Hey everyone, Hedgie here! Welcome to this week's market breakdown. I'm going to walk you through everything that happened in the markets this week and explain what it means for regular investors like you. This was another volatile week with trade tensions escalating and China now threatening to retaliate against any countries that work with the U.S. to isolate Beijing.

All three major indices finished the week lower, with the S&P 500 down 1.5%, the Dow down 2.7%, and the Nasdaq down 2.6%. As of Sunday evening when this newsletter was prepared, stock futures were pointing to another negative open on Monday (S&P 500 futures -0.81%, Nasdaq futures -0.84%, Dow futures -0.82%) as traders continue to digest the latest trade developments and bond market movements.

Note: This newsletter was prepared on Sunday evening for Monday morning release. Market conditions may have changed by the time you're reading this.

THE TRADE WAR TANGO: WHAT HAPPENED THIS WEEK

This week we saw the trade war escalate to new levels, with multiple developments creating a perfect storm of uncertainty:

China Threatens Broader Retaliation

China has now explicitly warned it will retaliate against any countries that cooperate with the U.S. in ways that compromise Beijing's interests. This comes as the Trump administration is reportedly planning to use tariff negotiations to pressure U.S. partners to limit their dealings with China.

The Chinese Ministry of Commerce warned about the risk to all countries once international trade returns to the "law of the jungle," stating: "China firmly opposes any party reaching a deal at the expense of China's interests. If this happens, China will not accept it and will resolutely take reciprocal countermeasures."

This is a significant escalation because it expands the trade conflict beyond just the U.S. and China. It's essentially China telling other countries: "If you side with the U.S. against us, you'll face consequences too." This creates a difficult position for U.S. allies who have significant trade relationships with both countries.

Powell's Warning and Trump's Response

Fed Chair Powell acknowledged that tariffs create a "two-pronged policy challenge" with higher inflation and slower growth occurring simultaneously. Speaking at the Economic Club of Chicago, Powell stated that tariff increases have been "significantly larger than anticipated," and that "the same is likely to be true of the economic effects, which will include higher inflation and slower growth."

This candid assessment prompted President Trump to call for Powell's "termination," creating uncertainty about Fed independence. Powell has maintained that the president does not have the legal authority to fire him.

This tension between the Fed and White House creates additional market uncertainty. The Fed is trying to navigate a complex economic landscape where they need to fight inflation while supporting growth, and tariffs make this balancing act much more difficult by pushing in opposite directions.

Bond Market Signals

The yield curve is showing interesting movements, with the 10-year Treasury yield rising to 4.364% (+0.037%) while the 2-year yield fell to 3.762% (-0.034%). This steepening indicates the market is pricing in higher long-term inflation expectations while anticipating Fed rate cuts in the near term.

Remember, when bond yields rise, bond prices fall. So anyone holding Treasury bonds is seeing losses as yields climb. The 10-year yield is particularly important because it influences mortgage rates and many other consumer and business loan rates throughout the economy.

10-Year Treasury Yield - 3 Month View

The chart above shows the 10-Year Treasury yield over the past three months. Notice the recent upward trend that's putting pressure on bond prices and influencing borrowing costs throughout the economy.

Housing Market Fragmentation

Housing starts fell 11% in March to 1.342 million, despite building permits actually increasing to 1.482 million. The regional breakdown tells an even more fascinating story:

The Midwest saw a massive 76.2% jump in housing starts

The South (the largest housing market) dropped 17.1%

The West plummeted 30.9%

The Northeast barely moved with a 1.4% increase

This regional divergence reveals that local economic factors are overriding national trends. It's unusual to see such dramatic differences between regions as typically housing trends move more in sync across the country.

Currency Movements and the Japanese Carry Trade

The Chinese Yuan has slumped 10% against the Euro and 14% against the Swedish Krona, creating what some call a "deflationary tsunami" headed for Europe. Meanwhile, gold continues its rise, up another 1.80% in Sunday night trading to $3,388.20.

But there's another currency story that's having a major impact: the unwinding of the Japanese carry trade. Let me explain this important concept:

For decades, investors borrowed money in Japan at super-low interest rates (near zero) and then invested that money elsewhere for higher returns. Think of it like taking out a 1% loan and investing it in something that pays 5% and you pocket the difference.

This strategy has been HUGE! We're talking between $1.5-3 trillion at its peak. But now Japan has raised interest rates for the first time in 17 years, and the yen is strengthening. This is forcing investors to sell their assets globally to pay back their yen loans, creating selling pressure across all kinds of assets.

U.S. Dollar Index - 6 Month View

The chart above shows the U.S. Dollar Index over the past six months. The recent decline illustrates the dollar weakness we've been discussing and its potential impact on global trade and investments.

WHAT THIS MEANS FOR YOUR INVESTMENTS

Impact on Your Portfolio

These market forces have several practical implications for regular investors:

Trade war expansion: With China threatening to retaliate against U.S. allies, the economic impact could spread beyond just U.S.-China trade. Companies with global supply chains face increasing uncertainty.

Inflation vs. growth concerns: The Fed is in a difficult position with tariffs potentially causing both higher inflation and slower growth. This could delay rate cuts, keeping borrowing costs higher for longer.

Regional investment opportunities: The stark regional differences in housing starts point to local economic factors creating both risks and opportunities depending on geography.

Safe haven demand: Gold's continued rise (+1.80% Sunday night) shows investors seeking protection from currency volatility and geopolitical uncertainty.

Dollar weakness effects: A weaker dollar has mixed implications:

International investments may see a boost when converted back to dollars

Imported goods might get more expensive (electronics, cars, clothing)

Travel to other countries will be more expensive as your dollars buy less foreign currency

Gas prices could rise as oil is priced in dollars globally

Special Considerations for Retired Investors

If you're retired or nearing retirement, this market volatility creates some unique challenges and opportunities:

Fixed income considerations: The steepening yield curve (10-year at 4.364%, 30-year at 4.868%) offers better income opportunities for retirees willing to extend duration. Consider building a bond ladder to capture these higher long-term rates while maintaining some flexibility.

Inflation protection: With tariffs potentially pushing prices higher, ensure your portfolio has adequate inflation protection through TIPS or I-Bonds, which currently offer rates around 4.28%.

Sequence of returns risk: Market downturns early in retirement can have outsized impacts on your portfolio's longevity. If you're recently retired, consider temporarily reducing withdrawals during volatile periods.

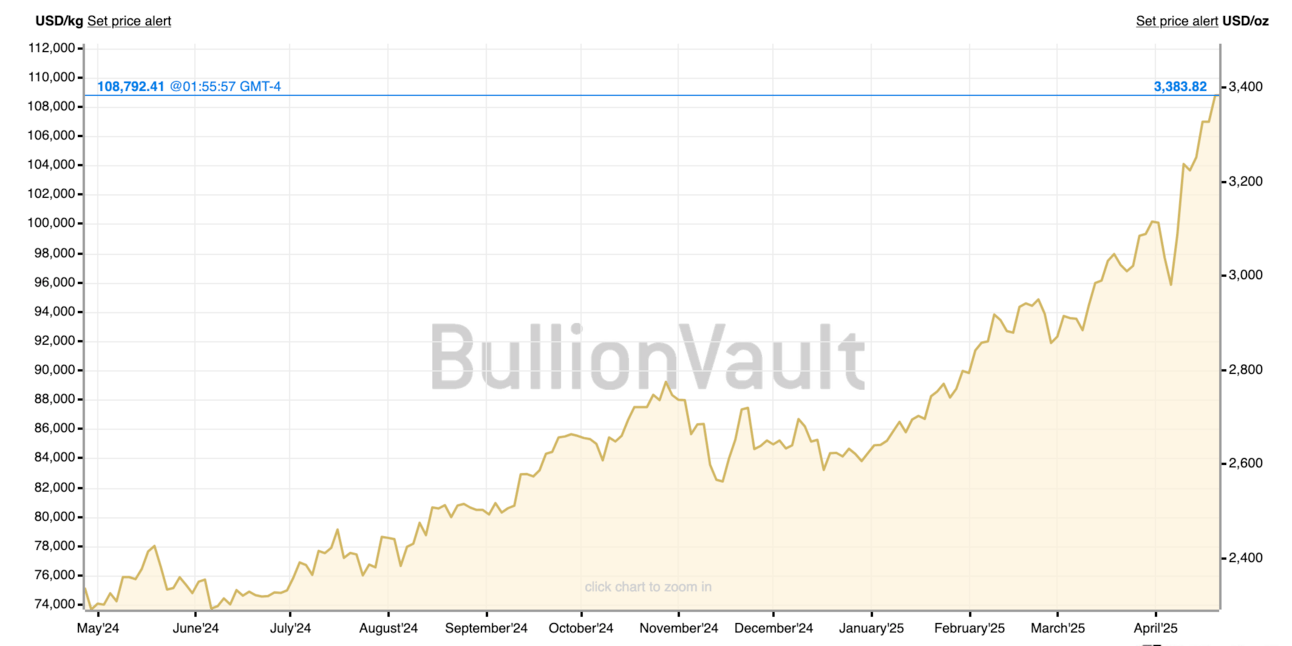

Gold Price - 1 Year View

The chart above shows gold prices over the past year. Notice the strong upward trend as investors seek safety amid economic uncertainty and dollar weakness.

BOND MARKET DYNAMICS: A DEEPER DIVE

The bond market deserves special attention this week because it's sending important signals about the economy. The 10-year Treasury yield hitting 4.364% and the 30-year reaching 4.868% is a big deal. These are significant moves in what's supposed to be a relatively stable market.

What's causing this? It's likely a combination of factors:

Inflation concerns from tariffs: Bond investors hate inflation because it erodes the value of their future interest payments. Tariffs are essentially taxes on imported goods that make things more expensive.

Carry trade unwinding: As we discussed earlier, the reverse carry trade unwinding is forcing some investors to sell bonds, pushing prices down and yields up.

China concerns: There might be worries about China potentially reducing their Treasury holdings in response to the tariff situation. China holds over $800 billion in U.S. Treasuries.

Debt refinancing challenges: The U.S. government needs to refinance about $9 trillion in debt over the next few years. When the dollar weakens, foreign investors get nervous about being paid back in less valuable dollars.

For regular investors, these rising yields have real impacts:

Mortgage rates are tied to the 10-year yield, so home loans could get more expensive

Auto loans and other consumer debt will likely see rate increases

If you own bond funds or ETFs, you'll see their prices dropping as yields rise

The silver lining? Higher yields do eventually attract buyers looking for better returns. If you're looking to add bonds to your portfolio, these higher yields offer better income opportunities than we've seen in years.

INVESTMENT OPPORTUNITIES IN UNCERTAIN TIMES

During periods of market volatility, certain strategies tend to work better than others:

Defensive Positioning

Sectors like utilities, consumer staples, and healthcare tend to be less affected by trade tensions. These sectors provide essential products and services that people need regardless of economic conditions.

Dollar Weakness Beneficiaries

With the dollar showing weakness, broad international stock funds could benefit as their overseas earnings translate into more dollars. U.S. exports also become more competitive globally when the dollar weakens.

However, be cautious about exposure to countries that might get caught in the crossfire of U.S.-China trade tensions.

Safe Haven Assets

Gold has been performing exceptionally well during this period of uncertainty, reaching new highs and continuing to climb in Sunday night trading (+1.80%). Gold loves uncertainty, and we've got plenty of that right now.

What gold is telling us is that investors are looking for safety. When currencies are volatile and bonds are unstable, gold becomes very attractive as a store of value. The fact that it's been steadily climbing for 6+ months shows this isn't just a short-term reaction to recent events.

Other traditional safe havens like the Japanese yen and Swiss franc have also strengthened as investors seek stability.

LOOKING AHEAD: WHAT TO WATCH NEXT WEEK

The market is gearing up for another crucial week with several key events to monitor:

Trade developments: Watch for any clarification on how the U.S. plans to pressure allies to limit dealings with China, and how China might respond.

Fed commentary: Any statements from Federal Reserve officials about how trade tensions might affect monetary policy will be crucial, especially after Trump's comments about Powell.

Housing data: New home sales (Tuesday) and pending home sales (Thursday) will provide more insight into whether the regional divergence in housing starts is a temporary anomaly or a longer-term trend.

Bond market stability: Continue monitoring Treasury yields for signs of stabilization or further volatility, particularly the spread between 2-year and 10-year yields.

GDP data: The first estimate of Q1 GDP will be released on Thursday, providing a comprehensive look at economic activity. Economists are expecting growth around 2.1%, down from 3.4% in Q4 2023.

The global economy is starting to look like a hedgehog trying to cross a six-lane highway which means lots of stopping and starting, with danger coming from multiple directions. With futures pointing to another down day on Monday, investors should prepare for continued volatility.

What makes this situation particularly challenging is how many major market forces are hitting at once:

Tariffs are creating inflation concerns and growth worries

The Japanese carry trade unwinding is forcing selling across asset classes

Bond market volatility is affecting everything from mortgages to corporate borrowing

China's threats of broader retaliation are creating uncertainty for global trade

Regional economic divergence is complicating the picture further

For long-term investors, remember that markets eventually find equilibrium. These kinds of storms have happened before and will happen again. The financial system is resilient over time, even if the ride gets bumpy for a while.

The best approach during times like these is to:

Stay diversified across different asset classes and regions

Avoid making emotional decisions based on short-term volatility

Focus on your long-term investment goals rather than daily market moves

Remember that panic is not a strategy

In times like these, the wisest hedgehogs don't panic, they prepare. Build your financial burrow with diverse materials, keep some extra acorns in reserve, and remember that even the harshest economic winters eventually give way to spring.

Phew! That was a lot, but I hope it was helpful. If you haven’t followed me on X, you can find the link below where I’ll be updating you daily on what is happening in the financial world. I hope this was helpful and thank you for reading!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Burrow Construction" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.