This newsletter you couldn’t wait to open? It runs on beehiiv — the absolute best platform for email newsletters.

Our editor makes your content look like Picasso in the inbox. Your website? Beautiful and ready to capture subscribers on day one.

And when it’s time to monetize, you don’t need to duct-tape a dozen tools together. Paid subscriptions, referrals, and a (super easy-to-use) global ad network — it’s all built in.

beehiiv isn’t just the best choice. It’s the only choice that makes sense.

🦔 Hi everyone, Hedgie here! The S&P 500 closed at 6,827, down 0.6% for the week but still up 16.1% year-to-date. The Nasdaq fell 1.6% as tech took a breather. This week brought the Fed's final meeting of 2025, more evidence of AI infrastructure cracks, and continued signs of consumer stress.

The Fed's Final Move

The Fed cut rates by a quarter-point to 3.5%-3.75% in a 9-3 vote Wednesday, marking the most dissents at a Fed meeting in years. Fed Governor Stephen Miran wanted a larger half-point cut, while Kansas City Fed President Jeff Schmid and Chicago Fed President Austan Goolsbee wanted no cut at all. That split shows deep disagreement about the path forward. The Fed's dot plot shows just two quarter-point cuts expected for 2026 and 2027, fewer than markets had priced in. The statement change about "extent and timing of additional adjustments" is Fed-speak for we're probably done cutting for now.

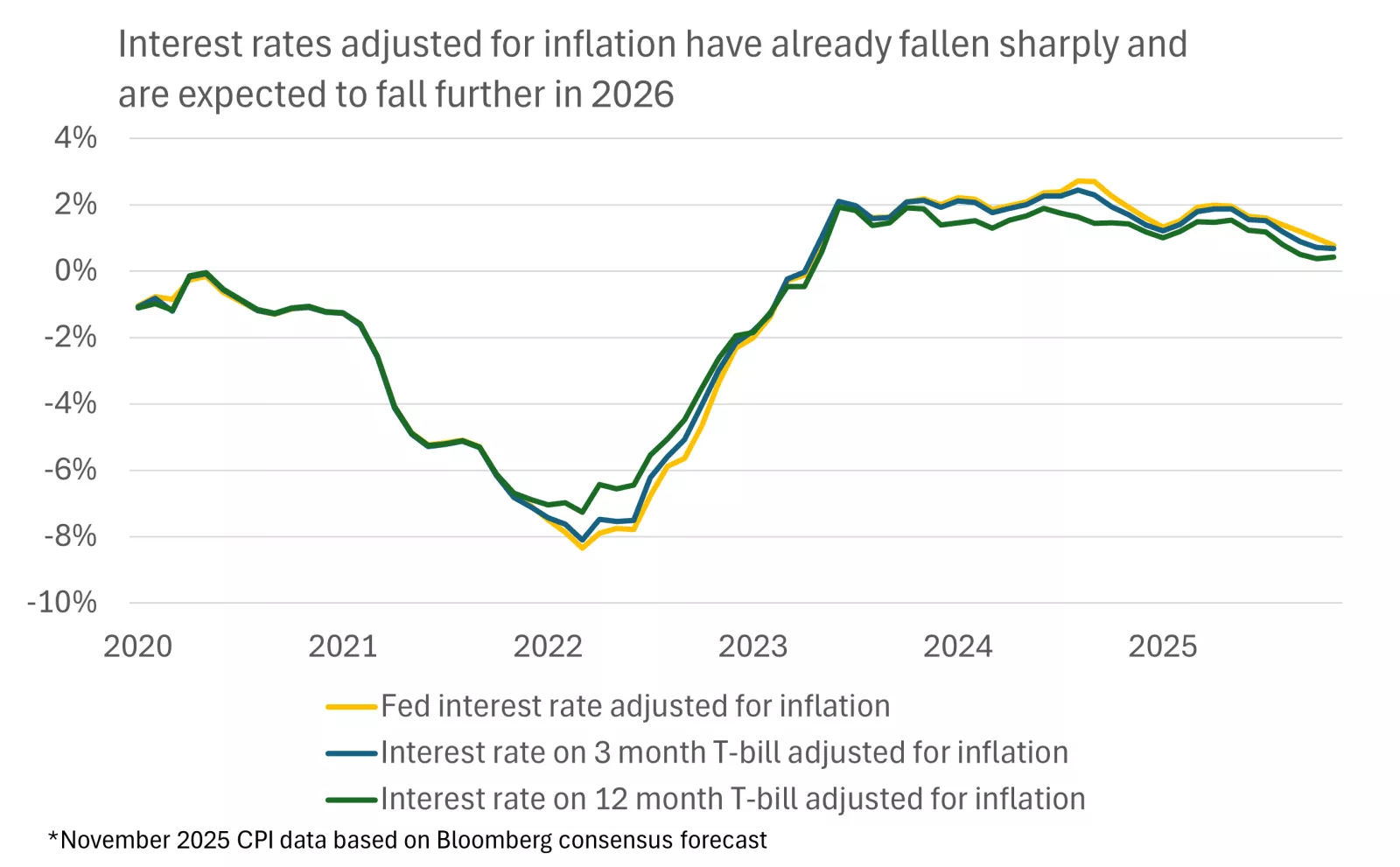

This chart shows the inflation-adjusted fed funds rate and 3-month and 12-month T-bill yields

Goolsbee dissenting for the first time since joining in 2023 matters. He was dovish all last year calling for cuts, but inflation staying sticky changed his mind. When someone flips from dovish to hawkish, they're seeing something in the data that worries them. The Fed upgraded their growth forecast for 2026 from 1.8% to 2.3%, which is optimistic given everything else happening. They're banking on growth staying strong enough to handle fewer rate cuts. The problem is Treasury yields kept rising despite Fed cuts, which means the bond market doesn't agree with the Fed's assessment.

The Jobs Reality

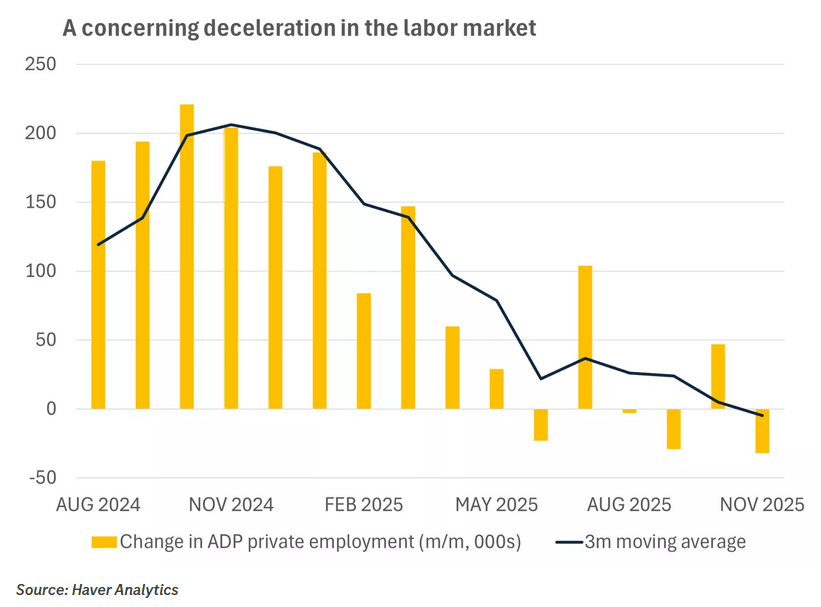

Fed Chair Powell admitted federal jobs data could be overestimating job creation by up to 60,000 jobs per month. Official figures show 40,000 jobs added monthly since April, but the real number could be negative 20,000 per month. The problem involves the birth-death model, which estimates jobs when businesses open or close and has overstated job creation by hundreds of thousands annually. Powell said "the labor market is under pressure, where job creation may actually be negative."

Small businesses cut 120,000 jobs in November. October layoffs hit 153,074, highest for that month in 22 years. Seasonal retail hiring came in at 15-year lows. Those numbers don't match official data showing modest gains. If official data says we added 40,000 jobs per month but the real number is negative 20,000, we're not in a slowly cooling labor market. We're already shedding jobs. Next week we get October and November data plus revisions. If those confirm Powell's concerns, the soft landing narrative falls apart.

In June 2025, employers reported 7.4 million job openings but made only 5.2 million hires, leaving 2.2 million jobs that never materialized. Nearly 1 in 3 job postings went nowhere. The worst-hit sectors include government (60% ghost job rate), education and health (50%), information (48%), and financial activities (44%). From 2010-2019, openings and hires moved together with gaps rarely exceeding 10%. In 2021-2022, openings spiked to 11 million but hires remained at 6-7 million. The relationship broke and hasn't recovered.

AI Infrastructure Cracks

AI infrastructure stocks sold off sharply after Oracle delayed OpenAI data center completion to 2028 from 2027 due to labor and material shortages. The Philadelphia Semiconductor Index fell as much as 5%. Broadcom dropped 12%, Nvidia fell 3.2%, and CoreWeave dropped 11%. Oracle's debt protection costs hit 126 basis points, the most expensive on record. Daily CDS trading on Oracle jumped 650% year over year to $75 million. By comparison, Nvidia CDS trade around 37 bps and Meta around 50 bps.

This chart shows the percentage change in major U.S. equity indexes over the past five days and month, with the small-cap Russell 2000 index outperforming

Microsoft cut sales targets for its agentic AI software by up to 50% after struggling to find buyers. Tests found AI agents failed to complete tasks up to 70% of the time. ChatGPT commands 61% of the market, Google's Gemini sits at 13% with 12% growth last quarter, and Microsoft's Copilot holds 14%. McKinsey is planning to cut 10% of headcount across non-client-facing departments, a few thousand jobs over 18-24 months. The firm's revenue has been flat for five years at $15-16 billion. McKinsey cut 200 tech jobs last month as it uses AI to automate positions.

Forrester predicts an AI market correction in 2026. An MIT report found 95% of organizations experience zero return on AI investments. OpenAI is losing $12 billion per quarter with $44 billion more in losses expected through 2029, spending $2.25 to make $1. The US faces a projected 35 GW electricity shortfall by 2028, with data centers needing 57 GW but only 21 GW available. Consumer confidence hit its lowest point since 1997. One study found 56% of companies miss AI cost projections by 11-25%, and one in four miss by more than 50%.

Consumer Finances Breaking

Foreclosures are skyrocketing with 35,651 properties receiving a filing in November, up 21% from a year earlier. This marks the ninth straight month of year-over-year increases. Properties officially repossessed by lenders grew 26% compared to a year ago. The states hit worst were Delaware (one in every 1,924 housing units), South Carolina (one in every 1,973), Nevada (one in every 2,373), New Jersey (one in every 2,511), and Florida (one in every 2,565). Philadelphia recorded the worst foreclosure rate at one filing for every 1,511 housing units.

This chart shows the monthly change in ADP private employment and 3-month moving average

More than 9 million US student loan holders have missed at least one payment this year. New York Fed data shows 9.6% of the $1.65 trillion in US student debt is more than 90 days past due, up from 0.5% a year ago. Delinquencies have driven steep declines in credit scores, with an average drop of 100 points. Borrowers formerly considered prime or super prime saw scores dip by an average of 177 points. Half say they can't afford the $200 median monthly payment.

Samsung is reportedly halting SATA SSD production in 2026, with an announcement expected in January. Samsung SSDs make up around 20% of Amazon's top-selling SSDs. Removing itself from the market would reduce overall SSD availability and put pressure on pricing for both SATA and NVMe drives. This comes on top of RAM shortages expected to last until 2028, with 64GB DDR5 hitting $500 and 256GB DDR4 reaching $3,000.

Market Concentration

UBS surveyed its billionaire clients on where they plan to invest. Western Europe jumped from 18% interest in 2024 to 40% in 2025. China rose from 11% to 34%. North America dropped from 80% to 63%. Tariffs are the top concern at 66%, followed by geopolitical conflict at 63%, policy uncertainty at 59%, and higher inflation at 44%. Private equity was the most popular choice at 49%, followed by hedge funds and public developed market equities at 43%.

Small-cap equities outperformed last week as investors rotated into lower-valuation stocks. The Russell 2000 gained while tech took a breather. This rotation accelerated after Oracle and Broadcom earnings raised concerns over AI investment and short-term revenues.

My Take

I've been watching these pieces come together for months, and this week they all started connecting in ways that worry me. Let me walk you through what I'm seeing and why I think 2026 could be very different from 2025.

The stock market is up 16% this year, which looks great on paper. But when you dig into it, almost all those gains came from a handful of tech companies betting huge on AI. The problem is that bet isn't paying off the way everyone hoped. Oracle just delayed their data center projects by a year because they can't get the workers or materials to build them fast enough. Microsoft cut their AI sales targets in half because nobody's buying what they're selling. When I see that happening alongside Powell admitting our job numbers might be completely wrong, I start thinking about how everything is connected.

Here's what keeps me up at night. The dot-com bubble in 2000 was funded with equity. When it popped, investors lost money, but regular people's jobs and homes were mostly fine. This time, companies are borrowing hundreds of billions of dollars to build AI infrastructure. Private equity firms have loaned out $450 billion with another $800 billion coming. Life insurance companies have $1 trillion tied up in this. Your insurance premiums are partially funding AI data centers that might never make money. If those companies can't pay back their loans, it doesn't just hurt tech investors. It goes through the whole financial system because all these institutions are connected.

And here's the thing that really worries me: the consumer side is already breaking before any of this AI stuff blows up. Foreclosures are up 21% from last year. Nine straight months of increases. People are losing their homes right now. Car repos hit 3 million this year, matching Great Recession levels. Nine million people are behind on student loans. When someone with a 720+ credit score drops 177 points because they can't make their student loan payments anymore, they're locked out of buying a home for years. That's not a temporary problem, that's their financial future getting derailed.

The job market is even shakier than it looks. Powell said the official numbers might be overstating job creation by 60,000 per month. If that's true, we're not slowly cooling down, we're already losing jobs and just don't know it yet because the data is wrong. One in three job postings never turns into an actual hire. Government sector has a 60% ghost job rate. That means if you're applying for government jobs, six out of ten postings you're spending hours on don't even exist. That's brutal for people trying to find work.

The AI infrastructure can't even get built as fast as planned. The US needs 57 gigawatts of electricity for data centers by 2028 but we're only going to have 21 gigawatts available. Some data centers in Virginia are running on diesel generators because the power grid can't handle them. That's not a temporary issue, that's physics. You can't just throw money at building transmission lines and power plants and have them appear overnight. It takes years. So even if the AI boom works out eventually, the timeline for revenue keeps getting pushed further out while debt payments are due right now.

What really bothers me is how split everything has become. The top 10% of earners are doing almost half of all consumer spending. Companies see that and optimize their entire business around wealthy customers. Chipotle's CEO said people making under $100K stopped eating out. That's 40% of their customer base. The economy looks fine in the headline numbers because wealthy people keep spending, but underneath, millions of people are drowning. A quarter of people using buy now pay later are using it to pay rent. That's not buying stuff you don't need, that's trying to keep a roof over your head.

Billionaires are pulling money out of US investments and moving it to Europe and China. That dropped from 80% bullish on North America to 63% in one year. When the people with the most money and the best information start repositioning away from where they've been winning, that tells me something. They're not doing that for fun. They're seeing risks we're all about to feel.

I don't think we're heading for a gentle correction where things slow down a bit and everyone adjusts. I think we're looking at something closer to 2008, where one piece failing pulls down everything connected to it. The difference is this time we're going into it with consumers already broke, the job market already weakening, and the government already running record debt. There's less room to fix things if they break.

I could be wrong. Maybe AI adoption suddenly accelerates and all this infrastructure spending pays off. Maybe the job numbers are actually fine and Powell is being too cautious. Maybe consumer finances stabilize and foreclosures stop climbing. But when I look at all the data together, I don't see any of that happening. I see leverage building to levels that can't be sustained, warning signs flashing across multiple sectors, and everyone hoping it works out because it always has before. History says that's usually when things break.

Thanks for reading. We're entering 2026 with more questions than answers about how this resolves.

Hedgie

Week Ahead: Delayed labor market data releases, final inflation readings for 2025, and whether we get a Santa Claus rally (historically happens 73% of the time in late December but looking less certain this year).

Weekly Market Stats:

INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

Dow Jones Industrial Average | 48,458 | 1.0% | 13.9% |

S&P 500 Index | 6,827 | -0.6% | 16.1% |

NASDAQ | 23,195 | -1.6% | 20.1% |

MSCI EAFE * | 2,810.47 | 3.2% | 26.3% |

10-yr Treasury Yield | 4.19% | 0.1% | 0.3% |

Oil ($/bbl) | $57.49 | -4.3% | -19.8% |

Bonds | $99.81 | -0.2% | 7.0% |