Hi everyone, Hedgie here! The S&P 500 closed at 6,835, up 0.1% for the week and 16.2% year-to-date. The Nasdaq gained 0.5% to 23,308, up 20.7% for the year. Markets held steady as investors digested delayed economic data and prepared for the holidays, but beneath the surface several concerning trends accelerated.

The Ratings Game Returns

Insurance companies are paying small rating agencies to upgrade risky investments to "investment grade" so they can use more leverage. The National Association of Insurance Commissioners found that ratings from private letter agencies averaged 2.74 notches higher than their own Securities Valuation Office. When securities migrated from NAIC ratings to private letter ratings in 2023, 80% received upgrades, just 4% were downgraded.

One small rating agency, Egan-Jones, operates out of a four-bedroom house outside Philadelphia with 20 analysts and rated more than 3,000 private credit deals in 2024. Global Atlantic, owned by KKR, has a quarter of its $100 billion bond portfolio carrying private letter ratings.

Here's why this matters: Insurance companies make loans and invest in debt. Regulators require them to hold cash reserves based on how risky those investments are. The safer the investment, the less cash they need to set aside, which means they can use more leverage and make more money. When the government rater wasn't giving insurers the ratings they wanted, they started paying smaller agencies for second opinions. Eighty percent of the time, they got upgrades.

Life insurers have $1 trillion tied up in private credit, much of it connected to AI infrastructure loans. If those assets are labeled "investment grade" by friendly rating agencies but are actually riskier, the insurers are holding way less capital than they should for the risk they've taken on. When loans start defaulting, losses will exceed what regulators expected because the ratings were inflated. This is the same pattern as 2008 with mortgage-backed securities.

The AI Resource Crunch

OpenAI's Stargate data center project could consume 40% of global DRAM output, with Samsung and SK hynix agreeing to supply 900,000 wafers monthly. Global DRAM capacity is projected at 2.25 million wafer starts per month in 2025. One project taking nearly half of global production explains the memory shortages driving up prices for consoles, PCs, and everything else that uses chips.

Micron reported record revenue of $13.64 billion, up 57% year-over-year, driven by AI data centers. CEO Sanjay Mehrotra said DRAM supply constraints will "persist beyond calendar 2026." Even with manufacturing expansion, Micron anticipates meeting only "half to two-thirds" of demand from key customers.

The impact ripples through the economy. Xbox Series console sales dropped 70% year-over-year in November while prices rose 30%. November was the lowest month for hardware dollar sales and physical software unit sales since 1995. Nvidia is planning to cut GPU production by 30-40% in the first half of 2026. Memory chips go into phones, cars, appliances, medical devices, and TVs. When manufacturers prioritize AI data centers, those costs spread everywhere.

Consumer Confidence Collapses

Gallup's Economic Confidence Index fell to -30 in November, the lowest since July 2024. Just 21% of adults described current economic conditions as excellent or good. Only 33% said it's a good time to find a quality job, the most negative reading since January 2021 during the pandemic.

Americans now estimate they'll spend an average $778 on holiday gifts, down $229 from October's $1,007. This is the largest midseason decline Gallup has recorded, surpassing the $185 drop during the 2008 financial crisis. High-income households ($100K+) predict spending $1,230, down from $1,479 in October. Low-income households (under $50K) cut projected spending to $384 from $651.

Messy Economic Data

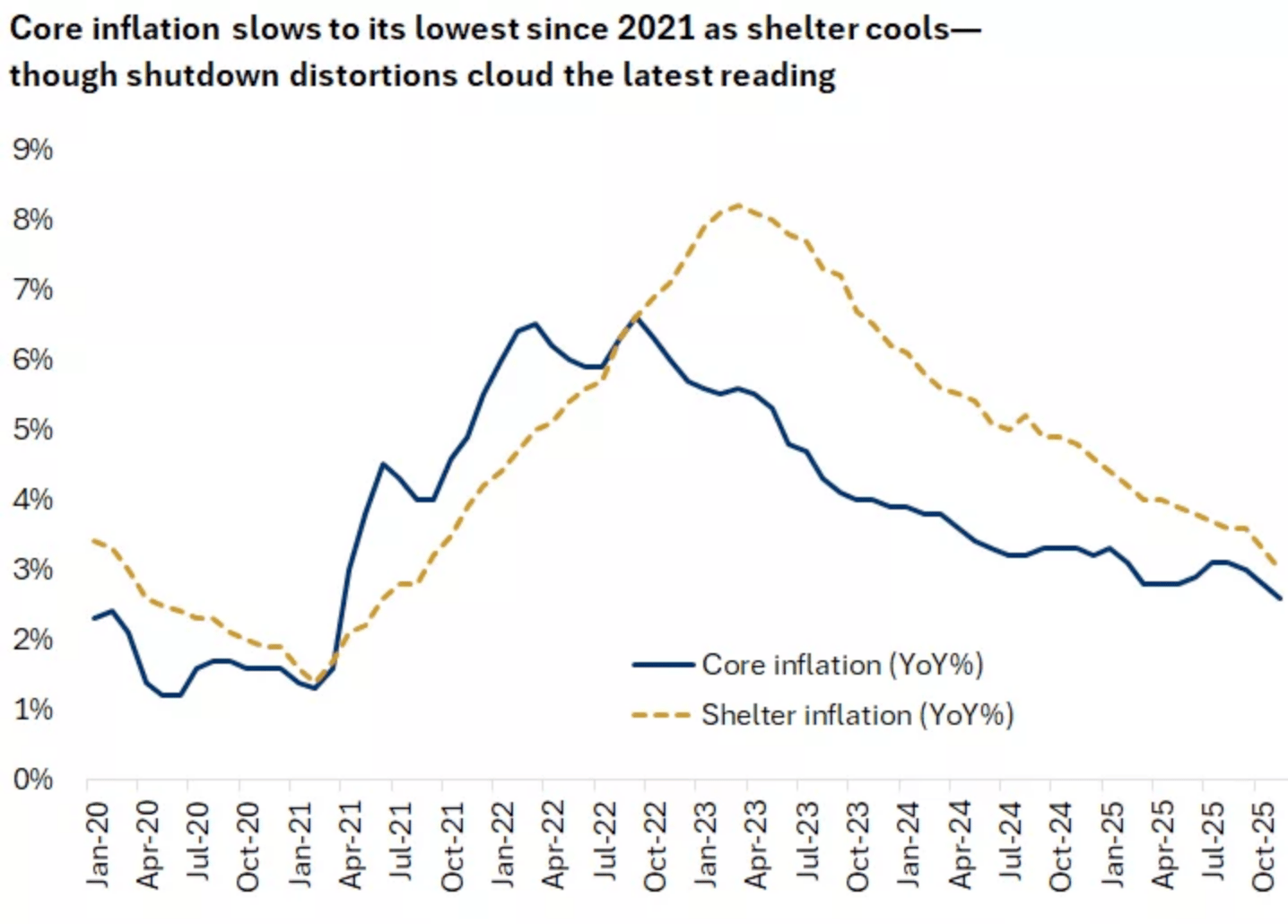

November CPI rose 0.2% monthly and 2.7% year-over-year, cooler than expected. Core CPI was up 0.3% monthly and 2.6% annually. But the October report was canceled due to the 43-day government shutdown, making month-over-month comparisons impossible. Goldman Sachs noted the truncated data collection process "could have caused systematic biases in the data."

U.S. core CPI, which eased to 2.6% from 3% helped by housing disinflation

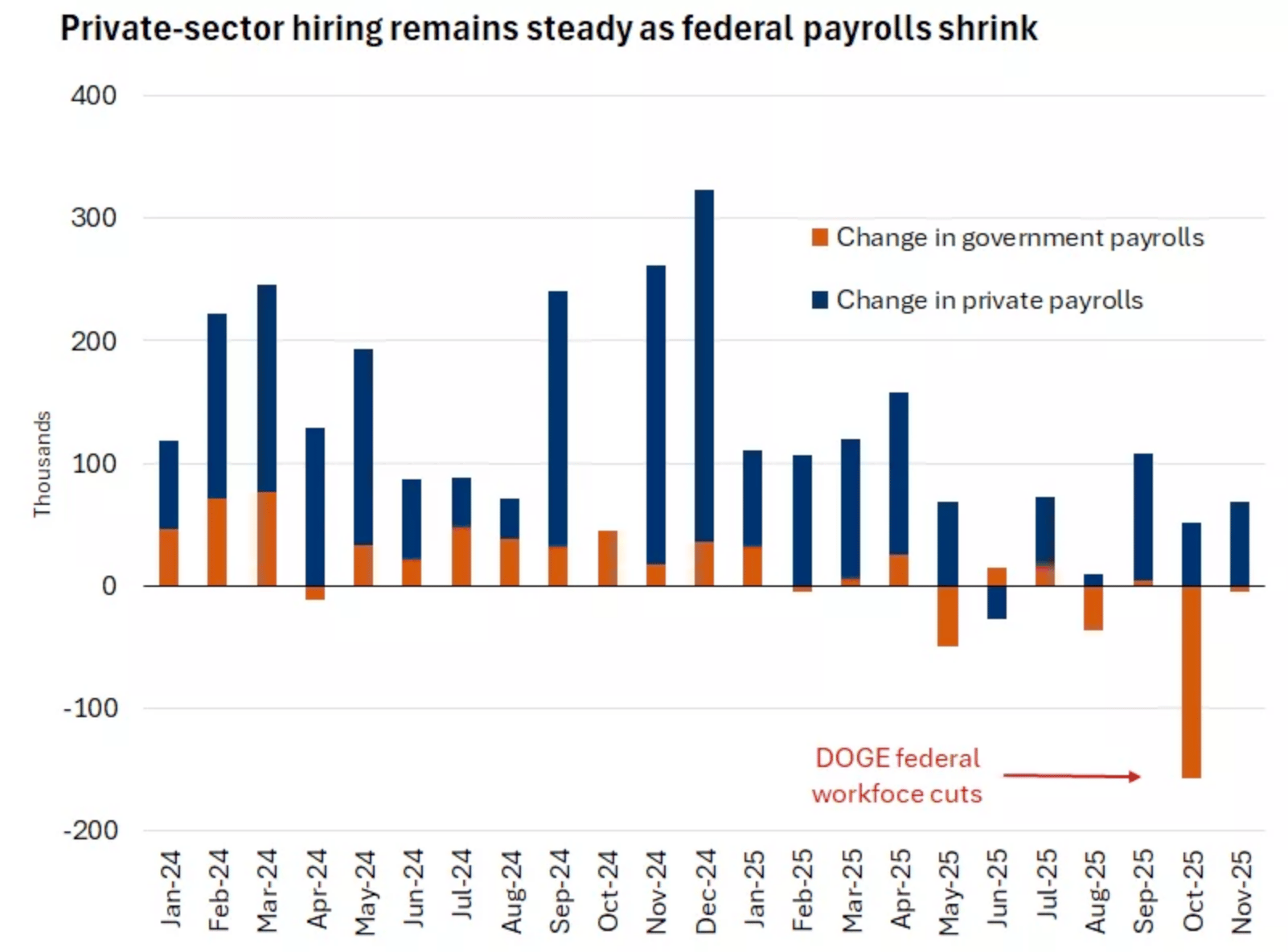

US job growth remained sluggish with 64,000 jobs added in November after declining 105,000 in October. The unemployment rate rose to 4.6%, a four-year high. Fed Chair Powell admitted federal jobs data could be overestimating job creation by up to 60,000 jobs per month, meaning the real number could be negative 20,000 per month.

The breakdown between government and private sector monthly payroll changes. Private sector hiring remains steady as federal payrolls shrink

A Goldman Sachs analysis shows more workers are embracing gig work as the labor market cools. Workers in the gig economy earn 50-65% per hour compared to traditional jobs. Federal Reserve data shows 20% of people who took a pay cut, lost their job, or had hours reduced in the prior two years took up gig work. Goldman warns the gig economy can't support all who lose jobs during a downturn because demand for gig workers falls as the economy weakens.

The Debt Spiral

The US will pay over $1 trillion in interest on the national debt for the first time in FY 2025, with projections showing $1.8 trillion by 2035 and potentially $2.2 trillion if Trump's policies are made permanent. Just five years ago in FY 2020, net interest costs were $345 billion. They've tripled. The $38 trillion national debt now equals 100% of GDP and grew from $37 trillion to $38 trillion in just two months.

Oracle's Funding Problems

Oracle's $10 billion Michigan data center is in limbo after funding talks with Blue Owl Capital stalled. Blue Owl has been the primary backer for Oracle's largest data center projects but is concerned about tougher debt terms and delays. Oracle had $105 billion in net debt at the end of November, up from $78 billion a year ago. Morgan Stanley forecasts this will soar to $290 billion by 2028. Oracle's total lease commitments jumped from $100 billion to $248 billion in three months.

Microsoft's Internal Pressure

Microsoft CEO Satya Nadella is pushing sweeping organizational changes, having conversations with executives to sign on for the AI transformation or leave. "Satya is pushing on intensity and urgency," one executive said, adding "You've gotta be asking yourself how much longer you want to do this." Nadella started weekly AI accelerator meetings where lower-level employees speak instead of executives, suggesting he doesn't trust his leadership to give him the real picture. Microsoft cut Copilot sales targets by 50% because customers aren't buying.

AI Reality Check

Only 15% of executives saw profit margins improve due to AI over the last year according to Forrester. BCG found just 5% of executives saw widespread value from AI. Forrester predicts companies will delay about 25% of their planned AI spending in 2026. A railroad company spent $300,000 developing AI products that couldn't consistently summarize a 100-page safety document without inventing rules. A wine app spent six weeks teaching its chatbot to stop being so agreeable and give honest recommendations.

My Take

The pieces keep fitting together in ways that worry me. Insurance companies are inflating ratings on risky assets to use more leverage, just like 2008. AI infrastructure is consuming 40% of global memory production while OpenAI loses $12 billion per quarter. Consumer confidence hit its lowest point in over a year while holiday spending plans dropped by more than during the financial crisis. Job growth is barely positive and might actually be negative when you account for data issues.

When I see insurance companies shopping for better ratings from agencies operating out of houses, that tells me the pressure to make the numbers work is overwhelming prudent risk management. Life insurers have $1 trillion in private credit, much of it tied to AI loans. If those ratings are inflated and the assets are riskier than advertised, the capital buffers won't be enough when defaults hit. Your annuity is only as good as the insurance company's ability to pay it. If they're undercapitalized because they gamed the rating system, those "guaranteed" payments aren't actually guaranteed.

OpenAI planning to take 40% of global DRAM production for Stargate tells you where resources are being allocated. That's why console sales hit 1995 levels, why RAM is expected to stay expensive through 2028, why everything with chips in it costs more. Memory manufacturers are choosing OpenAI over everyone else because OpenAI is paying more. The rest of the economy gets squeezed. When people are choosing between groceries and a $400 Xbox, the Xbox loses. When they're cutting holiday spending by record amounts, that shows up in retail sales and corporate earnings.

The job market data is messy but the direction is clear. Powell admitting official numbers might overstate employment by 60,000 per month means we could already be losing jobs. One in three job postings never turns into a hire. People are turning to gig work that pays 50-65% of what traditional jobs paid, and that only works until the economy weakens and demand for those services collapses too.

Interest payments on the national debt tripling in five years from $345 billion to over $1 trillion is not sustainable. When the government competes for capital by borrowing trillions, it pushes up rates for everyone else. That's part of why mortgage rates stay high and consumer debt becomes harder to service. The debt growing $1 trillion in two months shows how fast this is accelerating.

Microsoft cutting sales targets by 50% and Nadella telling executives to commit or leave signals they know they're behind. They invested $13 billion in OpenAI and ended up in third place while losing ground to competitors. Oracle's primary financing partner walking away from a $10 billion deal because they're worried about debt terms and delays shows the cracks spreading. When lenders start refusing to fund AI infrastructure, the buildout slows whether companies want it to or not.

I don't know exactly when or how this resolves. What I do know is leverage is building, consumer finances are breaking, AI spending is disconnected from revenue, and the same patterns from 2008 are showing up in private credit and insurance. Preparation isn't about timing the top perfectly, it's about being positioned so that if things break, you weather it instead of getting crushed. The data keeps pointing the same direction, and that direction concerns me heading into 2026.

Thanks for reading. Wishing everyone a safe and happy holiday!

Hedgie

Week Ahead: Consumer confidence, third-quarter GDP, and final trading days of 2025. Markets typically thin out during holiday week with lower volume and less volatility.

Weekly Market Stats:

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 48,135 | -0.7% | 13.1% |

S&P 500 Index | 6,835 | 0.1% | 16.2% |

NASDAQ | 23,308 | 0.5% | 20.7% |

MSCI EAFE * | 2,861.13 | 0.2% | 26.5% |

10-yr Treasury Yield | 4.15% | 0.0% | -0.4% |

Oil ($/bbl) | $56.59 | -1.5% | -21.1% |

Bonds | $99.84 | 0.0% | 7.2% |