When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Hey everyone, Hedgie here. Let's get into it!

Consumers Take a Breather

December retail sales disappointed. Headline sales were flat while the control group fell 0.1% month-over-month. Adjusted for inflation, that's a decline of around 0.3-0.4%. Spending had been running above income growth through 2025, meaning consumers were saving less each month to finance purchases. There are limits to how far that can go.

U.S household savings as a share of income fell through 2025

Two forces could help incomes in 2026. Tax cuts passed last year will hit personal finances through refunds and adjusted withholdings, with the Congressional Budget Office estimating a $150 billion boost to households. And the labor market is showing some signs of improvement after a weak 2025.

Signs of Life in the Labor Market

January payrolls came in at 130,000, an upside surprise. Strip out federal employment cuts and private payrolls rose 172,000, averaging 100,000 over the past three months. That's an improvement on 2025, when private payrolls rose just 30,000 per month on average. The unemployment rate fell to 4.3%, down from its recent peak of 4.5%.

Private payroll creation accelerated through the turn of 2026 following a very weak 2025

Better than last year, but I'd note that 100,000 monthly private payroll gains is still historically soft. The hiring freeze may be thawing, but we're not back to a healthy labor market yet.

Inflation Continues Its Slow Grind Lower

Headline CPI came in at 0.2% month-over-month in January, taking the year-over-year change down to 2.4%. Core was firmer at 0.3% monthly and 2.5% annually. Shelter inflation is finally easing as the slowdown in rents and house prices from 2022-2023 works its way into the official data.

Slowdown in market rents and house price growth from 2022-2023 now showing up in CPI shelter prices

Tariffs are adding pressure in the other direction. Core goods prices excluding used cars increased 0.4% monthly, and the dollar's 10% decline over the past year has made imports more expensive. The path to 2% is going to be uneven.

Fed on Hold Until Summer

None of this changes the Fed's near-term stance. Powell has made clear they're on hold, and stronger labor data will cement that position at his final two meetings as chair in March and April. Markets expect his proposed successor Kevin Warsh to deliver a couple of cuts after taking over in June. Maybe one or two cuts happen this year, but the urgency has faded.

Solid Headlines, Wavering Markets

Analysts expect positive earnings growth across all S&P sectors this year. The catalysts for broadening corporate earnings remain in place on paper.

Analysts expect positive earnings growth across all S&P sectors in 2026, compared to patchier 2025

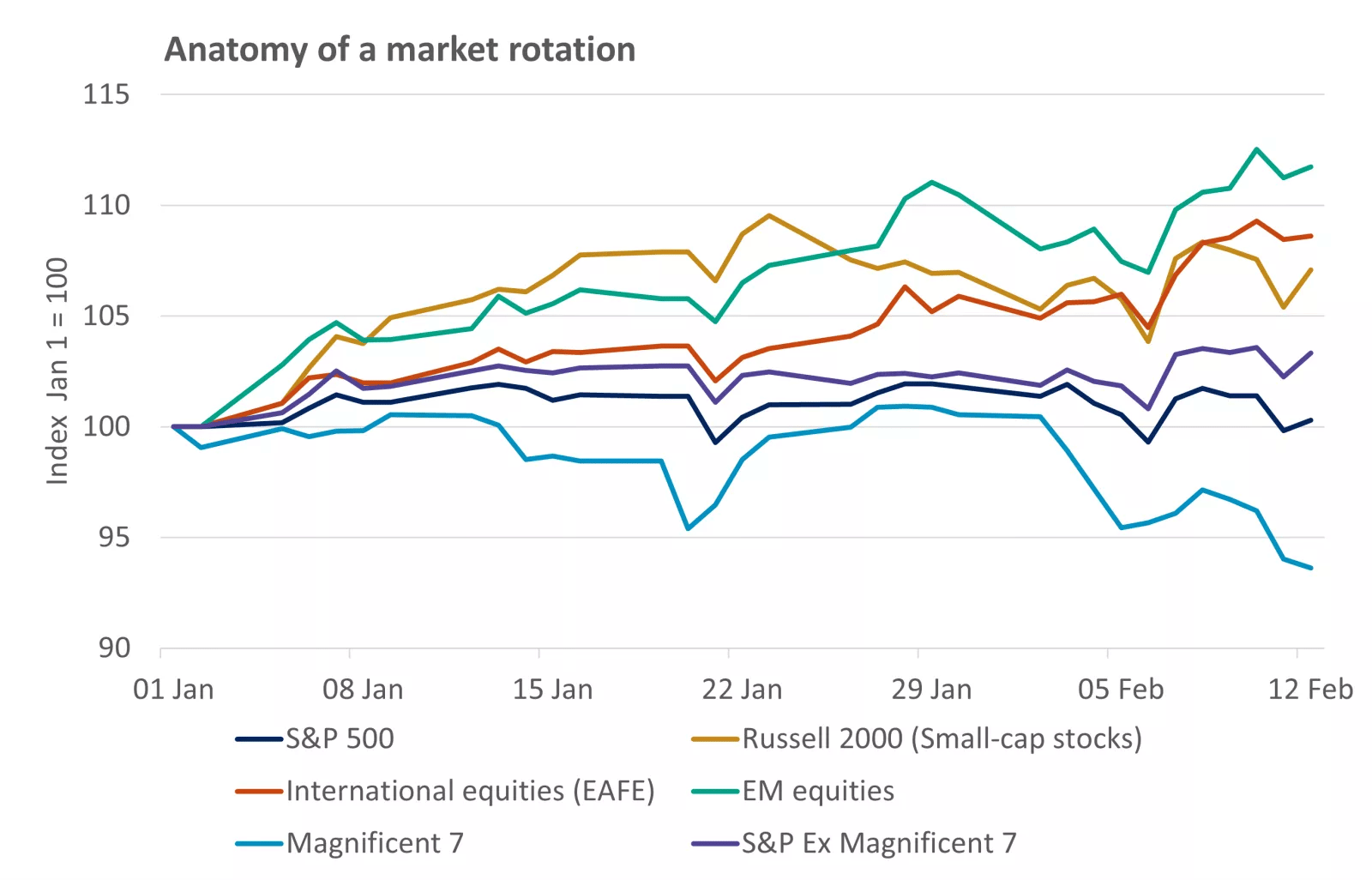

But volatility has picked up. The Magnificent 7 is down nearly 7% in 2026. More notable is the spillover. Investors are starting to price AI disruption fears across financials, insurers, real estate, and logistics. These fears aren't showing up in revenues yet, but they're moving real money.

Last week's selloff hit crypto and precious metals too, while Treasuries and defensive sectors caught a bid. Classic risk-off behavior.

Russell 2000, international developed markets, and emerging markets all outperforming US large caps YTD

My Take

Last week I wrote about stress building in places the headline numbers don't capture. This week the data looks better on the surface, but I'm not changing my view yet.

Yes, the labor market improved. Yes, inflation is cooling. But fund managers are the most optimistic since 2021 while simultaneously raising cash, piling into gold, and rotating out of US tech. A record number think corporate America is overspending on capex. A quarter see an AI bubble as the biggest tail risk. Amazon just lost $450 billion in market value over AI spending concerns. When sentiment and positioning diverge like this, I pay attention to what people are doing, not what they're saying.

The broadening into international and small caps is real. But so is the repricing of the AI trade that drove markets for two years. Investors are pricing disruption fears across sectors that haven't seen revenue impacts yet. That's speculative, but it's also how repricing starts.

Consumer confidence is still near 12-year lows. The gap between macro data and lived experience hasn't closed. And the capex boom is still built on AI demand that hasn't materialized at the scale these investments require.

The rotation might stay orderly. Or it might be the early stages of something messier.

Hedgie 🦔

Week Ahead

Housing data, GDP, and PMI manufacturing and services. We'll see if the broadening continues or the cracks widen.

Weekly Market Stats

Index | Close | Week | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 49,501 | -1.2% | +3.0% |

S&P 500 Index | 6,836 | -1.4% | -0.1% |

NASDAQ | 22,547 | -2.1% | -3.0% |

MSCI EAFE | 3,116.61 | +1.9% | +7.6% |

10-yr Treasury Yield | 4.05% | -0.2% | -0.1% |

Oil ($/bbl) | $62.80 | -1.2% | +9.4% |

Source: FactSet, Morningstar Direct, Bloomberg.

Disclaimer: I'm a hedgehog on the internet, not a financial advisor. Nothing in this newsletter is financial advice. I share what I'm seeing and thinking, but you should always do your own research and consult with a qualified professional before making any investment decisions.