This newsletter you couldn’t wait to open? It runs on beehiiv — the absolute best platform for email newsletters.

Our editor makes your content look like Picasso in the inbox. Your website? Beautiful and ready to capture subscribers on day one.

And when it’s time to monetize, you don’t need to duct-tape a dozen tools together. Paid subscriptions, referrals, and a (super easy-to-use) global ad network — it’s all built in.

beehiiv isn’t just the best choice. It’s the only choice that makes sense.

🦔 Hi everyone, Hedgie here! The S&P 500 posted its biggest weekly advance in five months, up 3.7%, helping stave off what would have been its first monthly loss since April. Markets rallied on rate cut expectations, with traders now pricing an 80% chance of a Fed cut in December. The week wasn't without drama: a cooling system failure at a single data center in Aurora, Illinois took down $25 quadrillion in daily CME trading volume on Friday morning, a reminder of how much critical infrastructure runs through concentrated chokepoints.

S&P 500 monthly performance - showing the choppy November with late-month recovery

The Consumer Picture

Black Friday online spending hit a record $11.8 billion, up 9.1% from last year. But dig into the numbers and the story changes. Order volumes actually fell 1% while average selling prices rose 7%. Units per transaction dropped 2%. People spent more to buy less, exactly what analysts predicted. AI-driven traffic to retail sites soared 805%, though that's off a base of nearly zero since these shopping chatbots didn't exist last year.

Physical stores saw subdued traffic. Seasonal retail hiring is at its lowest level in over 15 years, with retailers expecting to bring on 265,000-365,000 workers versus 442,000 last year. Interest in seasonal work is up 27% as people desperately need jobs, but the listings aren't there. When retailers would rather run thin-staffed through the busiest season than commit to hiring, they're not betting on a surge.

Meanwhile, a Harris Poll found 64% of Americans earning six figures say their income is the bare minimum for staying afloat. Among those making $200,000+, half have used buy now pay later for purchases under $100, 46% rely on credit cards to make ends meet, and 48% have pretended Venmo wasn't working to dodge a payment. When people earning $200K are faking app outages to avoid splitting a bar tab, something structural has broken.

The AI Reality

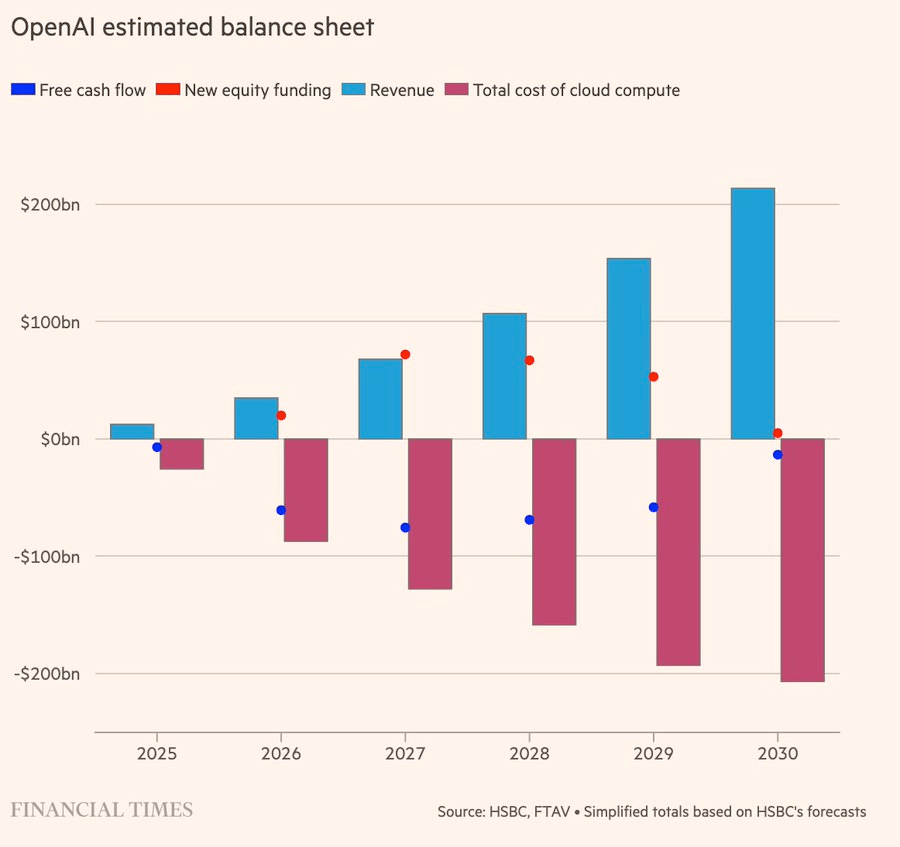

OpenAI's math continues to unravel. HSBC built a model to see if OpenAI can pay for its contracted compute. The answer is no. With $250 billion committed to Microsoft and $38 billion to Amazon, OpenAI faces a $207 billion funding hole even under optimistic assumptions about reaching 3 billion users and capturing advertising revenue. Their solution: a leaked Android app beta reveals OpenAI is testing ads in ChatGPT. The company that argued in court this week that a suicidal teenager violated terms of service is about to build an advertising business on top of the most intimate conversations people have with technology.

The AI peer review scandal captures the absurdity perfectly. 21% of peer reviews at a major AI conference were fully AI-generated, with over half showing signs of AI use. AI researchers are using AI to fake reviews of AI research at an AI conference. One paper got its lowest rating from a fully AI-generated review that contained incorrect numbers and put the paper "on the borderline between accept and reject." Careers depend on these decisions.

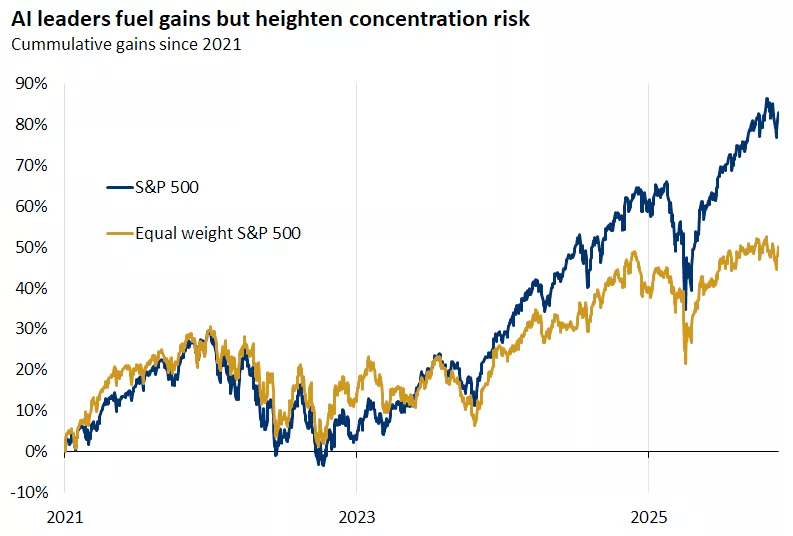

Market-Cap vs. Equal Weighted S&P 500 - showing divergence between cap-weighted and equal-weighted performance, highlighting concentration

Amazon employees are pushing back. Over 1,000 signed an open letter warning that the company's "all-costs-justified, warp-speed approach to AI development" could cause "staggering damage." A 20-year senior engineering manager called AI "almost like a drug that companies obsess over, use as a cover to lay people off, and use the savings to pay for data centers for AI products no one is paying for." Engineers report being told to double productivity using AI tools they describe as "slop" or risk their jobs.

Meanwhile, AI data centers are crushing domestic aluminum production by outbidding smelters for electricity. Aluminum producers need $30-40 per megawatt-hour to operate profitably. Amazon and Microsoft pay over $100. Alcoa is considering selling assets to Big Tech because the power generation equipment is worth more to them than the aluminum it produces. The AI boom doesn't just strain the grid, it restructures who gets access to electricity.

Infrastructure Fragility

Friday's CME outage was a wake-up call. A cooling system failure at a CyrusOne data center in Aurora, Illinois disrupted trading across futures, options, gold, and forex markets. The facility handles $25 quadrillion in daily notional volume. CME sold the data center to CyrusOne in 2016, which was then bought by KKR and Global Infrastructure Partners in 2021 for $11.4 billion as AI demand sent valuations soaring. Critical market infrastructure is now owned by private equity firms chasing AI returns, optimized for profitability rather than resilience.

The options market faces its own concentration risks. The top five clearing members contribute almost half of the OCC's $20 billion default fund. Bank of America, Goldman Sachs, and ABN Amro handle most positions from market makers. Zero-day options now account for more than half of S&P 500 daily volume and barely existed five years ago. OCC is asking the SEC to change how it calculates default fund contributions to account for a 1987-style crash. The system wasn't built for what it's handling.

The Labor Market

October layoffs hit 153,074, up 183% from September and the highest for that month in 22 years. Total layoffs through October reached 1.1 million, 65% higher than last year and the highest since the Great Recession excluding pandemic layoffs. Tech layoffs are running 17% above 2024.

Fear of AI job displacement has nearly doubled. 52% of US workers now worry about losing their jobs to AI, up from 27% last year. A Federal Reserve Bank of St. Louis study found "a striking correlation" between AI prevalence and unemployment increases since 2022. CFOs are split: 42% view headcount cuts as the clearest way to show ROI on AI spending. MIT's Iceberg Index found AI can already replace 11.7% of the labor market, representing $1.2 trillion in wages.

Forecasted Probability of Recession - showing recession probabilities declining through 2025

Americans are also stuck in place. Mobility hit a record low in 2024, with only 11% changing residences, down from 20% in the 1960s. Moving for opportunity requires affording somewhere new to live, and with median homes at $439,701 against median income of $83,730, the math doesn't work for most people. A stuck labor market facing automation pressure is a worse setup than a mobile one.

Credit Markets Are Watching

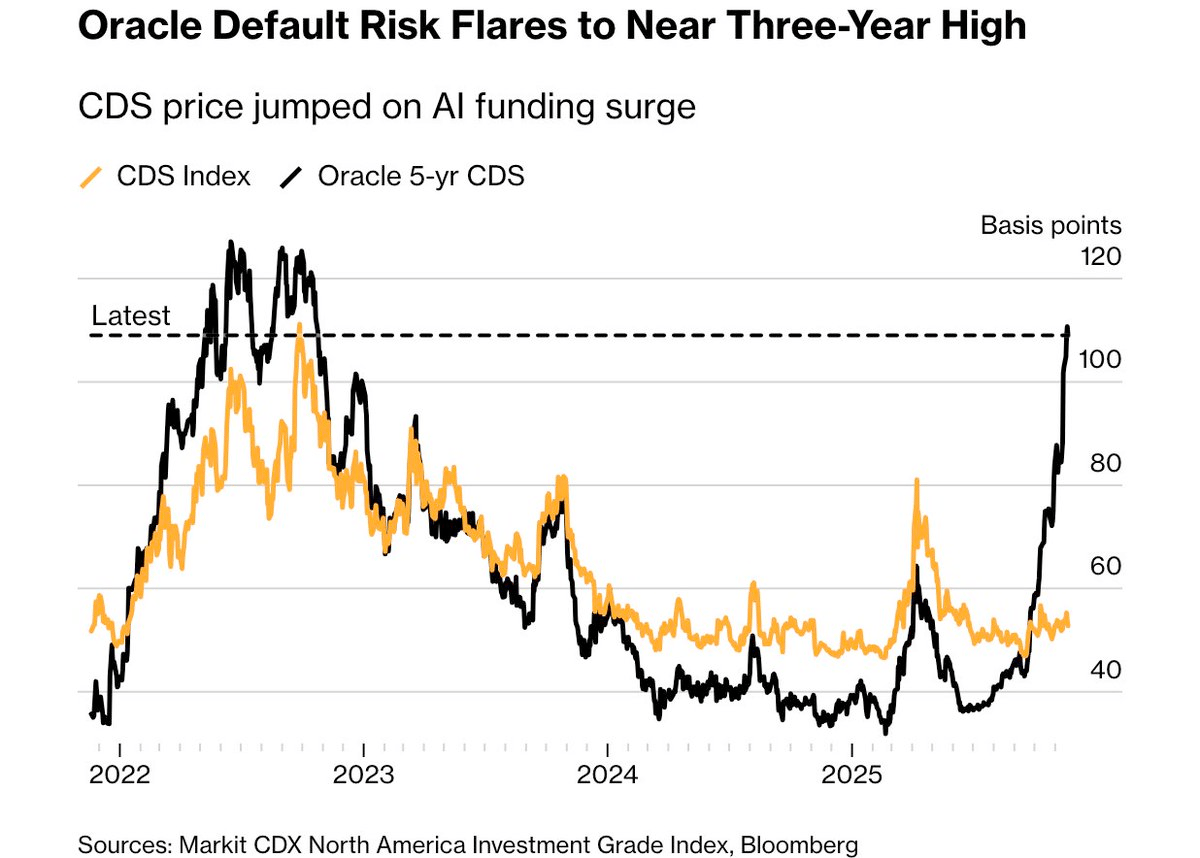

Oracle has become the credit market's barometer for AI risk. The cost to insure against default tripled in recent months. CDS trading volume ballooned to $5 billion over seven weeks, up from $200 million last year. The stock has lost a third of its value since September. Morgan Stanley expects Oracle's net debt to more than double to $290 billion by 2028. When traders want to bet against AI, they're buying Oracle CDS. The canary isn't dead yet, but it's getting a lot of attention.

Oracle 5-year CDS vs CDX IG Index - showing the divergence as Oracle CDS spiked while the index remained stable

My Take

The soft landing narrative is holding together because the data that would contradict it keeps getting delayed or canceled. The Fed is flying blind with October CPI canceled and other reports pushed back from the shutdown. Consumer confidence dropped the most in seven months. 22 states are contracting. Layoffs are at 22-year highs for October. Six-figure earners are using buy now pay later and skipping meals. Yet markets rally 3.7% on rate cut hopes.

The concentration keeps building everywhere you look. Seven stocks carry the market and account for a third of the S&P 500's value. A handful of banks clear all options trades. One data center in Aurora handles $25 quadrillion daily. AI spending funnels through circular deals between the same companies. When everything depends on a few nodes, the system looks efficient until something breaks. Friday's cooling failure was a preview.

What concerns me most is the gap between spending headlines and actual behavior. Record Black Friday spending came with falling order volumes and fewer items per transaction. Retailers posting strong numbers while cutting seasonal hiring to 15-year lows. Companies spending $400 billion on AI infrastructure while employees call the output "slop." The numbers look good until you ask what they're measuring.

S&P 500 Forward Earnings - showing earnings expectations continuing to rise despite economic headwinds

December will tell us whether the rate cut expectations that drove this week's rally were justified or just another case of markets front-running a rescue that may not come.

Thanks for reading. We made it through November. Now let's see what December brings.

🦔Hedgie

The Week Ahead

ISM Manufacturing and Services PMI

PCE Inflation (September, delayed from shutdown)

JOLTS Job Openings

OPEC+ Meeting results

Cyber Monday final numbers

Weekly Market Stats

Index | Close | Week | YTD |

|---|---|---|---|

Dow Jones | 47,716 | +3.2% | +12.2% |

S&P 500 | 6,849 | +3.7% | +16.4% |

Nasdaq | 23,366 | +4.9% | +21.0% |

10-yr Treasury | 4.01% | -0.1% | +0.1% |

Oil ($/bbl) | $59.53 | +2.5% | -17.0% |