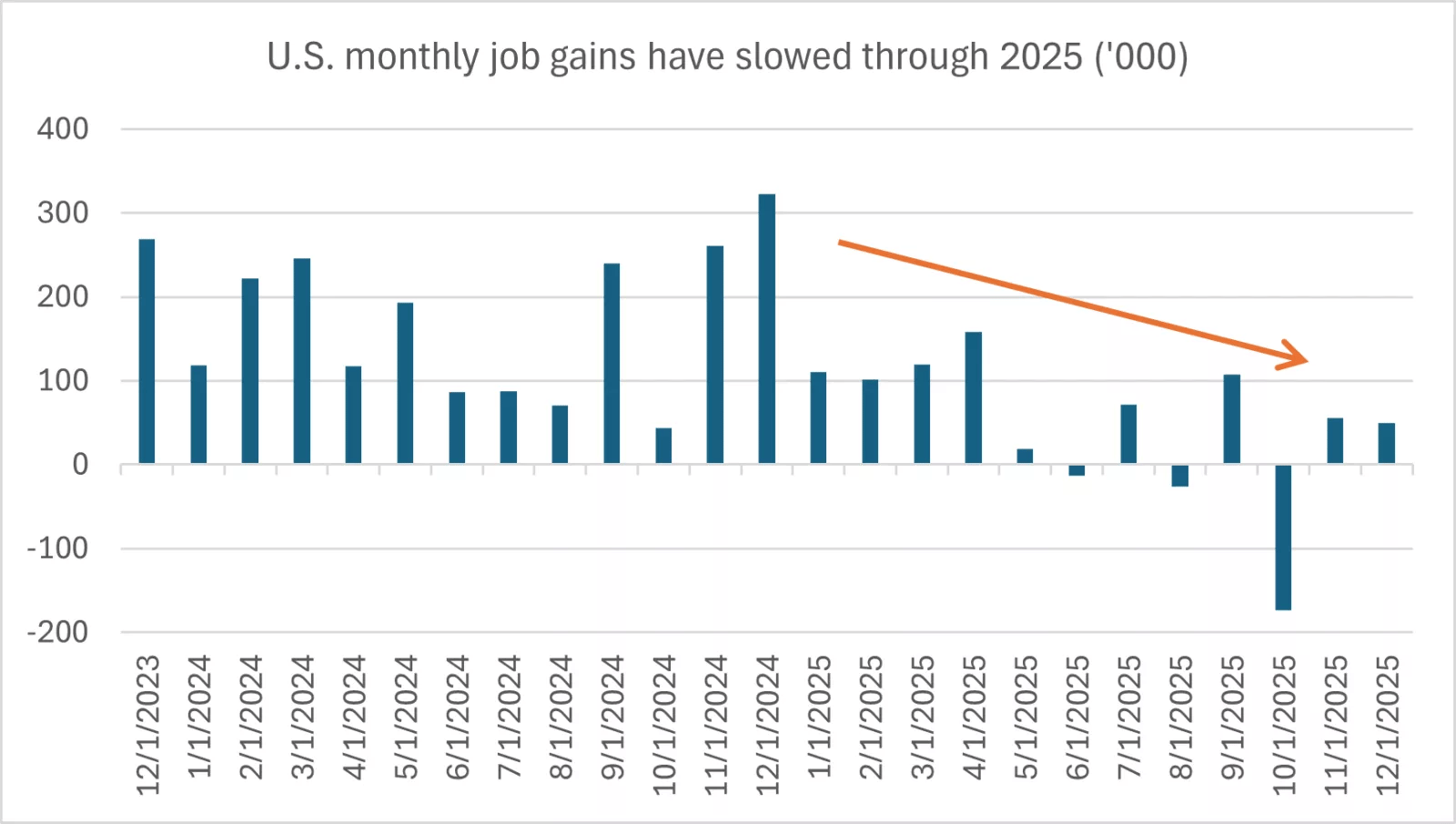

Friday's jobs report confirmed what I've been watching for months: the labor market is slowing faster than most people realize. The economy added just 50,000 jobs in December, below the 70,000 forecast. But the revisions are where it gets ugly. October was revised down from -105,000 to -173,000, and November dropped from +64,000 to +56,000. That's 76,000 fewer jobs than previously reported across those two months.

For all of 2025, monthly job gains averaged just 49,000. Compare that to 2024's average of 168,000. That's a 71% drop in job creation year over year. The three-month average is now negative 22,333 jobs per month.

The unemployment rate ticked down to 4.4%, which sounds like good news until you look deeper. People working part-time who want full-time work is up 980,000 over the year. People who want jobs but stopped looking is up 684,000. Long-term unemployed is up 397,000. These folks don't show up in the headline number, but they're feeling this economy.

The shadow unemployment is where the real pain is hiding. The NY Fed's December consumer survey showed job-finding expectations hit a record low, while fear of losing a job rose to 15.2%. People are scared to quit and scared they might get fired. That combination kills wage growth, which is exactly what we're seeing.

Labor's Shrinking Slice of the Pie

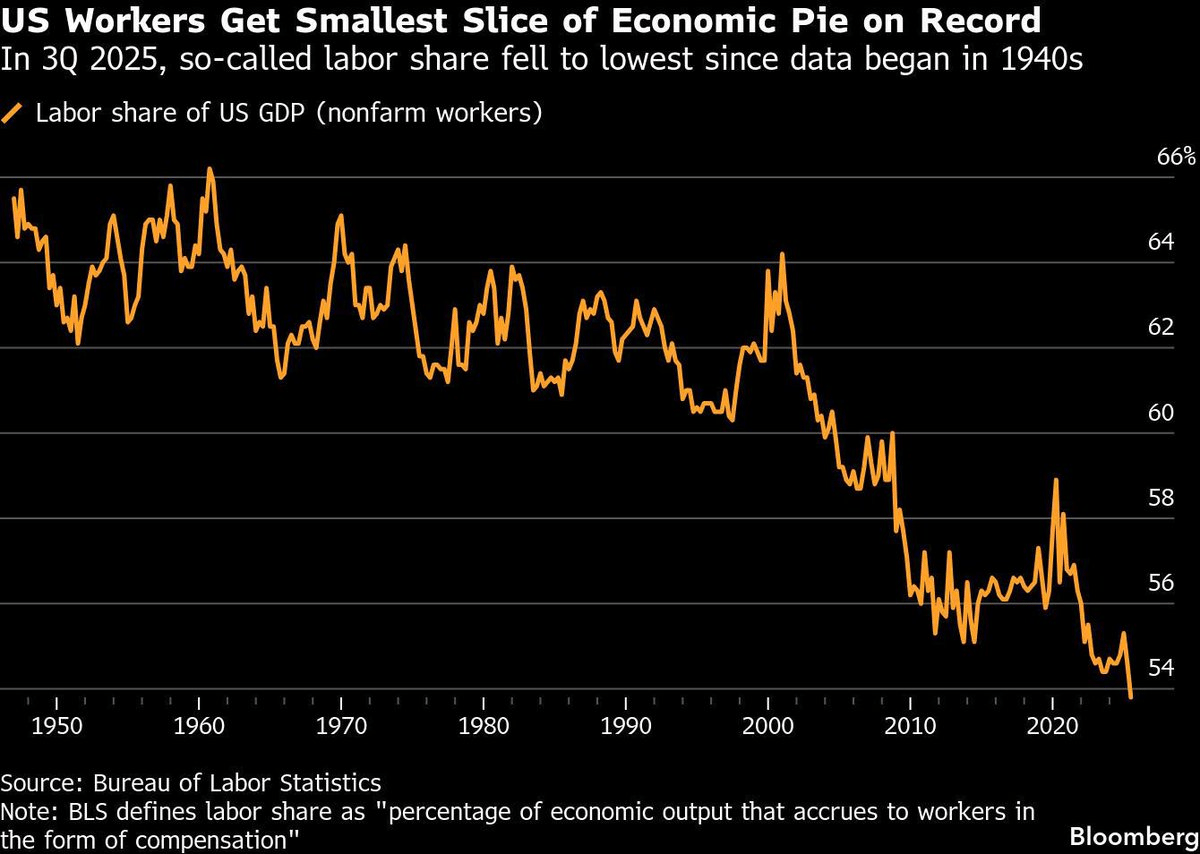

Here's a stat that explains why so many people feel left behind even when GDP looks fine: U.S. workers received just 53.8% of GDP in the third quarter, the lowest share since records began in 1947. That's down from 54.6% the quarter before and well below the 55.6% average for the 2020s.

At the same time, corporate profit margins are hitting some of their strongest levels in decades. The pie is getting bigger, but workers are getting a smaller slice. Productivity jumped at the fastest pace in two years, which sounds great until you realize companies are using those gains to operate with fewer workers rather than pay existing workers more. Richmond Fed President Barkin basically said as much: businesses are relying on productivity gains to run leaner.

This is why headline economic numbers don't capture what regular people are experiencing. The economy can look healthy on paper while the people who power it fall further behind.

Small Caps Surge, Precious Metals Shine

The Russell 2000, a benchmark for U.S. small-cap stocks, outperformed its large-cap peers by a wide margin, adding 4.6% for the week and nearly 14% over the past month and a half. The index eclipsed a record high set four weeks earlier.

Precious metals continued their run. Gold traded above $4,520 per ounce Friday, near the record set two weeks ago. Silver surpassed $80 per ounce for the first time on Tuesday. These rallies picked up momentum throughout 2025, and I've been watching the silver market especially closely. JP Morgan's disclosed 5,900 ton short position and prices up 169% year-over-year tell an interesting story about where smart money thinks we're headed.

Oil Volatility and Venezuela

Oil prices swung wildly this week on geopolitical news. U.S. crude fell to $56 per barrel Wednesday before rebounding to $60 by Friday, a 3%+ weekly gain. The Venezuela situation is driving a lot of the volatility.

The U.S. captured Venezuelan leader Nicolás Maduro and his wife on January 3rd, flew them to New York, and charged them with narco-terrorism. The U.S. has indicated it will run Venezuela until a transition of power occurs and plans to rebuild oil infrastructure with major U.S. energy companies.

Venezuela has about 17% of global oil reserves but only produces about 1% of global output due to failing infrastructure. Rebuilding that capacity could take 10 years and $100 billion. In the near term, oil prices could move higher on supply disruption fears. Longer term, more Venezuelan supply coming online could push prices lower, which isn't great for energy company margins already dealing with oversupply.

Supreme Court Tariff Decision Looms

The Supreme Court is expected to rule soon on whether the president has authority to impose tariffs under the International Emergency Economic Powers Act. If tariffs are struck down, the administration has alternative methods like Section 232 (national security) and Section 301 (unfair trade practices), though these take longer to implement.

There's speculation that companies could receive up to $150 billion in refunds if tariffs are deemed illegal, but there's no clear mechanism to issue them and the process could get tied up in courts. Either way, the administration would likely find ways to reimpose tariffs in the interim.

AI Bubble Watch

The gap between what AI leaders say and what their companies do keeps widening. Mustafa Suleyman, CEO of Microsoft AI and co-founder of DeepMind, warned this week that AI could spiral beyond human control. He said Microsoft is prepared to walk away from any system that threatens to "run away from us" and called for military-level interventions if AI begins self-improving independently.

Meanwhile, Meta signed 20-year deals to buy power from three nuclear plants and committed to help develop small modular reactors that don't exist commercially yet. The SMRs Meta is betting on won't be ready until 2030-2032 at the earliest. These companies are making decade-long infrastructure bets on technology that still needs permits and hasn't been built at scale, all to power AI products that businesses are adopting less than they were six months ago.

Amazon's layoffs expanded quietly from 14,000 announced in October toward 30,000 corporate positions, about 10% of their corporate workforce. The cuts run through May 2026 and hit engineering teams hard, with nearly 40% of cuts in some locations being software engineers. GM announced $7.1 billion in charges related to pulling back from EVs, bringing their total EV writedowns to $7.6 billion. Ford announced $19.5 billion in similar charges last month. That's $27 billion between two automakers admitting their demand projections were wrong.

Consumer Sentiment and Housing

Consumer sentiment ticked up for the second month in a row, with the University of Michigan's preliminary January reading at 54.0, up from December's 52.9. It's the highest level in four months, though still a modest rebound from a string of declines.

The housing market remains firmly in buyer territory. Only seven metro areas in the entire U.S. are still sellers' markets: Nassau County NY, Montgomery County PA, Newark and New Brunswick NJ, San Francisco, Milwaukee, and Cleveland. The rest of the country has 37% more sellers than buyers, the widest gap in a decade.

Mortgage rates dropped to 6.16% but applications still fell 9.7% over the holiday period. The average loan size hit $408,700, the smallest in a year, telling me buyers are going smaller because that's all they can afford.

Dividend Growth Accelerates

Some good news: dividend payments by U.S. companies accelerated in Q4 2025. The $13.1 billion in net dividend increases was well above Q3's $10.6 billion. S&P Dow Jones Indices expects Q1 2026 to be busy for dividend increases due to record-high earnings and sales levels. For income-focused investors, this is worth watching.

My Take

Markets are hitting records while job creation collapsed 71% year over year. Workers are getting their smallest share of GDP since 1947 while corporate margins hit multi-decade highs. Consumer sentiment is barely rebounding from multi-year lows. Housing is buyer-friendly at levels not seen since 2008.

The pieces don't fit together in a way that makes me comfortable. Either the stock market is right and the economy is about to accelerate, or the labor market data is right and we're watching a slowdown that hasn't hit earnings yet. The Fed is expected to cut rates one to two times this year, which tells you they're seeing weakness too.

I keep coming back to the same pattern: companies are spending aggressively on AI infrastructure while cutting workers, chasing productivity gains that boost margins in the short term. That works until demand weakens and there's no one left with income to buy what these companies are selling. The productivity boom during COVID worked the same way: fire people, sell their output, productivity per worker looks great. Until it doesn't.

Insurance companies gaming the rating system, private credit defaults rising, AI infrastructure consuming resources while adoption falls, workers getting squeezed while profits soar. These aren't separate stories. They're connected by leverage and optimism that hasn't been tested by a real downturn yet.

CPI data comes Tuesday. If inflation stays sticky while jobs weaken, the Fed is in a tough spot. If inflation cools, they have room to cut. Either way, the labor market is telling us something the stock market isn't listening to yet.

Stay sharp out there.

Hedgie

Week Ahead: CPI and PPI inflation, retail sales, housing data, and industrial production. Tuesday's inflation report will be the headline event.

Weekly Market Stats:

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 49,504 | 2.3% | 3.0% |

S&P 500 Index | 6,966 | 1.6% | 1.8% |

NASDAQ | 23,671 | 1.9% | 1.8% |

MSCI EAFE | 2,910.01 | 0.5% | 2.0% |

10-yr Treasury Yield | 4.17% | 0.0% | 0.0% |

Oil ($/bbl) | $58.82 | 2.6% | 2.4% |

Bonds | $100.16 | 0.3% | 0.3% |

Disclaimer: I'm a hedgehog on the internet, not a financial advisor. Nothing in this newsletter is financial advice. I share what I'm seeing and thinking, but you should always do your own research and consult with a qualified professional before making any investment decisions.