🦔 Hey everyone, it’s your favorite hedgehog here! Welcome to this week's market breakdown. I'm going to walk you through everything that happened in the markets this week and explain what it means for regular investors like you. This was an exceptionally volatile week with several major forces converging at once, so let's break it all down in simple terms.

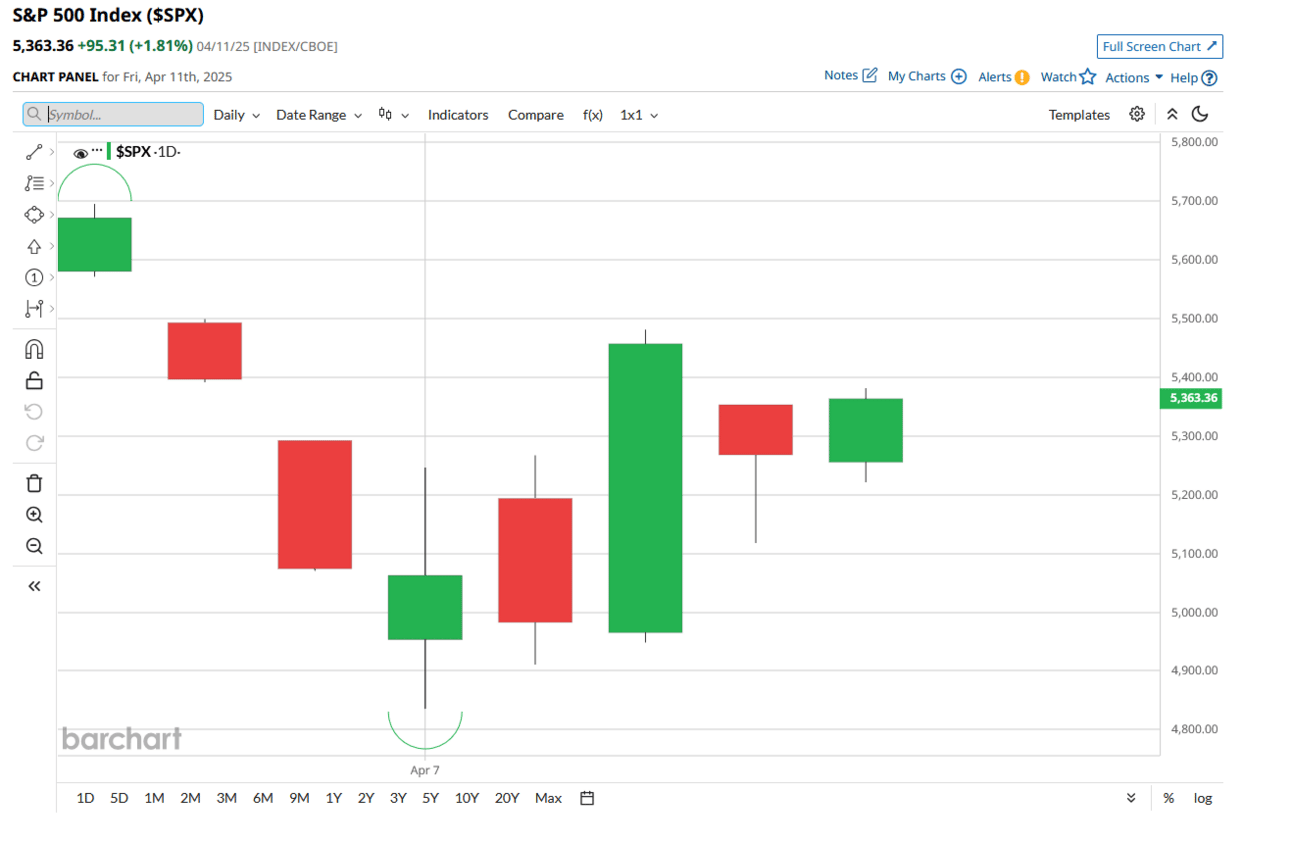

Despite the wild ride last week, all three major indices actually ended with gains for the week, with the S&P 500 up 5.70%, the Dow up 4.95%, and the Nasdaq up an impressive 7.29%. As of Sunday evening when this newsletter was prepared, stock futures were pointing to a positive open on Monday (S&P 500 futures +0.6%, Nasdaq-100 futures +1.1%, Dow futures +0.3%) as traders continued to digest the latest tariff developments.

Note: This newsletter was prepared on Sunday evening for Monday morning release. Market conditions may have changed by the time you're reading this.

THE PERFECT FINANCIAL STORM: WHAT HAPPENED THIS WEEK

This week we experienced what I'd call a perfect financial storm where several major forces hit markets simultaneously:

Tariffs and Policy Uncertainty

When President Trump announced steep tariffs on April 2nd (his "Liberation Day"), it created significant market turbulence. The S&P 500 has dropped 5.4% since the announcement, with day-to-day volatility reminiscent of much more severe market crises.

The situation became even more confusing this weekend. On Friday, US Customs announced that phones, computers, and other electronics would be exempt from the 125% China tariffs. Then within 48 hours, Trump stated there was no "exception" but rather these products are still subject to the existing 20% tariffs and are "moving to a different tariff bucket." Commerce Secretary Howard Lutnick further clarified on Sunday that these exemptions are not permanent, saying these products will face "a special focus-type of tariff" on semiconductors and electronics in the next month or two.

This kind of policy whiplash makes it incredibly difficult for businesses to plan and for investors to assess risks. The "Magnificent Seven" tech stocks have been particularly affected, with the CNBC Magnificent 7 Index down about 5% since the tariff announcement. Apple has been among the hardest hit, losing nearly $640 billion in market cap in just three trading days following the initial announcement.

Market volatility since April 2nd when tariffs were announced

Treasury Yields Spike

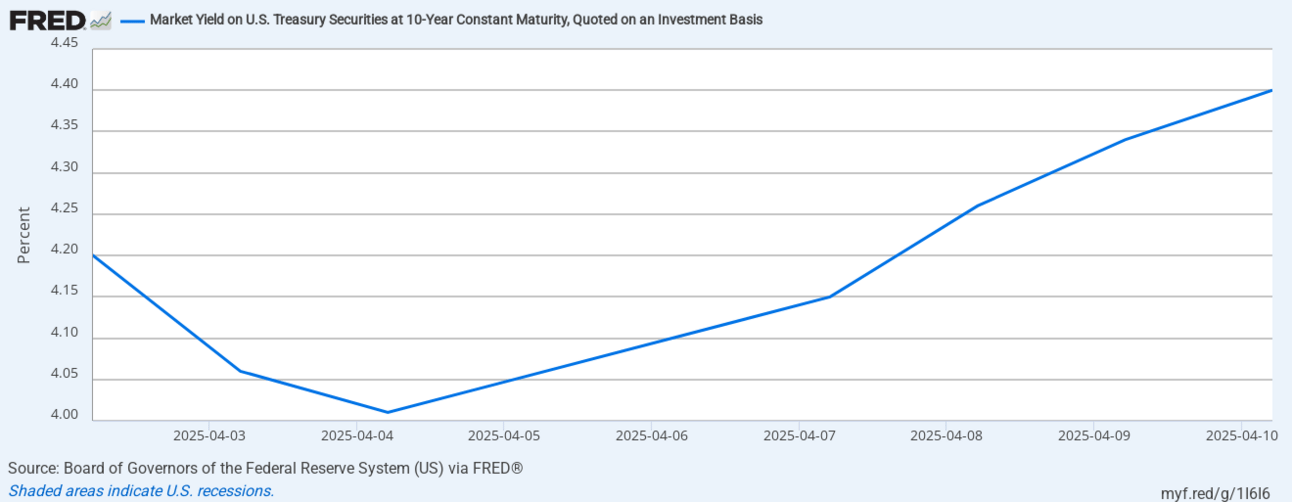

The 10-year Treasury yield jumped from 3.99% to over 4.5% in just a week. This is an unusually rapid move for what's supposed to be a relatively stable market.

Why did this happen? Bond investors hate inflation, and tariffs are essentially taxes on imported goods that make things more expensive. When inflation concerns rise, investors demand higher yields to compensate for the eroding value of their future interest payments.

10-year Treasury yield over the past month, highlighting the sharp rise since April 2nd.

Dollar Weakness

The ICE U.S. Dollar Index hit its lowest level in three years this week. The greenback has seen particularly sharp drops against safe-haven currencies like the Japanese yen and Swiss franc, as well as the euro.

This is unusual because the dollar typically strengthens during periods of market uncertainty. Its weakness signals that global investors may be reassessing the attractiveness of U.S. assets.

U.S. Dollar Index (DXY) showing its decline to three-year lows.

The Reverse Carry Trade Unwinding

For decades, investors borrowed money in Japan at super-low interest rates (near zero) and invested that money elsewhere for higher returns. This strategy has been enormous in scale, with estimates putting it between $1.5-3 trillion.

But now Japan has raised rates for the first time in 17 years, and the yen is strengthening. This is forcing investors to sell their assets globally (including US stocks and bonds) to pay back their yen loans, creating selling pressure across all kinds of assets regardless of their fundamental value.

USD/JPY exchange rate over the past month, highlighting the strengthening yen.

The Basis Trade Problem

Some large hedge funds and banks were using significant leverage (borrowed money) to profit from tiny price differences between Treasury bonds and Treasury futures. When bond prices started falling rapidly, these highly leveraged positions became unstable, forcing more selling and amplifying market moves.

WHAT THIS MEANS FOR YOUR INVESTMENTS

Impact on Your Portfolio

These market forces have several practical implications for regular investors:

Higher borrowing costs: Rising Treasury yields directly affect mortgage rates, auto loans, and credit card interest rates. If you're looking to buy a home or refinance, you may face higher costs.

Weaker dollar effects: A weaker dollar means more expensive foreign travel and imported goods. However, US companies with significant international sales might benefit since they get more dollars when converting foreign earnings.

Sector impacts: Tech companies initially rallied on news of tariff exemptions but may face pressure as the policy confusion continues. Companies heavily reliant on Chinese manufacturing could see increased costs and supply chain disruptions.

Increased volatility: The combination of these forces creates a feedback loop of market uncertainty, leading to larger price swings across asset classes.

The past week in the market has been a rollercoaster and there may be more to come.

Special Considerations for Retired Investors

If you're retired or nearing retirement, this market volatility creates some unique challenges and opportunities that deserve special attention:

Income stability concerns: Rising bond yields actually have a silver lining for income-focused retirees. New bond investments now offer higher income than they have in years. Consider building a bond ladder with staggered maturities to capture these higher rates while maintaining some flexibility.

Sequence of returns risk: Market downturns early in retirement can have outsized impacts on your portfolio's longevity. If you're recently retired, consider temporarily reducing withdrawals during volatile periods or drawing from cash reserves rather than selling assets at depressed prices.

Required Minimum Distributions (RMDs): If you need to take RMDs this year, consider taking them later in the year if possible to see if markets stabilize. Also, remember you can satisfy RMDs with in-kind distributions of securities rather than selling investments in a down market.

Inflation protection: While bonds are offering better yields, don't forget about inflation protection. The weaker dollar and potential tariff-driven price increases make Treasury Inflation-Protected Securities (TIPS) and I-Bonds worth considering for part of your fixed-income allocation.

Dividend stability: Focus on companies with strong balance sheets and histories of maintaining or growing dividends through economic challenges. Utilities, consumer staples, and healthcare companies often fit this profile.

Economic Indicators to Watch

Despite the market turbulence, some economic indicators remain relatively stable:

Inflation: The latest CPI reading came in at 2.4%, which is actually quite good considering the circumstances.

Unemployment: Currently at 4.2%, showing some cooling in the labor market but still historically strong.

GDP Growth: Annual growth has slowed to 2.4% from 3.2%, indicating economic momentum is slowing but not collapsing.

12-month percentage change, Consumer Price Index

INVESTMENT OPPORTUNITIES IN UNCERTAIN TIMES

During periods of market volatility, certain strategies tend to work better than others… let’s discuss.

Defensive Positioning

Companies with strong balance sheets, stable cash flows, and less exposure to Chinese manufacturing may weather this storm better. Consider sectors like utilities, consumer staples, and healthcare that tend to be less affected by trade tensions.

Dollar Weakness Beneficiaries

Companies with significant international revenue could benefit from dollar weakness. Look for large multinational corporations that generate substantial portions of their revenue overseas.

Potential Safe Havens

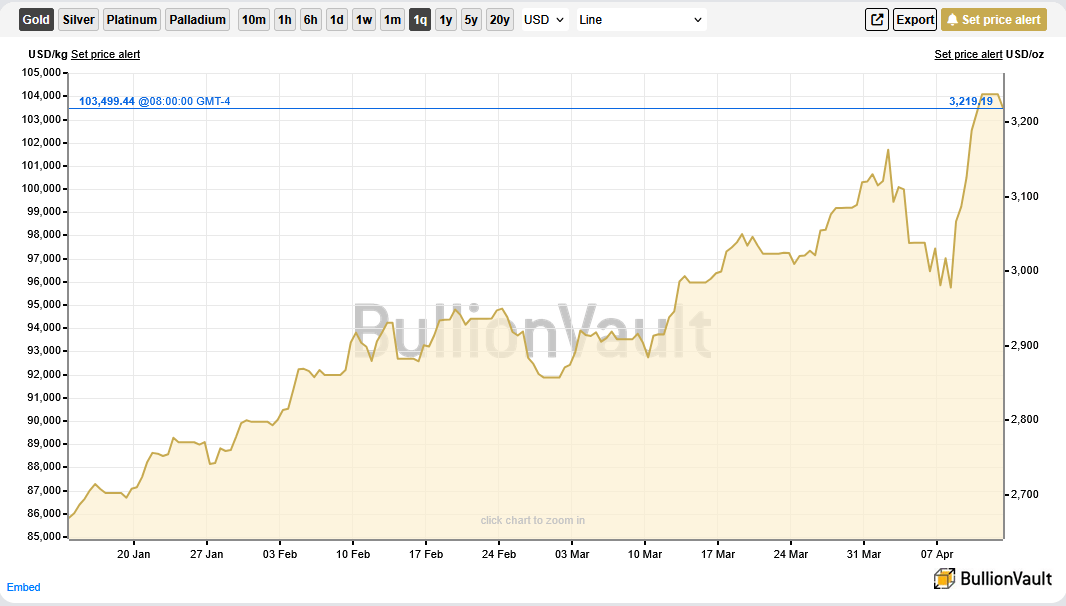

Gold has been performing exceptionally well during this period of uncertainty, reaching new all-time highs. It often serves as a store of value when currencies and bonds are volatile.

Gold prices since January 2025.

LOOKING AHEAD: WHAT TO WATCH NEXT WEEK

The market is gearing up for a major week of earnings, with results from more big banks and other key companies:

Bank earnings: Goldman Sachs, Bank of America, and Citigroup will report, following JPMorgan Chase and Wells Fargo's strong results on Friday.

Tech and transportation: Netflix and United Airlines are among the notable non-financial companies reporting this week.

Further tariff clarifications: Watch for additional statements from the administration about tariff policies, especially regarding technology products and the upcoming "National Security Tariff Investigations" that Trump mentioned.

Bond market reaction: The 10-year Treasury yield rose back above 4.50% over the weekend. Continue monitoring yields for signs of stabilization or further volatility.

Fed commentary: Any statements from Federal Reserve officials about how these market developments might affect monetary policy will be crucial.

FINAL THOUGHTS FROM HEDGIE

What makes this situation unusual is how many major market forces are hitting at once. It's not just about tariffs or any single factor, but the combination creating a feedback loop that's driving these dramatic market moves.

For long-term investors, remember that markets eventually find equilibrium. These kinds of storms have happened before and will happen again. The financial system is resilient over time, even if the ride gets bumpy for a while.

The best approach during times like these is to:

Stay diversified across different asset classes

Avoid making emotional decisions based on short-term volatility

Focus on your long-term investment goals rather than daily market moves

Consider gradually adding to quality investments if they become available at better prices

I hope this breakdown helps you understand what's happening in the markets right now. As always, I’m here to help clarify any questions any of you maybe have and hopefully educate regular investors to take more control of their finances.

My little paws are tired from so much typing, so until next time!

Hedgie

DISCLAIMER: For educational purposes only. I'm a hedgehog who types with tiny paws, not a licensed financial advisor (my only certifications are in "Acorn Hiding" and "Quill Maintenance"). Investments involve risk, sometimes as prickly as my back. Do your own research or consult with a human financial professional, as taking investment advice from woodland creatures, no matter how financially literate, is generally not recommended by the SEC.